Big question, loaded question, a lotta people ask me that question. (Ten points if you get the reference.)

Back in August of 2018, I wrote a piece called “In the Trenches”, talking about how the talking heads of financial planning got together and decided that financial planning itself wasn’t enough, but that the future of financial planners lay in being so specifically marketed and targeted (niched) that they would one day “only work with cardiologists who worked for a specific hospital network whose shifts were only on the 3rd Tuesday of months that start with J.” Sounds a bit preposterous, right? In that same piece, I highlighted that in Longmont, a city of approximately 95,000 people, there were 150 registered representatives (people licensed to sell or transact business around investments) but of those 150, only 3 were CERTIFIED FINANCIAL PLANNER™ Professionals offering Financial Planning, bringing the ratio from 1 representative for every 633 people to 1 financial planner for every 31,666 people. The change to being Fee Only moves that needle one step deeper, to there now being only 1 Fee Only financial planner for 95,000 people.

What is Fee Only?

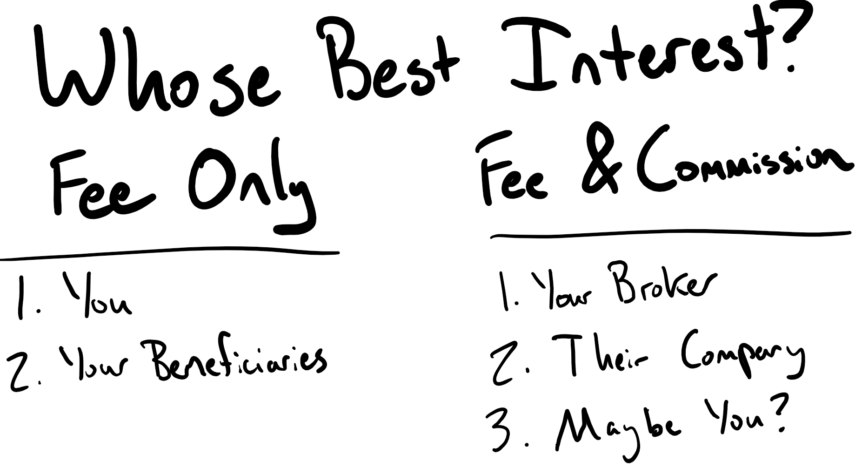

Fee Only is pretty simple. It means that a financial planner can only receive compensation directly from clients in the form of hourly, project, subscription, or percentage fees. The key thing here is directly. This means they can’t be paid a commission by a life insurance company or placing a policy, a sales charge commission by a mutual fund company for selling an investment, or receive third party funding after the fact directly or indirectly. Further, Fee Only financial planners are both ethically and legally bound to act as fiduciaries (a legal doctrine requiring they act with a duty of loyalty and a duty of care to place your interests before their own). This doesn’t mean they don’t have conflicts of interest, but they’ve eliminated a lot of them.

What kinds of conflicts don’t Fee Only planners have?

Other planners can receive compensation from all sorts of things. In fact, if you asked any fee based or commission based financial advisor where they get their compensation, and they were honest, they might tell you they receive: life insurance commissions, disability insurance commissions, long term care insurance commissions, annuity commissions, insurance commission trails, alternative investment and private placement commissions and sales charges, 12b-1 fees, back-end fees, wrap, platform, and sponsor fees, shelf-space fees, surrender charges, contingent deferred sales charges, sales prizes including bonuses and incentive trips, soft dollar benefits, performance based compensation, administrative fees, mortality and expense risk charges, insurance riders, fund management fees and expense ratio fees, subaccount fees, participation rates, cap-on-return limits, transaction or trade fees, annual account or custodial fees, recordkeeping fees, redemption fees, revenue sharing, and profit sharing. That list isn’t even all inclusive, it’s just a list of all the different places money might move out of your pocket and into that advisor, their company, or one of their vendor’s pockets. The big rub here is that they’re not even legally required to disclose their compensation to you, and it’s a good thing because your jaw will drop. Don’t believe me? Take this sworn affidavit and give it to any Fee Based or Commission Based advisor you work with and watch them jump through hoops to avoid filling it out, or if they’re honest, they might just admit that they can’t fill it out because they’re not allowed to disclose the information to you, or even worse, they don’t know the answers.

Okay so what are the benefits?

Once more, the nice thing about Fee Only is that it’s simple. When you work with a Fee Only financial planner, you will know exactly what you’re paying, what you’re getting for that fee, and you know that they’re legally required to place your interest before theirs due to their fiduciary responsibility. You know that they have no financial interest in what financial plan choices you make, what you invest your money in, and you know they aren’t trying to qualify for a trip to Hawaii using your life savings as the ticket. If that doesn’t help bring you some peace of mind, I don’t know what will!