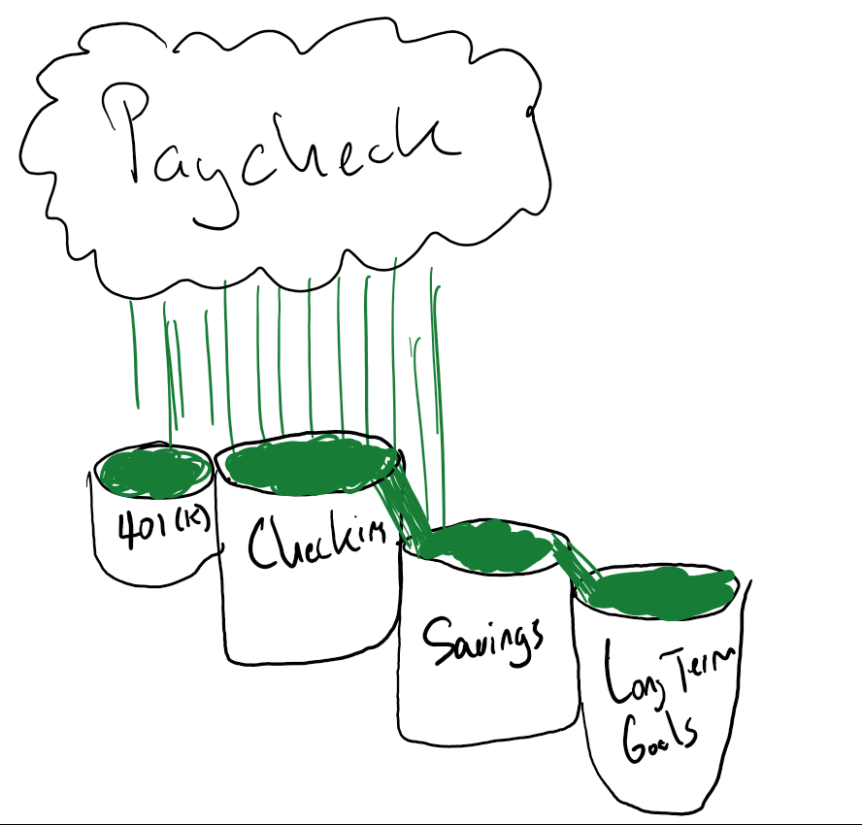

One of the most common points of improvement early on in the financial planning process is cash flow management. Whether the client lives paycheck to paycheck or is sitting on a significant amount of cash in their checking and savings accounts, most people don’t know the answer to “what’s right for me?” and consequently either overspend and run a constant cycle of risk or under-allocate their resources and end up paying too much in taxes while letting their growing savings shrink in relative value. As promised in my writing, I aim to keep much of what we do as educational as possible. In this case, this is a literal sharable guide to managing your month-to-month cash flow, with a trailer on saving for goals at the end.

Cash Flow Management Step One – Checking, Retirement, and Healthcare

Right out of school or just when starting a new job, we’re often presented with a bundle of benefits and options by our employer on our first day on the job. In a rush to make sure we don’t miss anything, we check the boxes quickly and try to get going on the actual work we’ve been hired to do. Yet, the decisions you make on your W4, 401(k) plan, and other day-one options can have a significant impact on your financial trajectory. So, here’s the basic rules of thumb to get started:

- Contribute the matching amount to your company retirement plan, and specifically the Roth option if it’s available. If they offer 3%, put in 3%, if they offer 5%, put in 5%. We’ll upgrade this savings rate later, but for now, we want to make sure we’re not leaving free money on the table.

- If you have no savings to speak of, go ahead and opt into the highest quality/highest premium health insurance your employer offers. While this might eat into your cash flow, remember that insurance is to protect you from catastrophic loss. If you couldn’t afford a $3,000 deductible, you shouldn’t use a plan that requires one. Like the retirement plan, we’ll come back to this one.

- Now, finally, after all the taxes, retirement, and insurance, you get a paycheck! At this point, however, you need to focus on building up a floor to your checking. In this instance, if you know your monthly expenses are $4,000, you want to ensure that you keep your checking at $4,000 and don’t let it dip any lower if you can avoid it. At the same time, you want to keep no more than $8,000 in your checking. Why are we doing this? To ensure there’s an immediate buffer in the event a considerable expense or a surprise bill comes due, but also to keep ourselves from over-accumulating money in our no-interest or low-interest checking accounts.

Cash Flow Management Step Two – The Emergency Fund

At this point, you’ve got two times your monthly expenses on hand in your checking, you’re getting the full match from your company retirement plan, and you’re protected against significant healthcare expenses. Now is the time to start building up the buffer that’s going to allow you to cut back on some costs in the future and to give yourself leeway to make more significant money moves.

- With a habit of keeping your checking balance between 1x-2x your monthly expenses, you should be using your paychecks to “top off” your checking account. Using our earlier example, if you have $6,000 in the account (1.5x the monthly expenses), you’re going to fill it back up to $8,000, and no more. The rest we’re going to put to work.

- Next, we’re going to start building up a savings reserve. Your savings reserve has its own unique equation, but it’s functionally this: 2x your monthly expenses + the combined deductibles of all your insurance. Using our example from earlier, if your auto insurance has a $500 deductible, your homeowners have a $1,000 deductible, and your health insurance has a $500 deductible, then you would want to keep $10,000 in your savings ($4,000×2+$500+$1,000+$500).

- A special note on bank accounts: Most banks require you have a checking and savings account, but let’s be clear: not all banks are made equal. While there are many reasons to bank at a variety of institutions, this is a guide to optimal cash flow management. Thus, you need to ensure that your savings are being kept in an institution offering high-interest rates on savings accounts. Examples in the current rate environment would offer no less than .75% APR on savings and include SIMPLE BANK, ALLY BANK, and other digital banks. Its members might locally own your local credit union, but they also tend to offer little to nothing on savings, and the big banks are even worse at this. If the bank charges you a monthly fee for not having a minimum balance, don’t give them your business, they’re just trying to siphon your savings account into their own.

Cash Flow Management Step Three – Reducing Costs & Increasing Savings

If we’ve successfully built up our checking and savings, we should now have $18,000 between our two accounts, with $8,000 in checking and $10,000 in savings. Now is the time to start optimizing our expenses and increasing our savings rate proportionately.

- Look at your insurance and start thinking critically about the confluence of events. I often joke that the most catastrophic thing that could happen to you is that you crash your car into your house, injure yourself, and hit a visitor in your living room. However, unless you’re a careless lead foot in your garage, it’s most likely that you’ll only ever experience a confluence of 1-2 insurance deductibles at the same time (for example, an auto repair deductible and a health insurance deductible during a car crash). As a result, start raising the deductible on your home and auto policies to be more or less equivalent to each other. You should then increase the amount of money in your savings account to address the increased risk you’re carrying, but raising your deductible from $500 to $1,000 could save you more than the $500 difference a year in some cases. Repeat this process until you have raised your deductibles to approximately $2,500. Additionally, compare the value of your vehicles to your deductible annually. At some point, your vehicle may be worth less than the deductible, and at that point, you should drop the comprehensive and collision coverage from your vehicle as the insurance company will happily charge you the premium but won’t pay out any benefit on your low-value vehicle.

- Last in the insurance deductible line should be your health insurance (where the most extensive potential claims still lurk.) Once your home and auto deductibles have increased and you’ve built up a substantial savings reserve, you should lower the quality of your health insurance to the point that you qualify to fund a Health Savings Account (HSA). Contributions to an HSA are tax-deductible. As long as you don’t have any recurrent healthcare expenses like an expensive medication, you should be able to build up a significant HSA balance while cutting your health insurance premiums significantly. If an event occurs that changes your healthcare outlook or depletes your HSA, you’ll have the option in the future to bring back on more significant coverage, but save considerable money on premiums in the meantime.

Cash Flow Management Step Four – Long Term Savings

At this stage, you’re financially optimized on a paycheck-to-paycheck position, but that doesn’t mean you should start inflating lifestyle. Instead, this is an opportunity to begin maximizing your long term financial position. Depending on how much financial bandwidth is left after you’ve paid into your retirement, topped off your checking, and covered your month to month bills, your approach here might vary. If you have a significant amount of free cash flow, you may look to maximizing retirement accounts and then allocating additional funds to non-retirement investments. In other cases, you might pursue tangible investments such as real estate. In any case, this is the most optimal order of operations to follow:

- Maximize your company retirement plan. You should have been putting money in at the matching rate this whole time, but unless you earn $325,000 and your employer matches 6% a year, you probably haven’t been maximizing your potential contributions. If you have free cash flow above and beyond your lifestyle and expenses, you should contribute as much of this extra cash flow as you can into the 401(k). If you’re feeling a budgetary pinch, you can make these contributions pre-tax, but it’s usually ideal to make them as a Roth contribution, given that future taxes are an unknown.

- If you have maximized your company 401(k) plan, your next stop would be a Roth IRA or a backdoor Roth IRA. Without getting too complicated about it, you can place another $6,000 into a Roth annually; if your household income is above the IRS limits, then there is a strategy to fund a traditional IRA and then convert the funds into a Roth, but this is not a DIY step, and you should consult a financial and tax professional to ensure this is done correctly.

- With retirement savings maximized, if you’re still fortunate enough to have extra free cash flow, at this point, you can safely begin investing in a non-qualified investment account. Ideal characteristics for this account will include no-commission trading, no annual fees, and an extensive catalog of tax-efficient exchange-traded funds to select from. The goal in this account is to invest in long term holdings that generate little in the form of dividends or interest payments, and that primarily will appreciate in asset value over time, which will allow you to minimize the tax impact of these investments until “the time is right.”

A Final Note on Short Term Savings

Investing is a strategy for the long term, but it’s not uncommon that someone asks me, “what’s a good place to park $100,000 for a year or so?” The answer? The highest interest rate money market or CD account you can find. When your financial goal is imminent (within five years), you should be focusing on minimizing the risk of inflation and volatility by investing the money in a form that keeps it secure, is insured against institutional failure (FDIC, NCUA, or SIPC), and fights inflation as best it can. While it can be tempting to toss your money into the market, if your goal is to buy a new house, fund a wedding, or save up for some other significant expense, you don’t want to risk missing your “deadline” by having the money in the market when a downturn strikes. Investing in the short term is significantly riskier than investing for the long term, so be sure to differentiate your desire for growth from your desire to accomplish your goals.

Comments 1

This was a fantastic read! Thank you! I had been compiling my own financial strategy and here you are giving me the formula!