Surprisingly, starting up a business is a common occurrence during economic recessions. As many people are laid off or their companies fail during an economic downturn, it’s not uncommon that some people say “now is the time to start a business.” This is a phenomenon that was somewhat absent during the recession in the late 2000s, largely driven by the fact that in that event, the economic downturn was tied to real estate. Quite often, businesses are funded through home equity as an individual or spouse transitions to part-time or full-time work on their business, using the line of credit from their home to finance their cost of living and initial endeavors. In the past two years, while a conflagration has overtaken certain industries, particularly restaurants, personal care, and hospitality, there have been a number of positive influences on entrepreneurship. Rapid appreciation in real estate growth and low-interest rates have encouraged home equity usage. Extended and expanded unemployment has made many worker’s statuses in unemployment change from subsistence to thriving. Ultimately, there are many sources and drives for entrepreneurship, but today we’re going to review some of the realities and considerations of the various approaches to financing a new business.

Venture Capital

The ever-famous “Shark Tank” approach to a business is to come up with a great idea and get investors. However, while Venture Capital can represent a golden ticket for many businesses, it is also by far the hardest to obtain. Venture Capitalists have a hard position on investing capital in startups, namely that they must be in a blue ocean within their broader industry, have a rapid opportunity to scale and grow, and that there is an expectation of a return in high multiples. Facebook famously returned a 1,228x multiple on its Series A investor’s capital, and since then has 10x’d its value since its IPO in 2012. Venture Capital is likely only a viable strategy for startup companies in the event that the business could not reach the scale it needs to survive without an enormous infusion of capital at the outset (think free apps or ultra-low-cost high-usage software) or that otherwise are too expensive to get a start in without capital, such as a biomedical or advanced technology manufacturing firm. With regard to the difficulty of being selected? Less than .05% or 1 in 2,000 firms succeed in raising startup capital.

Bootstrapping a Business

Bootstrapping a business is a classic method of starting a company. Whether through resources we’ve already mentioned such as home equity or by simply saving over time, a company can be started with a single employee/owner and enough money to pay their bills and get the business off the ground at the outset. This is particularly easy in skill-based businesses such as software development or advice-based businesses such as legal, accounting, or personal finance. For example, MY Wealth Planners was founded with an original bootstrapping budget of $5,000. However, bootstrapping is cost-prohibitive for many businesses. For example, to open something as straightforward as a convenience store can cost thousands of dollars in shelving, tens of thousands in refrigeration, and more tens of thousands for dispensing machines and equipment; and that’s all before paying, even more, to put goods on the shelves! Bootstrapping is certainly viable in some cases, but it’s important to acknowledge that this approach has limitations and that often the cost of initial capital can be far outweighed by the return on continuing a decent-paying nine-to-five job somewhere else.

The Bank of Mom & Dad

Let me start this one off by saying: This is not a fair, equitable, or equal option. Everyone is born with different parents (siblings excluded) and the resources of one family to another can vary significantly. That said, borrowing money from parents or family members is often a common strategy for overcoming the burden of startup capital when getting started as an entrepreneur. Quite famously, the first investors in Amazon were Jackie and Mike Bezos, who invested $245,573 in Amazon (for what would now be a whopping 12,000,000% return on their investment). Terms and conditions for borrowing from family can vary, but two material considerations are important. First, if it is being treated as a loan and not an investment, a fair rate of interest must be charged on the loan, which can be restrictive depending on the time it takes for the business to begin cash flowing. Second, that if it is treated as an investment, that the accounting and business compliance costs have just increased enormously for the startup. While either issue can be overcome, it’s important to also acknowledge the elephant in the room: lending money to friends or family can be emotionally and interpersonally complicated and sometimes the damage to relationships can make the endeavor not worth it.

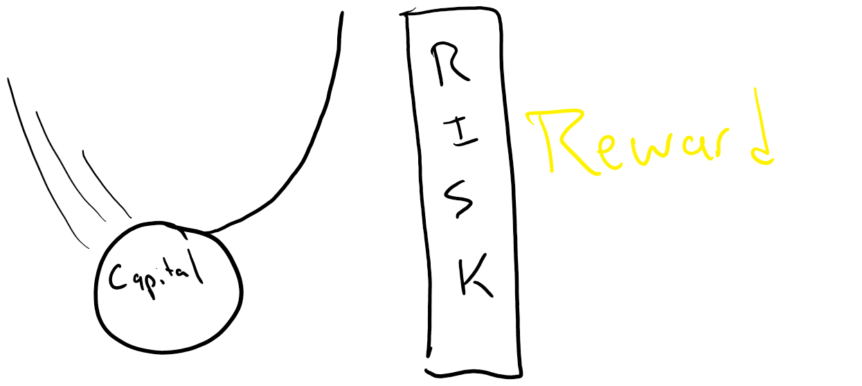

The Bank Bank

Despite my criticisms of banks last week, let’s not forget the traditional bank up the street. Let’s be clear: Traditional banks do not like to invest in startups as a general rule. Banks are in the business of lending money where it can have collateral on its loan and where it’s likely to get its money back. Borrowing money to build out a new building or purchase equipment can be possible, but it’s also quite likely that a bank will look at a new business with no product or sales to speak up and pass on the risk of not getting paid back its loan. Banks, however, are quite fond of lending money to purchase existing businesses. With an existing business, the bank can not only collateralize its loan with the assets of the business (buildings, equipment, computers, vehicles, etc.) but use the financials of the business to evaluate the likely cash flow that would come from continuing the business. This in turn provides some greater security to the bank, which is then more likely to make loans to help with the acquisition and growth of the business.