The old adage goes “you get what you pay for,” but I’m personally taken with a more realistic version from Hearn’s laws that goes: “You always pay for what you get. If you are lucky, you will get what you pay for.” Truly, this is the stuff of common sense, yet people often expect a French Bistro experience on a Denny’s budget; nothing has made this clearer than the past year of pandemic, in which we have all to some extent gotten used to paying extra fees for the delivery of everything from groceries to next-day Amazon deliveries. In the world of finance, we’re often suckered in by the “free checking account,” and while I’ve written about the shortfalls of banks before, today we’re peeling back the myths on discount financial planning and how little what you pay for might buy.

Understanding the Cost of Planning

First and foremost, let’s define our terms. The CFP® Board defines financial planning as:

Financial Planning is a collaborative process that helps maximize a Client’s potential for meeting life goals through Financial Advice that integrates relevant elements of the Client’s personal and financial circumstances.

Under this definition, it’s also important to understand the qualifications a basic financial planner has: Three years of professional experience, completion of 8 graduate level courses in financial planning, completion of a comprehensive exam, adherence and attestation to a code of ethics and professional standards, and continuing education for the duration of the professional’s career. Remember, those are the basics. Now a professional at that basic level of competency is compensated at an industry median rate of $75,768.29 in wages before benefits or taxes. Add on payroll taxes, a basic safe-harbor 401(k), and health insurance, and the cost to employ that financial planner grows to $89,595.29, not including any number of other common benefits that would increase that cost. So now, let’s consider the various forms of discount planning.

Free* Financial Planning*

The obvious example here goes to “free” financial planning. This often arises in one of two surprisingly different extremes. The first is that of a commission-only insurance agent and/or broker. In those cases, to meet the base income requirement of $89,595.29, an agent or broker would have three “quick” ways to meet such a production requirement. First, the sale of life insurance. Unbeknownst to most of the public, life insurance commissions are typically between 80%-120% of the first year’s premium for a policy; so for example, someone paying $3,000 for a life insurance policy has likely gotten the insurance agent a $2,400 to $3,600 commission. At that scale, a life insurance agent would need to sell between $71,676.23 and $107,514 in policy premiums annually to break even. To give you some idea of how much life insurance that is, if the insured were all 30-year-old healthy males buying 20-year term policies, the agent would need to insure approximately $89 million dollars in life insurance protection. Alternatively, if the agent was selling permanent whole or universal life permanent to the same customer, only $16-$18 million in insurance would have to be provided. If that same agent wanted to go about meeting their production requirement through variable annuities, they’d have to sell at least $1,279,932 in up-front commission variable annuities. In the second scenario, the fee-based or fee-only financial planner is likely offering a bundled financial planning and investment management service. With the average first quarter-million being charged 1.5%, this means for a brand new financial planner to pay their way, they’d need to bring on at least 24 accounts of a quarter-million in value, or otherwise bring on larger accounts at a lower fee. All of this to say, “Where’s the financial planning?” When the business model’s incentive structure is to sell products or bring assets on for management, financial planning is just an uncompensated added cost of time for that financial planner. Does spending an average of 32 hours to develop the financial plan for zero compensation in the first year make sense? Or should that planner simply go knock on more doors?

Robo Financial Planning

Much like the free financial plan, Robo financial planning might be the biggest joke in the industry. States such as Massachusetts outright deny that Robo advisors can meet a bare fiduciary standard for their clients, while defenders of Robo advisors claim that the robot’s “impartiality” is the thing that gives them exactly what they need to be true fiduciaries. Regardless, let’s look at the cost structure of one popular Robo-advisor firm. In their business model, investment management of static model portfolios is approximately 0.25% per year; this is a fairly normal pricing structure for what the industry would call a “TAMP” or “Turnkey Asset Management Platform,” where professionals can outsource their investment management services to a third party on top of their own fee (i.e., 1% advisory fee for investment management + 0.25% TAMP fee.) This particular firm also offers financial planning for an additional 0.15% on top of their existing investment management fee. Assuming that the 0.25% investment management fee is actually the cost of doing business, this means that they believe the cost of financial planning is only 0.15% of a client’s assets invested with them (at a minimum of $100,000 in the account balance, or $150 per year). Let’s assume that’s true for a moment: If that’s the case, to pay for one CFP® professional on their staff, at a rate of 0.15% of invested assets, that means they need to have at least $59,730,193 invested in their program. If we stretch that to the minimum account balance, that means one CFP professional for every 597.3 clients. Stretch that across the 2,080 hour work year (52 weeks at 40 hours per week) and every client is getting at most 3.48 hours of financial planning. With the most recent studies on financial planning indicating 32 hours of work required per year per financial planning client, that means clients of that Robo firm are getting only 10.87% of the attention they need to have a successful financial plan.

Call Center Humans

Then we can go to the next tier of discount-humans (no offense to the humans). Two major examples of this are Charles Schwab and Vanguard. Charles Schwab offers a financial planning service that starts at $300 upfront plus $30 per month, while Vanguard offers “Private Advisor Services” or PAS at 0.30% of invested assets with an investment minimum of $50,000, or $150 per year. If we apply the same basic math as we did to the Robos, this means that a Charles Schwab financial planner working with first-year clients only needs at least 135 clients per year to break even or 248.87 per year on an ongoing basis. In the case of the Vanguard advisors, they will need at least $29,865,096 in invested assets, and at an account minimum of $50,000, that’s 597.30 clients if clients are looking to minimize their cost and maximize their return. At 248 clients that’s 8.35 hours of financial planning per year or only 26.11% of the time needed, and for Vanguard at 597 clients that’s 3.48 hours of work, just like the Robo we referenced, and only 10.87% of the attention required for a successful financial plan. So how do they make up the margins in cost? Simply put, a clear conflict of interest. Financial planners in both Charles Schwab and Vanguard’s advisory programs are only permitted to recommend proprietary products to consumers. While this might seem to fly in the face of laws requiring that financial planners act as fiduciaries, those laws have clear carve-outs (which we’ve discussed before) that allow the financial planner’s firms to restrict what they’re allowed to recommend, thus allowing “fiduciaries” to recommend what’s in the “best interest” of the client from inside a limited catalog, and thus increasing the revenue per client above the base financial planning fee.

Full-Service Financial Planners

I know what you’re thinking: “Wait, if they’re full service then how could they possibly be falling short?” Well, the answer here is simple: While there are many CFP® professionals who are fully qualified and charge full and fair rates for their work, many offer limited engagements and services. The trick here is one of semantics: it’s not that the consumer isn’t paying for what they get, but that they’re not paying for financial planning. Engaging with an hourly financial planner for some quick questions or a portfolio review is not engaging in the structured financial planning process. Despite the loud voices of some financial planners in in the industry (including one who claims that financial planning can be done in two hours and for a mere $925), the simple fact is that the data developed in multiple studies bears out the balance that financial planning really does take about 32 hours per year. Even the initial plan development which takes over a dozen hours is not complete without following through on implementation and monitoring steps, along with adjustments as certain assumptions fall through. If we look at the requirement of 32 hours per financial plan per year, a financial planner can only realistically work with 65 clients per year without some form of efficiency or time arbitrage such as model portfolios or group education. Throw on the fact that the planner probably has decent vacation time and it’s more likely that they can’t support more than 60 long-term high-quality relationships. At only 60 client households, that financial planner realistically has to be charging a minimum of $1,493.25 per client, and just to highlight, that’s a median financial planner, to say nothing of financial planners who work in high cost of living areas, serve a highly specialized niche, or who work with high complexity clients who demand more time and energy.

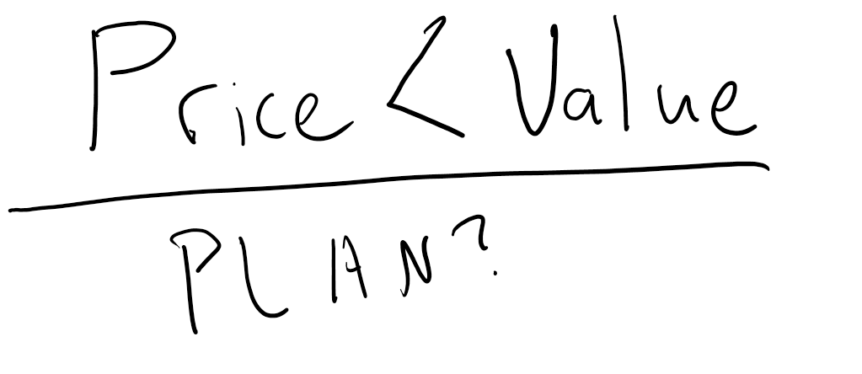

So, do you get what you pay for?

Well, here we’ll wrap up with an excerpt from financial planning client interaction theory, authored by Dr. Sarah Asebedo, Ph.D.: “The financial planner and client will enter into a client relationship because the total commodity output of the relationship is greater than or equal to the sum of the single aggregate commodity outputs of the financial planner. So long as inequality holds, the client and financial planner will maximize utility as a result of the relationship.” In plain English? It doesn’t matter what you pay a financial planner (above the basic cost of getting quality work), so long as you as the client derive more value from the relationship than what you pay. So if you’re engaging in the financial planning process, ensure that what you pay is enough to buy the financial plan you actually want, and not just paying an added fee to be added to a firm’s proprietary product funnel.

Dr. Daniel M. Yerger is the President of MY Wealth Planners®, a fee-only financial planning firm serving Longmont, CO’s accomplished professionals.

Comments 2

I love your eye-opening articles!

Sixty clients?

Hummmmmmm, if one hires more personnel, couldn’t one increase that number by delegating some of the less complex part of financial planning? However, somehow 60 seems a comfortable number for doing a job well.