In 2014 I was halfway through my graduate program in finance and I’d developed a habit that I think many of us can identify with: obsessively watching TED Talks. TED Talks started in the 80s but gained widespread attention as they started being shared online in 2006. Almost a decade later, I’d taken to the habit of getting a notification …

Man Versus Machine

A recent study by Vanguard researchers, Dr. Paulo Costa, Ph.D., and Jane Henshaw, has been conducted on the differences in value between human financial planners and the digital advice offerings of “Robo-advisors,” such as Betterment and Wealthfront. The results of this study of man versus machine are stunning to say the least, not only because of its explicit findings in …

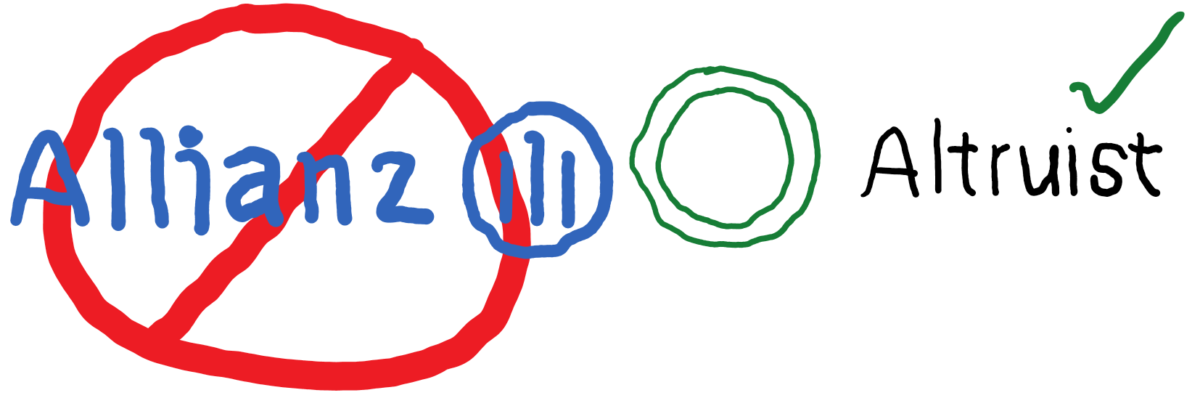

Allianz Scandal and Altruist Announcement

The Allianz Scandal Today the SEC announced that it had reached a settlement with Allianz to the tune of a billion-dollar fine and five billion dollars in restitution to victims of a fraudulent portfolio management scheme. In short, three of its senior portfolio managers had glossed over the potential risks of an options trading strategy that was sold to 114 …

Fee Debates Are Pointless

When I started working on my Ph.D. back in 2020, the very first class was taught as a crash course in how to read research, understand the framework through which research was conducted, and to draft up a mock version of a study we’d like to perform. My excited first presentation during the culmination of the class was a study …

No One Is Happy With Taxes

It has been a common remark over the past few years that taxes seem to have gotten tricky. Whether it be the complex kerfuffle of the child tax credits, the stimulus payments during the pandemic lockdowns, or simply never seeming to get your tax return check from the IRS, no one is happy with taxes as they stand today. However, …

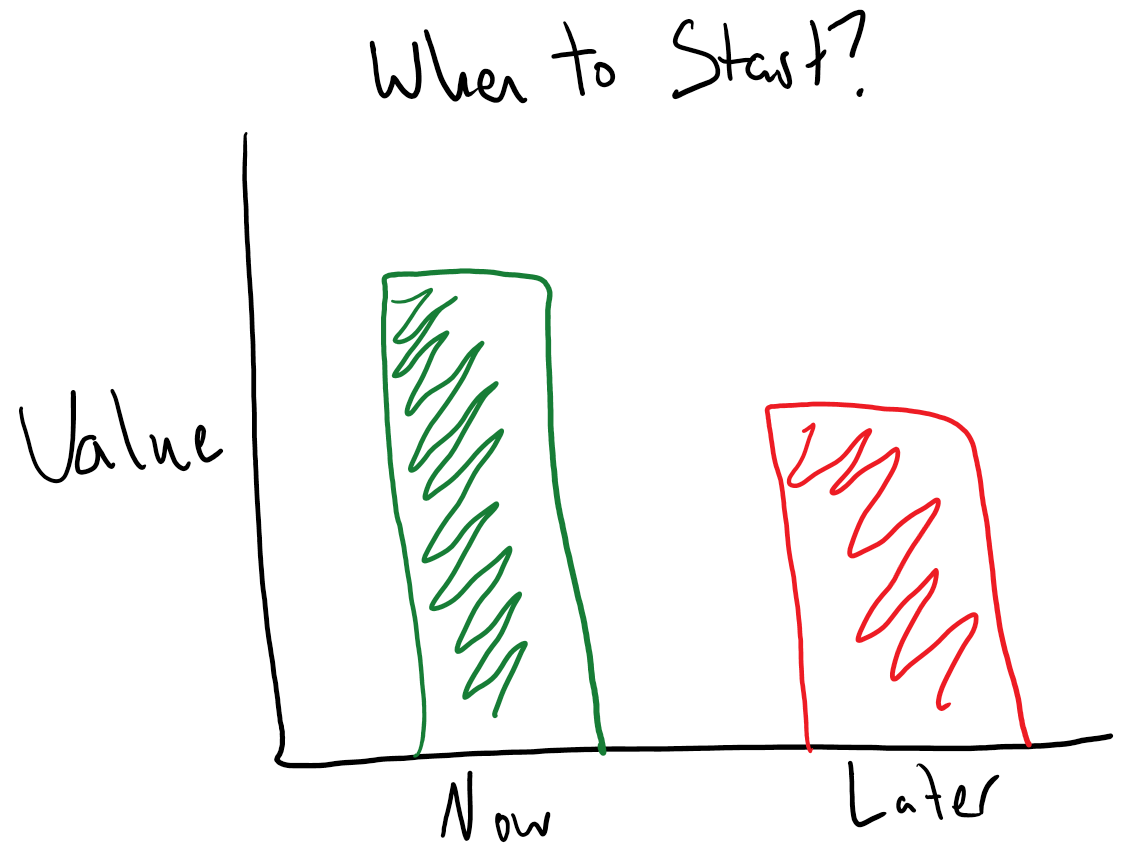

The Tenants of Effective Long-Term Investing

It never fails that investing lives in a perpetual Schrodinger’s Box of reputation. Investments simultaneously are too risky and also the reason billionaires exist. The market is equally “overpriced” and also “losing too much to buy into right now.” Cash is “safe” yet loses a guaranteed percentage of its value every year. On and on, the paradoxes of an investment …