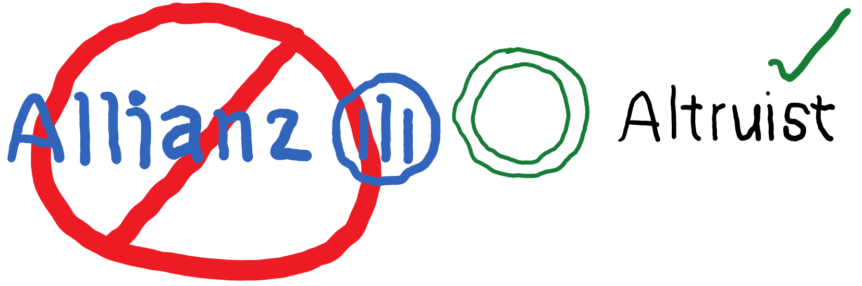

The Allianz Scandal

Today the SEC announced that it had reached a settlement with Allianz to the tune of a billion-dollar fine and five billion dollars in restitution to victims of a fraudulent portfolio management scheme. In short, three of its senior portfolio managers had glossed over the potential risks of an options trading strategy that was sold to 114 institutional investors (large state pension funds and the like), which cost its investors billions in losses that the company attempted to cover up by falsifying documents and records to create the appearance that the strategy was an effective downside hedge, when in fact it had lost billions of dollars. An example of how subtle but significant the fraudulent behavior was, investors were sent risk reports showing a 4.15% loss, when in fact the measure was 42.15%, or in another case cut an 18.2% single-day loss almost in half to 9.2%. The penalties amount to both the six billion dollars in penalties and restitution but also bars Allianz from advising on investments in the United States for 10 years. To give you an idea of how big that is, Allianz manages $2,751,566,400,000 in assets globally (that’s $2.7 trillion dollars), including the famous bond fund management company PIMCO, the largest active bond portfolio manager in the United States, and dozens of life insurance and annuity product subaccounts and products themselves. But within the next 4 months, Allianz will effectively be banned from doing investment business in the United States.

Altruist Announcement

Pivoting away from the story of the fall of Allianz’s Goliath, we now turn to our titular “David,” and no it’s not us. We announced at the start of the year that we were performing due diligence on Altruist, a new investment management platform for firms like MY Wealth Planners. We’re pleased to announce today that we’re opening up a small beta testing group for Altruist. The process for the beta test will provide us with more information and feedback from our clients about their experience with the platform and if it would make sense for us to bring business directly onto the platform or even potentially pivot our full investment management service onto the Altruist platform. In addition, Altruist has the capability of reporting for assets on other custodial platforms directly (including TD Ameritrade, Charles Schwab, and Fidelity), which makes it an appealing option for clients who want additional insight into self-managed or held-away accounts. Some considerations for participation:

- Altruist can integrate with TD Ameritrade, allowing our clients to experience the Altruist platform without moving your assets onto it.

- Participants in the Beta Test will have access to the Altruist online platform and mobile app to review holdings and performance data.

- Altruist is not the custodian, but a technology platform for clients and their investment managers that sits on top of a custodian. The custodian for Altruist is Apex Clearing, which holds over $200 billion in client assets. During the beta test, no client assets will be moved or placed on the Apex platform.

- Feedback is essential from the test, and we may ultimately decide whether Altruist is a great fit for our clients or not a good fit. We make no guarantees about whether we will adopt it fully or reject it in the long term, which is why we need your feedback!

If you are interested in being a tester for the Altruist platform, please let us know by sending an email to Dan or Samantha directly!

This Week’s Post is Short, Where’s My Content?

You’re right. If you’re craving more MY Wealth Planning content, we did publish a post over the weekend on how fee debates between financial planners are pointless. It’s more for a professional audience, but if you’re curious to know what we argue about, it’s an insight into the petty squabbles of financial planners.

Comments 1

If it weren’t for your blog, I would be oblivious to all these earth shaking events. It’s nice to know that someone is minding the store and the big swindlers get caught. Since they handle trillions of dollars, I guess a few billion won’t be impossible pay – however, not doing business in the US from now on is quite a penalty – Thanks for the info – P