As I’m sure you’re aware, the Supreme Court overruled Roe v. Wade on Friday, overturning a 50-year precedent limiting the state’s ability to restrict access to abortion. Consequently, abortion has become outright illegal in 17 states, and is time-limited in 6 states, while a handful of others are undetermined. Regardless of the state you live in or your personal politics, it is well established that having children is a significant expense. Many people choose to have a child or even many children, but whether this was a planned or unexpected event, there are many financial considerations that go with it. Today, we’re discussing the cost of children and the financial impact they can have on your financial plan.

Maternity Costs

Before a child is born, children can already be expensive. Expecting mothers can anticipate approximately $2,000 on average in out-of-pocket costs for prenatal care, including prescriptions and vitamins, multiple doctor’s visits, and the assorted tests and co-pays that can come with them. Outside of the medical expenses, come additional costs of maternity clothing, for which the average American will spend $500 on a “per occurrence” basis. In addition, come the costs of preparation; The USDA anticipates that expecting parents will spend approximately $4,500 on preparatory materials, including cribs, decorations, strollers, car seats, and the various tools and accouterments of caring for an infant. All-in, expecting parents should anticipate approximately $10,000 before their child has even arrived. For those of lower income or within certain communities, there are a number of non-profits that attempt to defray the costs of having a child, including cash grants for those in poverty, and donations of new and used furniture, toys, and support materials for childcare. Notably, pregnancy is not a triggering event for the affordable care act; this means that those who do not already have health insurance when they become pregnant cannot become eligible outside of the normal open enrollment periods or without another triggering event to create a special enrollment period (such as a job change or change in marital status.) This does change upon the delivery of a child. It is also noteworthy that disability and life insurance are affected by maternity and delivery. Some disability policies cover post-delivery complications and limitations to working ability, while others treat it as a carve-out, presuming that it was a “deliberate” claim rather than one as the result of unforeseen incidents, which goes against the purpose of insurance as a shield against significant but unanticipated losses. It’s also noteworthy that some insurance companies limit their coverage for expecting mothers and may not underwrite mothers or children after a certain point during the pregnancy and often for one to two weeks after delivery; All of this should be considered for those families that are planning on becoming pregnant.

Delivering a Baby

While the Affordable Care Act of 2010 ensures that delivery and maternity costs are covered by health insurance, there are no special exemptions for maternal costs. This means that those who undergo delivery in a hospital, clinic, or other medical setting, will incur the normal costs of their deductible and co-pays as they would for any other medical expense. The average cost of a vaginal birth in the United States is $13,024, while the average cesarean section costs $22,646. These costs can be capped by a health insurance policy, but for the uninsured, delivery of a baby can be a significant expense. It is also important to understand how health insurance applies to the newly born. The rule in the United States is a somewhat odd one: The health insurance of the parent who was born first in the year (i.e. January 1st vs. January 2nd) automatically applies to the newborn; this can create a planning issue for parents. For example, when advising people who plan to become pregnant, we strongly advise that the mother have “Cadillac health insurance,” such as an ACA Gold or Platinum plan since the costs of maternity are all but guaranteed to be high. However, the mother may not be the “born earliest” parent, which means that it can become incumbent on the partner to also carry Cadillac health insurance, even if they are otherwise health and risk-averse in lifestyle. The moment the baby leaves the mother, its coverage (or lack of coverage) becomes incredibly important for the family’s financial situation, as an inadequately insured “youngest” parent can end up with a child who incurs substantial poorly or underinsured healthcare expenses. The birth itself does create a special enrollment period under the Affordable Care Act, but it is noteworthy that health insurance often doesn’t start until the month following enrollment, which means any during-delivery or post-delivery complications may be underinsured.

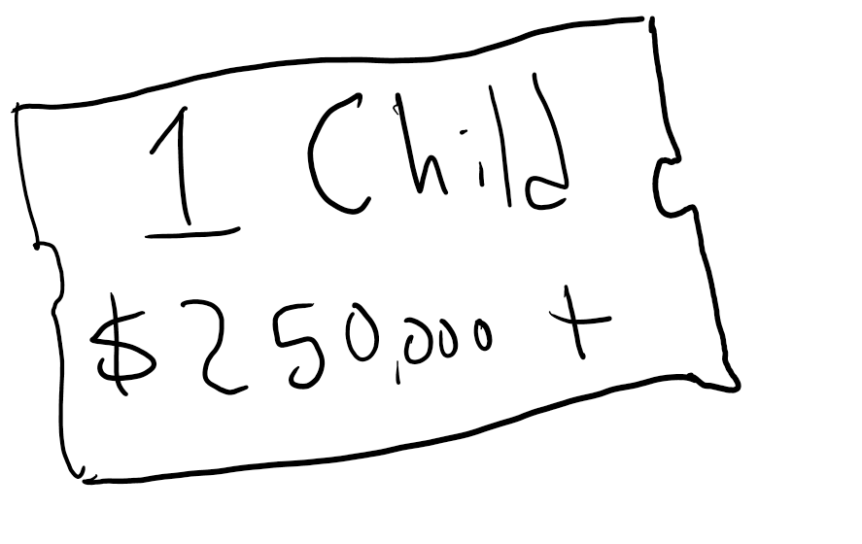

Raising a Child

Assuming all is well through the pregnancy and delivery, then comes the simple cost of adding another person to your family. The USDA estimates the average cost of a child is $13,000, as a combination of clothing, food, healthcare, and the various toys and activities a growing child demands. This is before costs such as daycare, babysitters, and other “optional costs” are accounted for, which can easily exceed an additional $12,000 a year, and often can stretch up in excess of $20,000 per child. Thus, raising a child can cost more than a full-time job at minimum wage, and these costs duplicate and multiple with each additional child. Costs can decline once the child reaches school age, but costs such as daycare can quickly be replaced by school activities, sports, and other expenses. It is also considerable that the cost of everyday activities such as eating out and travel can increase significantly with each child.

The Cost of Education

We’ve written extensively regarding the cost of college, how it has expanded, and how to attempt to control the costs. Something as “simple” as paying for four years at CU Boulder can cost $173,840.67 for tuition, books, room, and board eighteen years from now. Investing in something like a 529 plan to keep pace with the inflation of higher education (approximately 6% annually) will cost parents $446.56 per month from the day the child is born until they’re 18, and that assumes a low-cost in-state four-year education, to say nothing of the potential cost of out of state tuition, private college, or attending graduate school. Regardless of the parenting and expense philosophy of the parents, it’s likely to cost a significant amount monthly, and for those who defer or delay saving for college expenses, the required monthly savings rate can accrue substantially. Even those parents who elect not to save and pay for college are likely to incur the obligation of co-signing for private loans for their students if costs exceed the funding afforded by Stafford Loans, scholarships, or grants.

The Defraying the Cost of Children

There are some limited mechanisms to defray the costs of having children. Many employers make Flex Spending Accounts available to their employees, which can variably be used to pay for healthcare expenses and/or childcare tax-free. Users of “FSAs” should be cautious in that they have a use-it-or-lose-it design, which means funds not spent every year may be forfeited. Additionally, the aforementioned 529 plans can be used to save for college costs and in some states, can be used to pay for K-12 private schools on a tax-advantaged basis; both with a state income tax write-off and with tax-free appreciation on the growth of investment assets within the 529 plan. Finally, though this is less financial, children are wonderful in their own right. Though it’s rare that a child pays their own way (there’s always the occasional prodigy or child actor,) children are of course beloved by many and bring a great sense of pride and accomplishment to their parents. Whether you make the decision to have children is an intensely personal decision, preferably made with planning and forethought. But from here, you’re better informed about the costs of preparing for and having children and should have some ideas on how to have them a bit more affordably.