“A day may come when the courage of men fails, when we forsake our friends and break all bonds of fellowship, but it is not this day.” -Aragorn at the Battle of the Black Gate

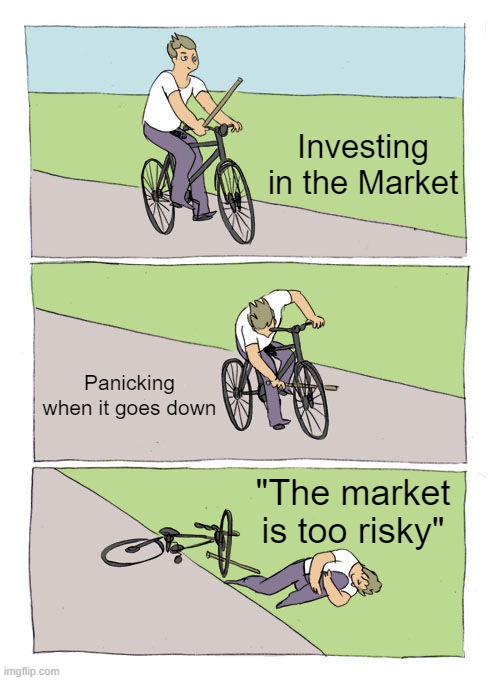

I have written a lot about volatile markets and market downturns, yet without fail, the lessons of dozens of market crashes before seem to fall on deafer ears the longer and deeper a market downturn goes. The fortune-telling begins: “Well it’s going to keep going down so I should just get out.” Then Captain Hindsight speaks up: “I knew it was going to go down!” Then the rationalizations: “Well how about instead of [investing at the current market discount] I [pursue a deliberately sub-optimal alternative]!” My personal favorite was a gentleman who casually told me at a pre-pandemic social in 2020 that he’d sold out of the market and gone to cash in his accounts the day before the market had started to decline. Perhaps forgetting this braggadocious claim, he came to me a few months later asking for financial advice because, as he confessed, he had not saved any money in his entire career and had no investments to speak of.

It’s funny because you would think that the panickers (and yes, that’s what it is no matter how it’s rationalized) would look like panickers. One imagines a little old lady fumbling over a checkbook, counting pennies in her change jar, worried sick that her pension is going to run out and she’ll have to call on her children for help. But in my experience, that’s not the case. Call this a sample bias of my clients, but the panickers are the people you’d expect to be made of sterner stuff: Retired military combat veterans, business executives, and even young people who shouldn’t have too much cause for concern. It seems that for those who’ve only known great success and triumph over difficulty in their lives, they struggle to handle things when they’re not able to affect a difference in the outcome, given that the market does what it likes, no matter how one individual might scream into the void. Meanwhile, the little old ladies I know simply smile and say “it’s happened before, it’ll happen again, and I’ve made it this far!”

With all due respect to King Aragon above, the great irony is that no one but yourself is betrayed when courage fails in the market. Sure, selling out of your positions causes selling pressure that cascades into the larger market’s selling or buying pressure, but ultimately you’re the one who suffers the defeat. It is not your friends, co-workers, or neighbors who you let down when you panic and run for the hills, but yourself. As the old saying goes, “a brave person dies but once, but a coward dies a thousand deaths.”

My potential client conversations are regularly filled with “I should have” and “I shouldn’t haves.” “I should have started saving sooner.” “I should have just stayed in back in 2008.” “I know the annuity wasn’t the best choice for me, but I was so scared after the dot com bust.” Regrets tend to haunt us over the long term because, unlike victory, missed opportunities do not become part of our lived status quo, simply echoes of what could have been. Even now, one could rationalize the opposite to themselves, but the simple fact is that once the fist has reached your face, there’s no good time spent thinking about how you should have ducked. All you can do is adapt to the new reality of the bruise on your cheek.

My regular readers will probably be puzzled at this point: “Dan, don’t you usually cut away to something after a paragraph or two? Isn’t this going on a bit long?” You’re not wrong, regular reader, but I’m here to make a point today. I’ve written a lot about market drawdowns, market recessions, volatility, and how to weather and survive in these environments. I can educate-educate-educate and encourage-encourage-encourage, but at a certain point, each person must decide for themselves whether they will be brave in spite of fear. To invoke just one more quote: “Being brave isn’t being fearless, it’s pushing ahead even when you’re scared.” If the “little old ladies” I know can tough it out, if the entrepreneurial single parents whose businesses are down 30% this year can tough it out, if the thirty-something professional who has only known market increases in their adult life can tough it out, I assure you, dear reader, you can tough it out. Where you might feel nothing but doubt, others are finding cause to be optimistic: Making the leap to retirement despite downturns, having their first child, buying a new home or an investment property

If you’d like more specific information, encouragement, and suggestions, please, avail yourself of my extensive library of just that. Otherwise, stay tough: Market downturns come and they go. They are normal, they are regular, and the market still has climbed by hundreds and thousands of percent in the lifetimes of every American.

“The Tenants of Effective Long-Term Investing” by Daniel Yerger, 05/03/2022

“Financial Stress and Time in the Markets” by Daniel Yerger, 04/27/2022

“You Should Never Invest Your Money” by Daniel Yerger, 03/29/2022

“Thriving During a Market Correction” by Daniel Yerger, 01/25/2022

“The Difficulty of an Investment Process” by Daniel Yerger, 11/02/2021

“Rethinking Risk” by Daniel Yerger, 10/19/2021

“This Time I’m Different” by Daniel Yerger, 04/06/2021

“This Time It’s Different – Why I’m a Boring Investor” by Daniel Yerger, 03/09/2021

“Lessons Learned from an over-concentrated Economy” by Daniel Yerger, 06/09/2020

“Riding out the Storm” by Daniel Yerger, 3/10/2020

“The Market is on Sale” by Daniel Yerger, 02/25/2020

Comments 1

Bravo. Thank you Dan.