Colorado is a well-known destination for climbers, hikers, skiers, and all sorts of adventurers. It’s no surprise that not only is it a popular place to live, but a popular place to retire. Retiring in Colorado, whether you’re a local or a newcomer, comes with some particular planning elements that should be considered. So today, we’re talking about retiring in Colorado and what you should know as you plan for it.

Choosing a Retirement Income Style

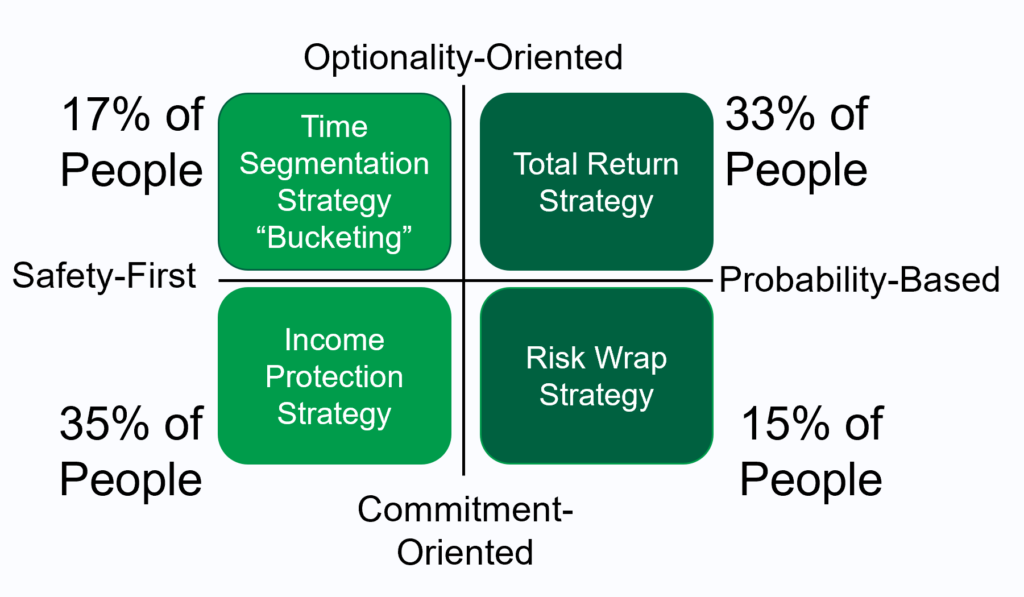

Before you learn the specifics of Colorado’s rules of retirement, take a moment to consider how you should structure your income in retirement. The current method of assessment “in vogue” for financial planners is called “retirement income style awareness” or “RISA,” which was developed by faculty at the American College and involves two choices:

- Would you rather base your retirement income on a safety-first approach or a probability-based approach, knowing that safety is likely to underperform probability but has more assurances and that probability is likely to outperform safety but is not guaranteed?

- Would you rather your retirement choices include optionality and the ability to make changes, or that involve a commitment to the strategy?

Depending on your answers, you’re going to fall into one of four camps.

The four camps are summarized as:

- Total Return Strategy: Relying on a diversified portfolio and the risk premiums provided by more aggressive investing to provide the best long-term outcome. This strategy carries the most risk, but also the highest probability of building up wealth and assets that can sustain you in retirement.

- Time Segmentation Strategy: This strategy involves allocating investments based on your expected length of retirement, putting aside enough investments in segments of months or years to fund retirement over the long term. This is similar to the total return strategy but involves selecting assets “by layer” and only using the assets appropriate for the current moment while leaving others alone.

- Risk Wrap Strategy: This is a combination of total return that includes a floor of income. That floor of income is typically provided through social security, a pension, annuities, or a reverse mortgage. The income floor should pay for all necessities, while any extra assets above the level required to fund necessities remain invested for the risk-reward premium.

- Income Protection Strategy: For the most risk-averse investor, this strategy involves committing most if not all income into fixed income-producing assets such as a pension and fixed annuity products. While this strategy runs little risk of running out of money in retirement, it often leaves little to no legacy or inheritance for heirs and has little-to-no ability to make changes over time. Thus, the most significant risk of this strategy is inflation, which can eat away at the purchasing power of the guaranteed income streams.

Why Knowing your Retirement Income Style is Important

Many of the specifics of retiring in Colorado have to do with the longevity of time you’ve lived in your home and the amount of income you receive from retirement sources, as well as net income for the year. For those who want to take full advantage of all programs, some control over your income is vital for capturing the maximum tax benefits of living in Colorado. Those with a purely fixed income protection strategy preference may find that they qualify constantly if their income levels are low enough; others with more savings and assets may find that they need to work with their accountant and financial planner every year to keep their income below certain thresholds to ensure they qualify for maximum benefits. With that said, let’s talk about some of the special conditions of retirement in Colorado.

Tax Exemption of Retirement Income

Colorado has a 4.4% income tax as of 2023. However, this income tax’s applicability to retirement income is limited. Specifically, Colorado law excludes retirement income of $20,000 per year per person between ages 55-64 and $24,000 for those aged 65 and over. This translates to between $880 and $1,056 in reduced state income taxes. This rule applies to income from pre-tax retirement accounts, pension plans, qualified annuities (IRA-based or 403(b) based), and social security. For the year you might turn 55 or turn 65, your age on December 31st determines your eligibility for the exemption that year.

Senior’s Homestead Exemption & Disabled Veteran’s Homestead Exemption

People over the age of 65 in Colorado can reduce the value of their home by up to $100,000 for the purposes of property tax assessment. Specifically, if they have lived in their primary residence for at least 10 consecutive years, they can apply to exempt up to 50% of the first $200,000 of their home from property tax assessments. In lower cost-of-living areas in Colorado, this might easily reduce your property’s assessed value, which differs from its saleable value, down to zero, or close to zero. This same rule applies to veterans who are rated 100% disabled due to a service-related injury, and after the passage of Colorado Amendment E in 2022, applies also to their surviving widow or widower after their passing.

PERA Recipients

Many public employees in Colorado participate in PERA. PERA participation often involves paying into PERA rather than Social Security, which can leave many retirees thinking they aren’t eligible for Social Security benefits, particularly if they’ve worked in the Colorado public sector their whole lives. Yet, this isn’t necessarily true! All married couples who have been married for at least 10 years become eligible for a spousal benefit under social security, equal to one-half of the benefit of their spouse. For a married couple where one works as a school teacher and the other works at an IT company, this means that the school teacher could be eligible for 50% of the IT-working spouse’s social security benefit. Now, there is an element called the “windfall elimination program” which reduces monthly social security benefits by approximately $500/year (adjusted annually with inflation). However, for those whose spouse’s social security benefit is greater than $12,000/year, this means that there is extra income available from social security available, even after the windfall elimination.

Retiring in Colorado with High Retirement Income? Be Careful!

If your income exceeds $300,000, whether single or married, watch out! In Colorado, Proposition FF in 2022 created a cap on the standard deduction and itemized deduction claimable by individuals with $300,000 or more in total income. This cap is about half the difference between the single standardized deduction and the married deduction, but the key element here is that the cap applies both to the standardized and itemized deduction. In tandem with this issue is the state and local tax (SALT) limit that passed at the federal level as part of the Tax Cuts and Jobs Act in 2017, which limited deductions of state income tax and local taxes (i.e. property tax) to no more than $10,000 for either a single or married taxpayer (including cutting the $10,000 in half to $5,000 for those who are married and file separately.) The result is that between high property taxes and Colorado’s 4.4% income tax, many taxpayers miss out on a few thousand or even tens of thousands in deductions that would have applied to their itemized returns before 2017.

Helping with Grandkid’s Education

Many of us were excited to get Christmas and birthday presents from Grandma and Grandpa when were kids, and your grandkids are probably not going to be any exception to that. However, when you think about gifting things to your grandchildren, be careful about not accidentally burdening them with extra expenses! Specifically, for grandparents who want to help their children save for their grandchildren’s education, gifts into a 529 college savings plan are ideal. A child beneficiary can technically have as many 529 plans as there are people to gift to them, but it’s ideal from a compliance standpoint that all 529 dollars for one child stay in one account, as there are aggregate limits that a 529 plan can hold for one child. For those who want to help with the cost of education today, be careful about giving the parents or grandchildren money for tuition. Because money in gifts is considered fungible, the normal gift tax limit of $17,000 (in 2023) applies per grandparent per beneficiary, meaning a married couple can gift up to $34,000 to someone each year. However, more usefully, grandparents can pay tuition directly to a college on an unlimited basis, and the tuition payments will not be considered a gift for gift tax purposes.

Giving Money to Charity – Double Dipping

Giving money to charity is a big perk. In the United States, retirees can make a “qualified charitable distribution” to gift their annual required minimum distribution to a 501c3 non-profit. These donations are typically excluded from both Federal and State Income tax. However, in Colorado, we also have the “child care contribution tax credit” which generates a tax credit equal to 50% of the gift made to a qualifying non-profit that provides support for children’s care, i.e. daycare, orphanage, foster, and so on. This is valuable because the tax credit offsets state income taxes owed, which can help taxpayers with more than $10,000 in state income and property taxes get below the SALT deduction line. For those retirees with “excess” retirement income, this can be a valuable tool for not only helping a good cause but keeping your retirement taxes low!

Retired Police Officers

The Pension Protection Act of 2006 gives retired “public safety officers,” i.e. police and federal law enforcement agents, an exemption of $3,000 of their income for qualified health insurance premiums, so long as those premiums are deducted from their retirement benefits. This means that payments have to be directly deducted from social security or pension benefits, not paid for outside of the stream of income from something like IRA distributions. This eligibility applies to most if not all Colorado law enforcement officers, who are typically covered by a hybrid PERA program that has both an investment and pension program attached.

Comments 1

Very helpful. Thank you!