Recently, a financial planning colleague asked on his Twitter page:

One of the first replies was from an Anesthesiologist: “5%. Expect 7% and account for 2% inflation with projection for “today’s dollars.” While that seems like a perfectly reasonable set of assumptions, there are actually several major problems with using this assumption baseline. Today, we’re using this example of a seemingly reasonable set of assumptions to illustrate why even basic amateur DIY financial planning can end up in financial catastrophes.

*A language note: I’m going to say “he” about the Doctor; this is not gender normative; the Anesthesiologist was actually a man. Women make awesome Anesthesiologists and anything else they want to do, for that matter.

The Rate of Return Assumption

We’ll start with the good news: 7% is perfectly fine as a rate of return. I will typically tell clients that an expectation of a long-term average return between 5% and 9% before inflation is a healthy spectrum of expectations, depending on how aggressive or conservative they want to be. While in any given year, someone targeting a 9% return might see their money go up or down by 10, 20, or 30 percent, it’s not an unreasonable long-term average to expect 9% a year. But when we say long-term, we mean 10 or 15 years plus, not just longer than a single year. Really, the only risk in practice with the 7% assumption is the difference between investment and investor returns.

Author Carl Richards has branded the term “Behavior Gap,” illustrating the concept of what investment returns are versus what human behavior leads to in terms of investments. While he uses a simple napkin sketch to illustrate the gap between the returns from investments and the returns investors enjoy, there is actually a serious body of statistical research on this front. For example, Morningstar, a major investment research firm, publishes an annual “Mind the Gap” study, which in its most recent release just a few weeks ago showed that while fund investors had an average 6% annual average return over the past ten years (2012-2022), the average fund holdings produced a 7.7% rate of return; in other words, they underperformed their own investments by 1.7%. What gives? Human behavior. People have a nasty habit of roleplaying as Warren Buffet. The problem with doing so, of course, is that you’re not Warren Buffet, and make-believe doesn’t translate into real investing chops. One might try to point to something like the cost of the investment products, but the study even took that into account, showing that even the cheapest investment funds had return gaps between the investment and investor that were still about the same as the overall group.

So, while it’s fun to envision a world in which the good doctor receives an annualized 7% rate of return, that might be a bit of a rosy vision if he does not pick the right investments in the first place, and even once he has, if he does not exhibit the proper discipline, systems, and processes to actually obtain the returns he says he’s planning on.

The Real Problem: Inflation-Adjusted Errors

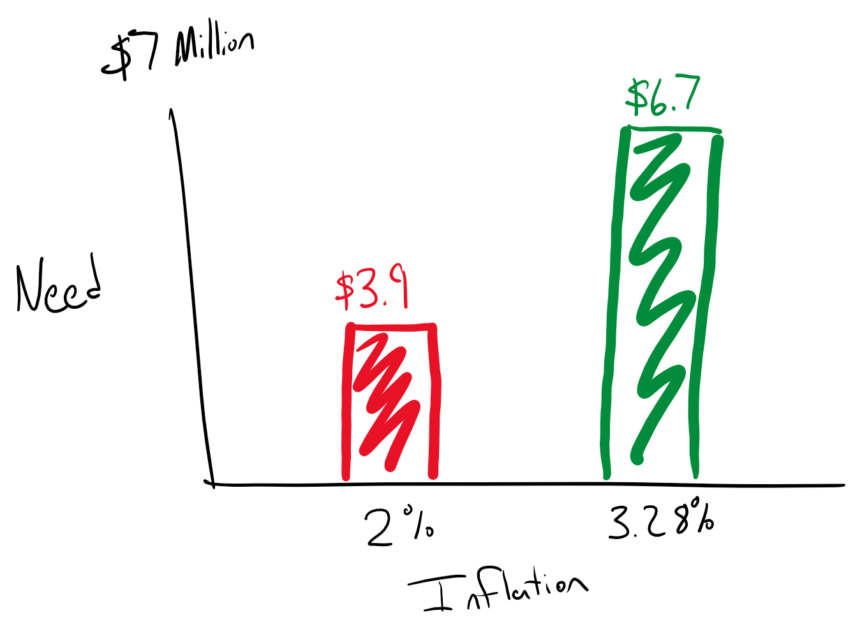

Surprisingly, the 2% number and 5% number in the doctor’s response are the bigger issue here. Let’s break this down step by step. First and foremost, a 2% inflation rate might seem okay, but it’s actually problematic on its own. The long-term inflation rate average in the United States and on the United States Dollar has been 3.28%. Over the past two decades, we’ve seen inflation rates hovering a bit north of 2%, closer to 2.25% or 2.3% as an average during that time, and that’s ignoring the almost 10% spike in inflation rates over the past two years. All of this to say, 2% is a very generous assumption for inflation, and in using such a low inflation rate, there’s a real risk in the plan that it not only has no margin for error but might already be assuming a negative margin of error, that things will work out better than they historically or even recently have. But let’s compare the doctor’s assumption of 2% and the long-term average of 3.28%.

Anesthesiologists’ mean income in the United States is $302,970. While I did the math on the exact taxes and so on that the doctor should expect to pay after maxing out a 401(k) plan and paying 10% of their income on student debt (it comes out around $172k being left over depending on whether there’s a state income tax or not), let’s keep this simple and assume that the cost of living after all of that is going to be $150,000 a year. An Anesthesiologist should be done with medical school and residency by around the age of 30, assuming they’ve gone straight from undergrad to medical school to residency to full-time practice. If we assume they’re going to work until 65 and retire, that gives us a 35-year timeline to save and invest for retirement. So, if we assume that said $150,000 cost of living will inflate by 2% and 3.28%, then over a 35-year career, the doctor assumes he will need $299,983.43 per year in the future to offset his cost of living, while at 3.28%, he would actually need $464,150.99. That’s a $164,167.56 margin of error per year.

Now, there’s another step that’s being done incorrectly here. The doctor is assuming that with a 7% rate of return and a 2% rate of inflation, that the inflation-adjusted return is 5%. This is actually incorrect. The formula for calculating an inflation-adjusted return is (1+rate of return)/(1+Inflation Rate)-1. When you run that math out, a 7% rate of return and a 2% rate of inflation is actually a real post-inflation return of 4.901%. Now, 0.099% probably doesn’t seem like a big difference, but let’s compare. The doctor assumes a 5% versus 4.901% difference in inflation. If he assumes he will need a 20-year retirement (age 65-85), then under his incorrectly inflation-adjusted assumptions, he thinks he needs $3,925,379.47 to retire on, when in fact, he would actually need $3,954,520.58. Now you’re probably thinking: “Dan, that’s only $29,141 off, that’s no big deal,” and you’re right, that’s probably a survivable margin of error. But now, let’s use the long-term inflation rate of 3.28%. The same 7% adjusted for 3.28% inflation comes out to 3.601%. When we apply the same formula with that better-founded real rate of return, he’ll actually need to save $6,771,742.23. That’s a $2,846,362.76 gap!

How Much Does He Need to Save?

Well, herein is the tricky part. If the doctor’s numbers were correct, he’d be pleased to realize he could meet his retirement savings goals with just a 401(k) and a Roth IRA, without any need for an employer match (though it wouldn’t hurt!) Based on his assumption that he needs $3,925,379.47, at a 7% rate of return, he’d only need to save $28,396.04 a year, which could be accomplished with a 401(k)’s $22,500 annual employee contribution and a back door Roth IRA’s contribution limit of $6,500 per year. He wouldn’t even need employer matching, social security, or other retirement benefits (huzzah!) But, when we account for a better-founded and more conservative rate of inflation, along with an accurately calculated real rate of return, we find that he actually needs to save $48,986.51 per year, which means not only will he have to use more than his 401(k) unless the matching is generous, it means he will have to dip into non-retirement investing, which adds additional factors on top of the existing tax question present in how much he needed to save that we didn’t even discuss, and further complicates the vision of a clean 7% rate of return. As the expression goes: Amateurs measure the rate of return, and professionals measure the rate of return after taxes.

So What Can We Learn Here?

There are plenty of things we DIY. Most of us clean our own homes, drive ourselves to school, do our own grocery shopping, etc. We hire professionals for things that we’re wildly unqualified to do (such as administering drugs to prevent pain before and during surgery), and we weigh the costs and benefits of hiring professionals to do things we think we can do ourselves. In the case of financial planning, I have an obvious bias when I say this, but I think it’s utterly foolish to build a financial plan on your own if you don’t have the education or training to do so. That’s not to say you shouldn’t do some scratch paper math or break out a spreadsheet from time to time to try to figure some things out, and there’s nothing wrong with taking an interest in finance and educating yourself. But when it comes to building a financial plan for your entire life and future, you only get one shot at it. You will either get it right or get it wrong and if, god forbid, you made an error such as 5% vs. 4.901% or relied on a bad number like 2%, you might be making multi-million dollar errors. The good news is that if you later catch the error, you can then correct your course, but doing so can be incredibly expensive. Time is the most valuable resource in all of finance, and it’s the only resource we have no control over.

I hope this has been a good illustration of just how sensitive the assumptions of a financial and retirement plan can be and why it makes sense to, at the very least, get a second opinion. You don’t have to hire a comprehensive financial planning firm like MY Wealth Planners, but at the very least, if you’re going to be DIY, splurge on an hourly or project planner to make sure you’re building a foundation for your financial future with valid figures.

Dr. Daniel M. Yerger is the President of MY Wealth Planners®, a fee-only financial planning firm serving Longmont, CO’s accomplished professionals.

Comments 1

This is an incredibly eye-opening breakdown of how small miscalculations in financial planning assumptions can snowball into massive shortfalls over time. The way you dissect the difference between investment returns and investor behavior—especially with the “Behavior Gap” concept—is both insightful and humbling. It’s a powerful reminder that discipline and strategy matter just as much as the numbers themselves. And your analysis of inflation assumptions is spot-on; using overly optimistic figures can create a dangerously false sense of security. This post is a must-read for anyone serious about long-term financial planning—thank you for making such a complex topic so clear and compelling!