There’s a funny thing about entrepreneurship: many people who have successful businesses never thought of themselves as, and to this day may not think of themselves as, entrepreneurs. While this can apply to many common examples, such as those working in the trades as independent contractors, the same thing can often happen to those in more creative businesses. What might …

When the tide goes out

The Oracle of Omaha once said, “Only when the tide goes out do you discover who has been swimming naked.” While the meaning of this colloquialism varies based on who’s quoting it and the circumstances thereof, today we’re thinking about leveraged portfolios. Specifically, the risks of leveraged portfolios and where it’s often considered risky or safe, despite the risks being …

The Latest and Greatest in Planner Compensation

The latest study on compensation within registered investment advisers has been released, so today, we’re providing an overview of the compensation measurement changes for three entry-level and early career positions: non-licensed support (e.g., customer service, receptionist, office admin), entry-level financial planners (paraplanners, associate advisors, planning analysts), and experienced CFP® Professional Financial Planners. Non-Licensed Support Based on the data from 2022, …

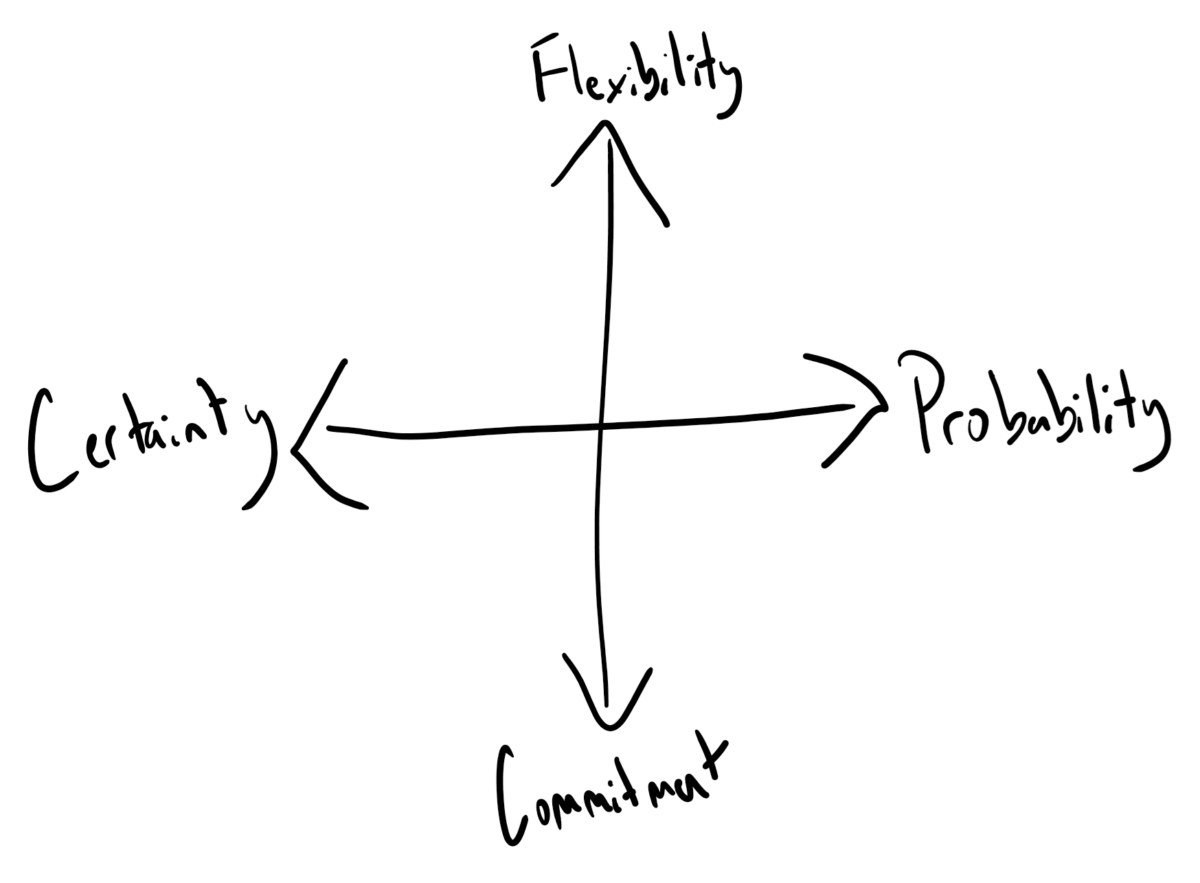

Establishing a Retirement Income Strategy

One of the things often missed by retirement savers is that they have a decision to make as they reach that point of financial independence: Where is my money going to come from? Despite potentially having saved an enormous amount of money during their lifetimes (or sometimes not enough!), many savers are ill-equipped to establish a strategy for sustainable retirement …