One of the things often missed by retirement savers is that they have a decision to make as they reach that point of financial independence: Where is my money going to come from? Despite potentially having saved an enormous amount of money during their lifetimes (or sometimes not enough!), many savers are ill-equipped to establish a strategy for sustainable retirement income distribution. This week, we’re covering the “Retirement Income Style Analysis” framework and the underlying strategies behind the four proposed styles.

What’s My Retirement Income Strategy?

First things first, let me as you two questions:

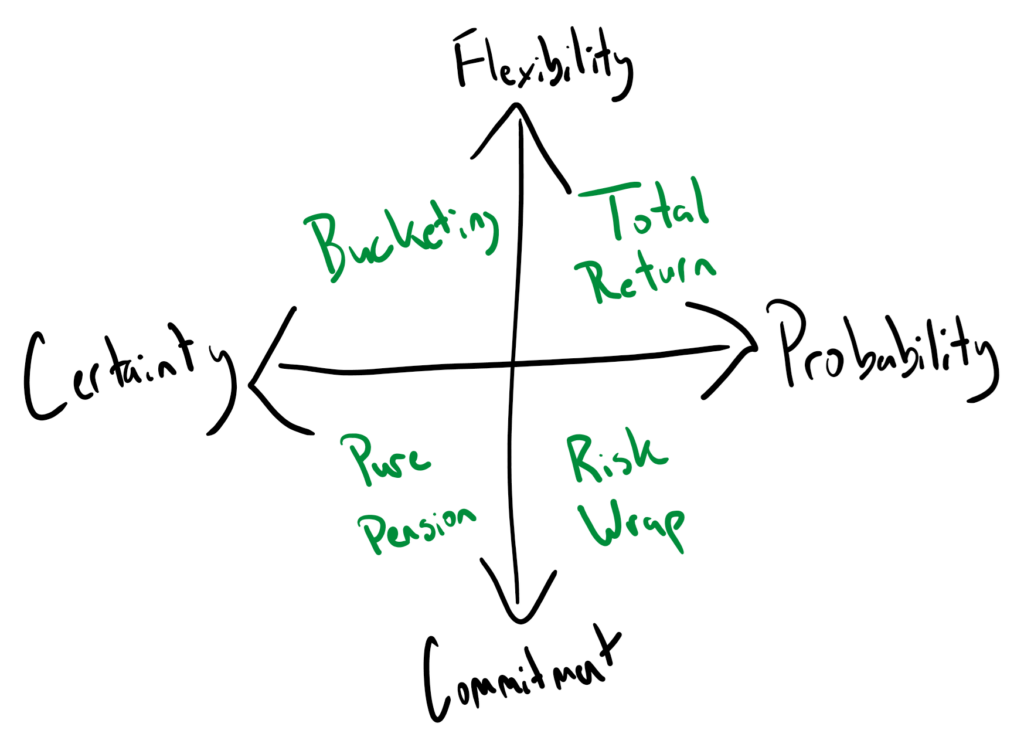

1) If I were to draw a line, and on one end of the line, you wanted a conservative certainty, and on the other you wanted a generous probability, where would you be most comfortable when thinking about your life savings?

2) If I were to draw another line, and on one end of the line, you had total flexibility and on the other, you had total commitment, how would you want to set up your retirement strategy?

Between the two answers, we come up with a simple diagram like so:

Within the framework, there are four retirement income strategies that we’ll now discuss.

Total Return Retirement Income

The basic premise of a total return approach is that you’re going to rely on what is known as the “stockholding puzzle,” or an observation that over the long term, the strongest returning asset class are common stocks and equities held in the marketplace. Consequently, this strategy means holding a high amount of equity (preferably through highly diversified equity-based products such as index-tracking mutual funds and ETFs) with little to no guaranteed or insured income. The basic idea behind this strategy is that, while there may be sharp market downturns, the retiree is comfortable riding out the long term rollercoaster of the markets to obtain the probable maximum amount of possible wealth in retirement.

However, this strategy does leave the retiree exposed to a number of risks, and most importantly, the sequence of returns risk. Sequence of returns risk is the observation that while returns themselves can happen in any order (e.g., 1.1*1.2*1.3*1.4*1.5 is no different than 1.5*1.4*1.3*1.2*1.1), when you introduce cash flows into the equation, there can be a serious difference in the outcomes (e.g., subtracting needed income distributions from returns can result in the depletion of assets during downturns.) Provided someone has a strong risk tolerance or the assets and lifestyle that can be adjusted in the event of market downturns, this can result in the best of outcomes for retirees, but also presents the highest risk approach.

Retirement Income Bucketing

The Bucketing strategy is also known a “time segmentation” strategy. In this instance, the retiree creates time-delineated pools of assets that are meant to fund different phases of retirement. For example, a retiree expecting to need to distribute 5% of their assets every year might break their assets out like this:

| Holding | Allocation |

| Checking, Savings, & Money Market | 5% |

| 1 Year CD | 5% |

| 2 Year CD |

10% |

| 3 Year CD | 15% |

| Intermediate US Treasury Fund | 10% |

| Long Term Corporate Bond Fund | 10% |

|

Large Cap Stocks |

10% |

| Mid Cap Stocks |

10% |

| Small Cap Stocks | 10% |

| International Stocks |

15% |

With this setup in mind, they might intend to live on what’s in their checking, savings, and money market accounts the first year, then the output of a 1 year certificate of deposit the second year, then the output of a 2 year certificate of deposit the third year, and so on. The idea behind a portfolio like this is that each asset class is generally riskier than the next, and that by bifurcating investments into time-delineated brackets, they can predict that they might average out any downturns in riskier assets over the course of their retirement, leaving the most volatile and riskiest assets for the latest years of retirement, while planning to live on safer assets earlier in retirement when the need is more imminent and risks are less acceptable.

Retirement Income Risk Wrap Strategy

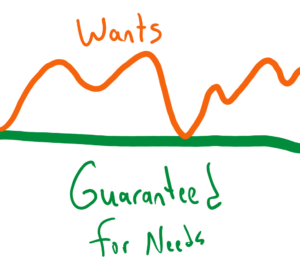

The strategy of a risk wrap is the first of the strategies we’re discussing that involves a degree of commitment. While a total return portfolio can be converted to another strategy at any time (assuming it hasn’t been depleted) and nothing in the bucketing strategy requires the investor to stick to it forever, thus meaning both strategies are flexible, a risk wrap strategy involves making long term commitments. In the simplest terms, a risk wrap strategy involves buying guaranteed income sufficient to meet your needs as a retiree, and then being aggressive with the remainder of your money to help fund the wants you might have.

Many retirees already have some of this done via their eligibility for a pension and/or social security benefits, which may provide the most inexhaustible foundation for their retirement income strategy. Yet, by extension, many have needs greater than the guaranteed income from these sources and thus must use options such as single premium immediate annuities or reverse mortgages to make up the gap. However, once the necessary minimum income is funded to provide for a retiree’s needs, they can then afford to take greater risks akin to a total return strategy with their remaining money, which can then potentially afford them a greater level of comfort in retirement, funding the proverbial “wants.” However, you should be mindful that there is still risk in that portion of a strategy, and overspending on wants during a market downturn could exhaust the flexible resources of a retiree.

Pure Pension Retirement Income

For the most conservative of retirees, the strategy here is simple: invest every dollar you have into an annuity or pension product with guaranteed income and take all the market risks out of the picture. A large number of retirees, such as those retiring under the military’s traditional pension system or as teachers in PERA who buy years and do not maintain any 401(k), 403(b), or 457 balance in retirement, engage in. This strategy might seem foolproof to many retirees, but it does typically carry one major risk that can be very difficult to account for: inflation risk. Simply put, while retirement income guarantee products can be inexhaustible, riders or benefit guarantees to adjust for inflation can be scarce or expensive, and may have limited upside adjustments that substantially hinder the ability to fund expenses later on in retirement as the purchasing power of a dollar declines.

Dr. Daniel M. Yerger is the President of MY Wealth Planners®, a fee-only financial planning firm serving Longmont, CO’s accomplished professionals.

Comments 1

Hummmm, I glad there are people like you to figure this stuff out. How to manage retirement money so that it doesn’t run out nor leave us with a niggardly pittance to eke out our last days with is a comfort.

You go, man, we need you! (smile)

P