As you might have seen, over the past few weeks, we’ve been in the recruiting process to add a wealth planner assistant to our team. This hybrid role includes reception, office management, and data entry. Essentially, someone who can help run the office and support the team while we focus on client-facing and service work. Two years ago, we hired Emily Green for such a role, and Emily, demonstrating stellar performance, was promoted in 2024 to Associate Wealth Planner. So, if you were familiar with Emily’s work circa 2023, that gives you the idea.

However, hiring in the financial planning world is a funny thing. While most members of the public are very familiar with major financial institutions and the roles therein, such as bank tellers and insurance agents, financial planning is a much smaller niche of the financial world, and consequently, it’s rare that someone’s life ambition since they were a kid was to work in a financial planning firm. In addition, almost all roles in financial planning or financial advisory firms are sales jobs rather than salaried career-track roles with stability and benefits, so often, a job hunt for a role in a financial planning firm involves filtering out literally dozens or even hundreds of not-so-subtle “unlimited earning potential” advertisements for sales jobs.

In turn, financial planners are famously bad at hiring. Because of our particular professional focus, that being personal finance, we are often a bit overly vigilant about money in our own business, and many of us started financial planning practices not because we wanted to be entrepreneurs but because we couldn’t find a “good financial planning job” for ourselves. Consequently, many financial planners have a hard time recruiting, attracting candidates, and training their team members when they join the firm.

This week, we’re sharing our hiring process for the most recent addition to the MY Wealth Planners team and breaking it down step by step to show how we attracted 222 applications for an entry-level position and made our selection within three weeks.

Creating The Position

Many small businesses like to reinvent the wheel when hiring. “I need help!” Thinks the manager, whereby they shout their needs into the void (or the internet) and see who shows up to help. With a few people responding to the request, they then scramble to invent a clear-ish job description and figure out what they actually need to pay for someone to help them in their business.

If that leaves you scratching your head, that’s because it’s as illogical a process as any. Some of the best advice I’ve ever heard in the context of running a business or being in charge of an organization is to imagine what you want the team to look like in ten years and then reverse engineer the steps to reach that point. As financial planners, we *should be* singularly good at then calculating the costs of those steps and the revenue required to support those roles, but the word “should” carries a lot of weight, and whether that’s actually the case is another discussion.

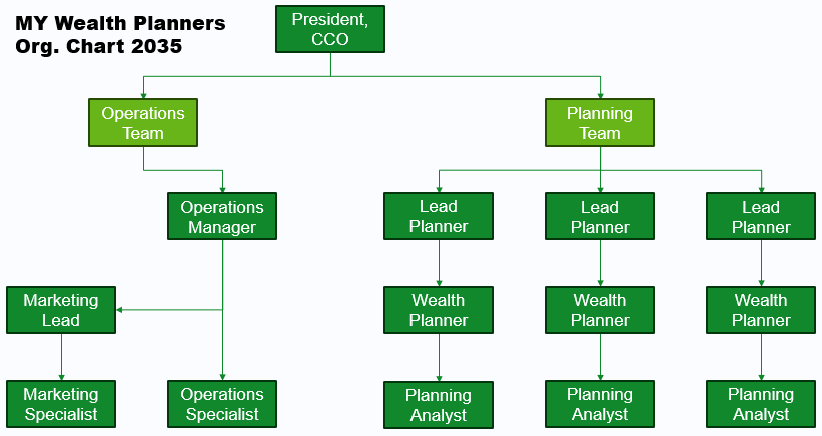

For our firm, the intent is that by ten years from now, we will probably have approximately nine wealth planners and analysts and need approximately four people in operations or non-planner roles. That might look something like this:

With this in mind, today, there are two associate planners and a president in the firm, so while there is significant planning capacity, there is little operational support, which necessitates starting to hire and develop that team. Thus, the first operations role we’re hiring for and have recruited for this month has been the Wealth Planner Assistant, who will, in the future, likely be promoted into an operations management role as time progresses. Bear in mind that this is not a guaranteed path, but it’s the practice we’re building toward over the next decade, and that informs the recruitment process.

The Job Posting

Overview

This is an entry-level position in Longmont in the financial services industry. A planner assistant primarily supports the firm’s financial planners in administrative and client service tasks. This includes reception and client service, generating reports, basic data entry, appointment scheduling, and other general administrative and upkeep tasks. The Planner Assistant may attend meetings with planners to take notes and engage in follow-up tasks such as updating client relationship management software and providing recap emails to clients. The position is expected to staff hours from 8:30 am through 5:00 pm, Monday through Friday, with a low to moderate level of work volume. A longer-term career path would lead to operations specialization or management as the firm grows.

Compensation

- Salary: $56,485.00-$62,394.58 based on relevant experience

- Quarterly Gainshare Bonus Eligibility based on company profitability

- After 90 Days:

- 401(k) with a 6% Match

- Health Insurance (Gold-Tier Plan) 100% paid by the Employer, with the option to add family members at the Employee’s cost

- Health Savings Account (HSA) and Flex Spending Accounts (FSA)

- Vision & Dental insurance 99% paid by Employer

- Life, Long-Term, and Short-Term Disability Insurance 100% paid by Employer

- 21-26 Holidays per year (24 Scheduled in 2025)

- Unlimited Vacation Policy

- Paid Medical, Jury, Military Service, and Bereavement Leave

- Continuing Education Budget

- After One Year: Paid Paternity & Maternity Leave

- Paid Sabbatical every 5th Employment Anniversary

- Link to our full Employee Benefits Guide for additional details

Common Tasks

- Manage office reception and client service

- Maintain the office in an orderly condition

- Prepare and service meeting spaces

- Attend meetings and take notes

- Basic financial plan data entry & client material preparation

- Answer basic questions for clients and forward client requests

- Complete basic client account paperwork

- Interface with custodial firms to obtain information or convey service requests

- Maintain information in the Client Relationship Management System

- Generate reports

Minimum Qualifications

- High School Diploma OR 1 Year of Relevant Work History

- Speak, read, and write English

- Able to lift and carry up to 15 lbs.

Preferred Qualifications

- Upbeat and personable

- Prior experience in finance, retail, reception, hospitality, and/or food service a plus.

- Proficient with basic PC and Microsoft Office Software, including:

- Word

- Excel

- Outlook

- OneNote

- Interest or background in financial services as a career path

Hiring Process

Each step after the first should be considered as if moving forward. We will never ghost a candidate and will always provide positive confirmation that you are moving forward or have been declined at a certain stage. Below are the steps of the hiring process:

- Submit your application between January 1st – January 10th

- Complete a Kolbe A Connotative Work Assessment

- Interview with the MY Wealth Planners Team January 13th – January 17th

- Tentative offer extended, background check performed

- Offer made and accepted no later than January 24th

- Start Date: February 3rd, 2025

About MY Wealth Planners

MY Wealth Planners is the first fee-only financial planning firm in Longmont, CO. Established in 2015, MY Wealth Planners serves approximately 180 households and small businesses in the northern Front Range area, providing comprehensive financial planning, investment management, and employee benefits consulting services.

~~~

Notice the structure of the job posting. It starts with a general and non-lingo explanation of the role that anyone with any work background could understand the basics of, then immediately transitions to compensation. Many job postings leave compensation for the end of the description, but this fails to establish a basic understanding of what’s important to the candidate for any position: “What is the job and what’s in it for me?” Only after a basic explanation of the role and a detailed summary of the compensation is provided does the posting break down examples of tasks the role involves and specify qualifications.

Notice, too, that qualifications are extremely limited rather than extremely specific. Many qualifications sections in multiple industries read like a list of a hostage taker’s demands: nine years of experience in software that has only existed for four years, five years of experience for an entry-level position, multiple credentials, and a demonstrated history of excellence, and letters of reference from the President and the Pope. Silly demands, and yet you’d think that the cashier job at the sandwich shop was a stepping stone to being the next American Billionaire, based on how so many requirements sections read.

The job posting wraps up with a detailed timeline of the hiring steps and stages so that candidates know where they are in the process, and only at the very end do we have much to say about the company. The clarity around the hiring process is a point of comfort for applicants who often feel like their applications are sent into the void, never to be heard from again, and the information on the firm is enough for context but not the brag-fest so many job postings start with. This structure for a job posting almost entirely reverses both the order and means by which so many firms hire, but in doing so, emphasizes what’s important to an applicant rather than what’s important to the firm.

Screening Resumes

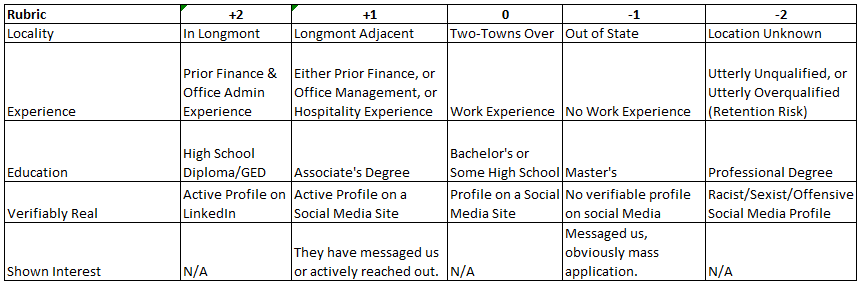

With 222 applications, you’d think we would employ some sort of algorithm to exclude candidates. Nope! I personally screened all 222 applications, including resumes and cover letters. But how do you make this process easy? Well, simple: Establish a rubric before you start reviewing, and score your applicants objectively. How do you do that? Well, let’s use our rubric as an example:

When thinking about our ideal candidate for the position, we envisioned someone who was local to the area, had a demonstrated history of personability, was comfortable using technology, and for whom the role was a good opportunity. Let’s break down those dimensions.

- Local to the area was important to us because this is an in-person 8:30 am-5 pm role Monday through Friday. That means for someone with a longer commute or for whom relocation is required, this job is less ideal for the long term, and consequently, the position may suffer from retention issues with a candidate coming from a long distance.

- A demonstrated history of personability is something that’s hard to screen for at the resume phase, but lots of jobs show evidence of this. Everything from reception work to retail, customer service, or food service demonstrates this. Thousands of people in Longmont alone make a living doing barely more than being polite and pleasant to interact with in a shop, store, or small service business. This skill is important for the role because, when serving as our front desk person, the new hire needs to have the ability to warmly greet clients and guests and maintain a conversation until we are ready to see them.

- Comfort using technology: As a digital-only firm, everything we do involves the use of a computer. This one can be a bit tricky because while it’s somewhat of a snuck premise that “young folks” just know how to use technology, that doesn’t mean they’re comfortable with applications such as Excel or handling a client relationship management program. Conversely, just because someone is older doesn’t mean they do or don’t have comfort with technology, and their work history might be a much stronger indicator of competence than their age because if you’ve worked in white-collar professional services for two decades, you’re probably going to be very comfortable with normal workplace applications, even if what our firm uses is a different version of something else you’ve used.

- “For whom the role is a good opportunity” is a very tricky item to screen for, but succinctly, this is a more holistic examination of what the resume tells us about the candidate’s work history and what their education and credentials tell us about their future career potential. Surprisingly, we had many candidates who had master’s degrees apply; we even had about half a dozen financial advisors apply for the job! But when we think about the role being a good opportunity for the candidate, we’re trying to consider the holistic value of the job to that candidate insofar as it satisfies their compensation needs to provide for their lifestyle and family and also whether it makes sense for them as a longer-term career path, rather than simply being a stepping stone on their way to do something else.

All of this boiled down to the following scoring rubric:

To explain the rubric:

- Locality: As previously described, the closer to the office, the better.

- Experience: An ideal candidate might have experience in administration in a financial services business. However, as noted from personability and technology, if they had experience in some form of finance, office management, or hospitality, then they still had a degree of experience that was relevant to the role.

- Education: While you might think we want the most educated candidates possible for the role, education is a double-edged sword in consideration of the dimension of “For whom the role is a good opportunity.” Therein, we wanted someone with less education because that would make the flexibility and education benefits of the role more appealing and, therefore, a better long-term fit, rather than hiring someone highly qualified from an educational standpoint for whom the role was, frankly, beneath.

- Verifiably Real: This appears to be a strange dimension, but it’s actually one of the most helpful. Candidates submit resumes, which are unverified claims of their work and educational experience. Yet, people are much less likely to lie in publicly available mediums where their professional peers can call out inaccuracies. Further, other social media presences are helpful in understanding the candidate’s situation, personality, and so on, and sometimes can be helpful in identifying problematic issues.

- Shown Interest: This is largely bonus points territory, but a candidate who has written a cover letter or done anything above and beyond submitting their resume deserves some degree of recognition. In turn, this can backfire if a candidate is clearly doing so in a “bulk” manner that doesn’t show actual effort or interest, e.g., a mass-mailed template cover letter or a generic email that doesn’t actually speak to the opportunity or firm.

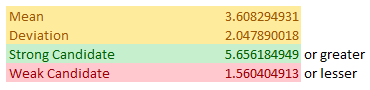

When scoring our 222 applications, in the aggregate, our candidate pool’s scores came out as follows:

This scoring across the entire candidate pool showed us who our applicants were that were one standard deviation above the mean of the entire applicant pool, which led us to our blind screening steps. But before we moved on to this phase, we let the other 84.2% of our applicants know they were not being advanced to the next phase. Never leave applicants to your company in the dark about whether they’re moving forward or not. It’s just polite.

Blind Screening

As the individual responsible for filtering all 222 resumes, you start to get a pretty strong feeling of “bias” as you filter the best from the worst and so on. Worse, when you have so many resumes, you’re looking at 35 or so strong candidates in a pool of 222 applicants based on the standard deviation math, which could translate to two or three weeks of interviews. Far too much!

To screen the dozens of strong candidates when you have so many to consider, a valuable step is to have a team member or team members perform a blind review of the highly qualified resumes and rank order them. In our case, we had 39 resumes that were in the strong candidate category. To filter these down to ten to interview, both Daniel and Emily were provided with anonymized versions of the resumes (just changing names to “Candidate 1, Candidate 2, etc.” and removing contact information) and asked to rank them from best to worst. Their scores were then averaged to identify the ten applicants they both agreed as being the most qualified.

We then extended invitations to the top ten applicants and kept the 11th-13th place applicants in reserve, notifying them that they had not been selected for the interview round but asking if they were open to being invited to interview if someone dropped out or otherwise didn’t come to their interview.

Preparing for Interviews

There’s not too much to be said about preparing for interviews themselves, but there are a few practices we recommend when it comes to having your candidates interview:

- Provide candidates with ample opportunities for day and time to interview. Don’t try to cram all your interviews into one morning, and never make your candidates sit in a waiting room together waiting for their turn like a bad movie.

- Unless you are hiring someone from a long distance (e.g., out of state), have them interview in person. When they schedule, have them positively affirm specific directions on the location of the interview and that they should arrive on time, no earlier than 5 minutes prior, and certainly not late. This avoids the issue I’ve seen many times where applicants will show up 20-30 minutes before their interview trying to make a good impression, which is great, except that it interrupts the work you and your team were doing during that time to either start their interview early out of an abundance of politeness or forces them to wait awkwardly for you to be ready.

- Have them take a Kolbe or other empirically validated work-style assessment. There are two reasons for this: First, you want to know that how they naturally work aligns with your expectations. If it does, great, and if it doesn’t, you can discuss how their work style deviates from your expectations so that no one is surprised when they don’t act exactly the way you’d expect. The second is to see if they follow directions. Tell them that they must complete the assessment no later than 24 hours prior to their interview time and see if they can do that.

The Interview

This is the hardest part to get right because everything you’ve done up to this point can be measured and established more objectively. Interviewing, both as the interviewer and the interviewee, is a skill. For financial planners hiring, it helps to think of it as an initial financial planning consultation. Spend as much of the interview getting to know the applicant, and ask questions that help validate the things that are most important to you as part of the hiring process. In turn, try to ask your applicant questions and spark questions of their own that help them ascertain whether this is the right job and opportunity for themselves.

When it comes to the questions you’re asking, be sure to have them written out and ask all of your applicants the same questions. You can bridge between questions where they’ve answered more than one question with their answer so they don’t awkwardly have to repeat themselves, but otherwise, you should ensure you ask each applicant the same questions to obtain the same information from each of them, and ideally, you can record the interview so that members of your team who are not present can review the recording and give their own feedback for the interview.

Some things you shouldn’t do in an interview:

- Ask stupid questions. When I say this, I mean stereotypical or weird hiring questions like “What is your biggest weakness?” or “Tell me about a time you faced adversity.” or “Describe how to tie your shoes.” These are questions that are either so rote as to be meaningless or so bizarre as to undermine the validity of the answer.

- Ask discriminatory or HR-inappropriate questions. If you don’t know what these are, hit pause, go order “The Manager’s Guide to HR” by Max Muller, and read it front to back before you hire anyone.

- Ask your candidate for their salary preference or prompt them to negotiate. This is your business; you should know what it can afford and should have provided a clear salary range and criteria for what puts someone at any given point in the salary range. Your candidate’s ability to “charm you” into giving them a raise or bump in compensation shouldn’t influence whether you do or do not offer more than you intended, and opening the door for this to happen inadvertently increases the likelihood of pay discrimination between men and women (as men are significantly more likely to negotiate). You know the value of the role, so pay for the value of the role, no more, no less.

Wrap up your interview by explaining the next steps to your applicant. At this point, it should be pretty straightforward: “We will make a tentative selection by X date, we will present a tentative offer pending a background check, and we will finalize the offer by date Y, assuming that clears. If you aren’t selected, we will let you know by Z date.”

You might wonder: Should we do multiple rounds of interviews? Maybe, but probably not. My rule of thumb for whether you can invite someone to multiple rounds of interviews is how many multiples of your firm’s base wage the role pays. For example, if your lowest job pays $50,000, do not invite anyone who will be offered less than $100,000 for the role to have multiple interviews. Even then, ask yourself what is accomplished by forcing someone to have multiple interviews: Are you going to ask different questions? Demonstrate different competencies? Have them interview with different members of your team? Why not just have those members at the first interview?

All of those questions to ask: How much time and energy should we spend on hiring this person, let alone how much can we ask of several people before they actually get the job or are declined for it?

When you finally are ready to decide on who you’re hiring, review your candidates (with your team, if applicable and possible), and compare how you evaluated the interviews and the resumes of your applicants to decide on who holistically is the best fit for your role. People are more than their resume, but also, anyone who tries hard enough can wow you in a thirty-minute conversation. Balance these issues accordingly.

What can a candidate do?

In a sea of jobs and candidates, it’s not unheard of today to hear about people applying to hundreds or even thousands of jobs without receiving an interview. In the era of big data and algorithms, it can feel like the West World dystopia in which computers are deciding your fate, and you have no power over your career. However, you shouldn’t despair. While we cannot speak to the preferences of every company and hiring manager, here are some tips on how to best improve your chances of getting an interview and winning the position:

- At the application phase, you will probably be asked screening questions, e.g., “Do you have # years of experience in XYZ?” Honesty is the best policy here. If you don’t give an answer that clears the hurdle the employer is screening for, they will never even see your application. But worse, if you lie to get on their radar, they will clock you as being dishonest, and you’re already out of the running, having put in that much more effort. Don’t bother applying to jobs that are screening for things you do not have most or all of the qualifications for, but recognize too that many employers make the mistake of using their “requirements” list as a “wish list” rather than a minimum qualifications description. Do your best to read between the lines when you see an entry-level position with absurd requirements versus an advanced position with only nominal requirements.

- Tailor your resume to the job or industry you’re applying for. While this can be a big lift when you think about submitting dozens of applications, it does materially improve your chances of being offered an interview. Ensuring that your resume reflects the responsibilities and requirements of the job posting reduces the likelihood that the hiring manager doesn’t understand how your skills align with what they’re looking for and improves the odds that they’ll want to learn more.

- Cover letters: There are three shades of cover letters, ordered from best to worst:

- A well-tailored cover letter written specifically to this job, company, and hiring manager that shows you clearly understand the company and the role being hired for.

- No cover letter.

- A boilerplate cover letter with generic corporate-speak. Every hiring manager gets about a dozen of these in every hiring round, and it’s very easy to pick out a low-effort mass-mailed cover letter that says things like: “I think I could contribute to a fast-paced and innovative leader in the coffeeshop field like Mom’s Black Coffee Co.” Tailor your letter to your audience or don’t include one at all.

- Preparing for the interview: Research the company. Look at every single page on its website (unless it’s Amazon, that’s a big website!) and read about its programs, its services, its history, and its team members. Does the company have a YouTube channel? Watch some videos. Podcast? Subscribe and search for episodes relevant to discussions related to the role you’ll have at the company if you’re hired. Understand to the best of your ability its business model and the customers or clientele it serves so you can speak directly to that. And if you get lost or you’re not familiar with exactly what they say they do? Great, write that down in the form of a question and be prepared to ask it in an “I was looking into you, and I understand X and Y, but I was hoping you could explain more about Z to me?” format.

- The Interview.

- Clothing:

- Gentlemen, wear a suit and tie. No exceptions. Don’t have a suit? Wear the nicest button-up you own and slacks. Match your shoes and belt. Shave or groom your facial hair and get a haircut.

- Ladies, wear a dress, suit, or blouse and slacks. Do not wear giant coats or sweaters, and this is not the time for a fashion experiment. Be judicious in the use of make-up and jewelry.

- For anyone of any identity: It is never a bad decision to dress business professionally and to err on the side of caution in your fashion choices. If you bring an overcoat because it’s negative one degree outside (like it is this week!), take the coat off before starting the interview. You will never regret overdressing for an interview, but you may regret under-dressing or trying to counter-signal by showing up too casually.

- Clothing:

-

- Conversation:

- There is no such thing as a correct “yes or no” answer. An interview is not only an occasion to answer the interviewer’s questions about you, your experience, and your expectations, but to get to know you individually. It’s very hard to relate to “yes” and “no,” but it’s much easier to build rapport with, “Yes, I have experience in that area…” or “No, I don’t think it would be an issue for me to…” The interview is going well if it’s flowing more like a conversation, and it’s going poorly if it’s zooming on by because your answers are too terse.

- Bring questions, but wait until you’re invited to ask them. There can be topical or appropriate times to ask a question in the middle of the interview, but your question should be specific to the exact topic you’re on at the moment, not a change of topic. As you reach the end of the interview, it’s normal for the interviewer to ask if you have any questions. Now is your time to showcase that you did your homework on the company and to ask smart and specific questions; generic “why do you like it here” type questions aren’t going to win you any points.

- Conversation:

-

- No one cares if you’re nervous. Telling the interviewer that you’re nervous, particularly repeatedly, is not helping you build rapport. It goes from understandable the first time you say it to annoying the fifth time. Everyone understands that interviews are an “unnatural” environment for most people and that you’re probably nervous. Channel your anxious energy into the conversational flow rather than pausing to tell the interviewer you’re nervous.

- Other things

- Many interview invitations come with specific instructions. Read them thoroughly, more than once, to ensure you are prepared and doing everything they expect you to do when you arrive to interview.

- Bring two paper copies of your resume with you, one that you can give the interviewer if necessary and one for yourself. Be willing to give up your copy if there are multiple interviewers. Ensure you bring it in a folio or folder that protects it so that it’s not a crumpled piece of paper when you hand it over.

- Arrive a little early, but not extremely early. Five minutes prior to your interview time? Great. Half an hour? Now you’re a disruption. If you arrive at the building well in advance, you can walk around and find out where you should end up at your interview time but don’t sit in reception or try to start your meeting early. Conversely? Show up on time and never arrive late.

- Post-Interview

- Send a follow-up thank you email to your interviewer or interviewers. Be sure to express your appreciation for the opportunity, and be sure to highlight any bright moments of the interview where you felt a good connection in the conversation or think your answer was well-received.

- Don’t do weird stuff. Weird stuff includes things like mailing the company a box of donuts, “stopping by” to see where they are in the process of making a decision, or otherwise stalking the people who you met at the company. They might like you just fine and want to hire you already, so don’t make it weird and disqualify yourself by doing something unusual or concerning.

Putting it All Together

Hiring is hard. Applying for jobs is hard. Most of us are bad at both of those things. What’s important in your hiring process is that anyone even remotely qualified should be encouraged to apply, and you accomplish that by sharing the job in a manner that emphasizes what’s in it for them and encourages them to apply. When you have your applicants, try to objectively screen down your applicant pool based on what’s important to you. If it’s possible, have someone else double-check your work before you get to the interview phase, and when you get to the interview phase, don’t make your applicants play silly games or rely solely on the interview as your deciding criteria. You’re hiring a whole person, not just their resume or the quality of a single conversation.

When you’ve made your offer, and it’s been accepted, be certain to notify those in your applicant and interview pool that they have not been selected. Be gracious and polite, but keep in mind best practices that you don’t provide critical feedback or otherwise denigrate the folks who weren’t selected. They put themselves out there and tried to impress you, and just because they weren’t the person you chose doesn’t make them any less for it. Sometimes, you’re just hiring the very best option in a group of great people, and that, unfortunately, means you have to let down some of those same great people.

If you need more reading on this subject, Caleb Brown from New Planner Recruiting published “Successful Hiring for Financial Planners” back in 2018, and many of the ideas and practices in this article and how we hire at MY Wealth Planners were developed with that book providing a helpful baseline.

Overall Hiring Pool Results

Our overall application pool was rather diverse. We saw a slight over-representation of women than men in the entire application pool, and our interview pool after the blind review process was screened down to an entirely female applicant group. This is not to say there were not qualified men in the applicant pool, but that when identifying information was removed from our top group of applicants, the ten best applicants were, surprisingly, all women.

- Total Applicant Pool

- Gender (assumed from gender presentation norms)

- Male: 31.53%

- Female: 68.46%

- Race (assumed from the Etymology of names)

- Caucasian: 58.56%

- Black: 8.11%

- Hispanic or Latino: 23.42%

- Asian: 4.50%

- Unknown: 3.60%

- Education (explicitly shared in resumes)

- High School or GED: 43.69%

- Associate’s Degree: 19.36%

- Bachelor’s Degree: 32.43%

- Master’s or Professional Degree: 4.52%

- Interview Pool (ten scheduled interviews, nine interviews held)

- Gender (as seen in person)

- Male: 0%

- Female: 100%

- Race (assumed from the Etymology of names and as presented in person)

- Caucasian: 55.55%

- Black: 0.00%

- Hispanic or Latino: 44.44%

- Asian: 0.00%

- Unknown: 0.00%

- Education (explicitly shared in resumes)

- High School or GED: 66.66%

- Associate’s Degree: 22.22%

- Bachelor’s Degree: 11.11%

- Master’s or Professional Degree: 0.00%

- Gender (as seen in person)

- Gender (assumed from gender presentation norms)

Final Admin Item

If you’re reading this, you can stop here. What follows are just search keywords to help future applicants who are really doing their homework on the firm find this article so they can better prepare and understand our hiring process.

Company hiring process

How to apply for MY Wealth Planners

MY Wealth Planners job application guide

Interview process at MY Wealth Planners

Working at MY Wealth Planners

Career opportunities at MY Wealth Planners

MY Wealth Planners hiring tips

What to expect during MY Wealth Planners interview

MY Wealth Planners recruitment process

How to get hired at MY Wealth Planners

Job openings at MY Wealth Planners

MY Wealth Planners job application steps

Applying to MY Wealth Planners jobs

Tips for success in MY Wealth Planners interview

MY Wealth Planners hiring timeline

MY Wealth Planners employee benefits

MY Wealth Planners company culture

Job application FAQs MY Wealth Planners

Dr. Daniel M. Yerger is the President of MY Wealth Planners®, a fee-only financial planning firm serving Longmont, CO’s accomplished professionals.

Comments 1

Pingback: Recruiting Wealth Planning Analysts