There’s an old expression amongst professionals: “If you think paying for service is expensive, just wait until you see how expensive doing it yourself is.” The premise of the point is simple: Many people do not respect the time, energy, and effort that go into a professional’s services. Not only the service as someone receives it but also the education and experience of the professional providing the service. This week we’re explaining why going the DIY route on many issues can be far costlier than simply paying a professional.

The Opportunity Cost of Being Cheap is Expensive

Something as simple as building a fence might seem like it shouldn’t be expensive, but as a combination of lumber costs and the three men who worked on the project, my own family recently paid just shy of $10,000 to have a fence built. To those professionals’ credit, the fence was not only well built, but they completed it in less than a day. Compare that to if I had attempted to build the fence myself (something I’ve never done.) Not only would the material costs still be involved (about $5,500), but it likely would have taken me well over fifty hours to complete on my own. At a remaining margin of $4,500, that’s a comparative cost of $45/hr that I could save, but that pales considering the value of my professional time is well into the hundreds of dollars an hour. To boot, I’m a terrible carpenter (sorry, Grandpa, I know you’re disappointed,) and any fence I could build in even as much as two hundred hours would likely be a shoddy production. All of this to emphasize a simple point: While paying professionals might cost money in a real way, the missed opportunity to spend productive time on something we are better at could well outstrip the cost of the fence. For a neurosurgeon who takes home a salary equivalent to $300 an hour, building a DIY fence for 50 hours would cost them $15,000, not under $10k.

The Risk of Not Knowing What We Don’t Know

An even more particular issue in our desire to avoid paying for things can be the problem of the things we don’t know. This year I’ve been watching Tax Twitter with fascination, as literally hundreds of CPAs and EAs working the tax preparation business made it clear: Most of our clients don’t know what they’re doing with regard to taxes, most of them don’t care, and none of the understand how much work is required of us. As my friend, Michael Pharris (a CPA in Longmont,) commented the other day: “Twenty years ago your tax preparer reported income. Today we report income and calculate eligibility, qualification, and metrics for a dozen social programs. The budget for support of those obligations has gotten smaller, not bigger, and the public being uninformed of those changes, is shocked that there is no longer such a thing as a ‘simple tax return.’” A word to the wise here: If you work with a CPA next year, call them on January 2nd, 2023, to get on their calendar in early February, and be extraordinarily patient with them in getting your return completed. It is not unlikely that showing up even as “early” as March might see you being extended or your return being rejected, and if you make a fuss about “how long it’s taking,” don’t be surprised if you find your tax documents mailed back to you with a “good luck finding another preparer” note attached to it.

A Case Study in Penny Wise and Pound Foolish

I recently worked on a pro bono divorce financial analysis case. The offer presented by one of the spouses was straightforward: “Let’s keep all the personal property we have right now, keep the accounts in our respective names, and split the savings account we share.” That sounds reasonably equitable at first glance, right? “I’ll keep what’s mine, you keep what’s yours, and we’ll split the difference.” But this is a classic red herring that divorce professionals work to keep divorce petitioners from falling into. When looking at the documentation for this case, what the proposition really translated to was “I’ll keep $56,000 in assets and my $100,000 a year income, you keep $4,500 in assets and your $30,000 a year income, and we’ll split the $15,000 in savings.” And that’s just the proposed division taken at face value! One of the classic mistakes people make in the divorce arena is thinking that “if the value of the income and assets came from ‘my job’, then that means it’s all mine.” Hardly! Think of the countless housewives (housemen, housepeople, etc.) who stayed at home raising multiple children, keeping up the home, cooking every meal, coordinating everything from school lunches to piano lessons, etc. for no money, only to be told twenty or thirty years down the road: “I’m no longer happy with this marriage. I’ll take the financial fruits of my twenty or thirty year career and you take nothing” by their ex. To return to the case study at hand and every spouse who has supported their spouse’s more lucrative career: Now is not the time to think about “does that seem fair,” because no matter how balanced a proposal might sound on its face, it’s certainly not going to be fair AFTER the divorce is settled in your ex’s favor! Even an hour with me as a pro bono specialist in divorce caught such an obvious problem, let alone the issues that could lurk in a much more complex divorce case.

The Simple Word to the Wise

Respect the professionals whose help you need. That doesn’t mean you have to love paying them, that doesn’t mean that they have to have perfect customer service skills, and that doesn’t mean that you have to work with them forever, and you don’t even have to like them very much. But when you’re faced with something you know nothing about (building a fence, preparing a complex tax return, getting divorced, etc.) Now is not the time to question the value of someone whose entire professional life is solving that problem for people like you! If you think professionals are expensive, just wait until you find out the price of being cheap.

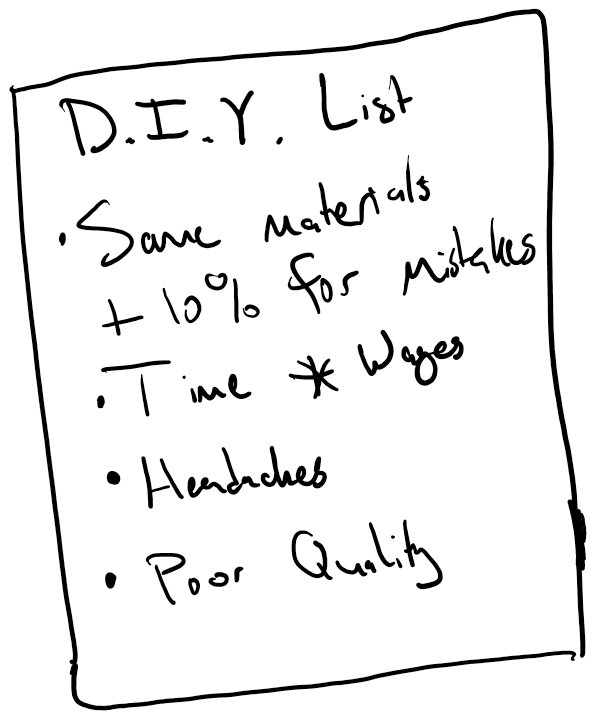

P.S. As a DIY artist, my point above regarding “poor quality” I think is well made!

Comments 1

So very true. Know your limits and know when to leave it to the professionals!