For those who wondered, “What happened to the blog last week? Heck, where was the blog yesterday?” The answer is as fun as it is mundane. Rather than writing a blog for July 30th, I was in Chicago attending the summer leadership meeting for the National Association of Personal Financial Advisors, or “NAPFA,” for which I sit on the west region board; you may hold your applause. NAPFA is the membership association for fee-only CFP® Professionals and financial planners, representing about 1% of the “financial advisor” industry. Despite being a minority, NAPFA has been a proud advocate for the client’s best interest in pushing for broader adoption of less conflicted financial advice through fee-only financial planning service models.

At the summer leadership meeting, a question arose during one conversation, and it’s one that I would pose to the public: “Who’s paying your planner?” The answer is incredibly straightforward in a fee-only financial planning relationship: You are. This simplicity and transparency are key features of the fee-only model. Yet, as I returned to Longmont, it gave me a moment of pause to consider. In the community of Longmont, MY Wealth Planners remains the sole fee-only financial planning firm with a CFP® Professional practicing financial planning. While in a city like Denver or San Francisco, there are tons of fee-only financial planners, here in Longmont, it’s just us.

But, more importantly, it sparked a question: Who IS paying all the other financial advisors in town? So, we took a look. What started yesterday morning as a task I thought might take an hour or so, something that could be published on time for the usual Tuesday newsletter, quickly spun into a multi-team-member deep dive into regulatory filings and deeply buried disclosures. But, not to worry you, it only took Daniel and I about ten hours today and yesterday combined just to come up with an answer. And the answer is… troubling.

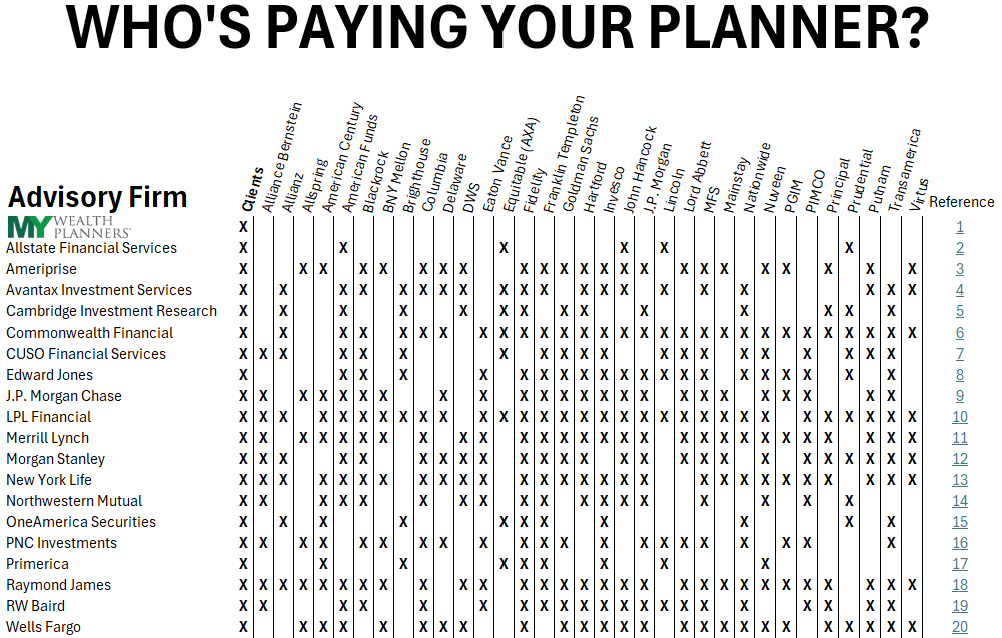

The screenshot below is the first page of a 16-page table showing revenue-sharing payments from third-party investment and insurance firms to the 19 other largest financial advisory firms with a presence in Longmont; it’s noteworthy that no other planning firms are local to Longmont, they’re all national company affiliates. Understandably, the whole table doesn’t fit on the webpage, so you can download the full version below, if you’re curious to see how many other firms each of these companies are taking kickbacks “revenue sharing” and commissions from.

Click Here to Download the Full List of 549 Companies

It’s a bit shocking, no? The full list comprises 549 investment and insurance product companies paying just these nineteen firms we sampled from those present in Longmont. If you’re a consumer looking at the list, it would be hard to believe that, as any singular consumer, you’d have even the slightest bit of influence on what a company receiving hundreds of thousands, millions, or even tens or hundreds of millions of dollars from these companies annually would then recommend to you. After all, you’re probably not even 1/1,000,000th the size of their biggest customers; the investment and insurance companies whose products they’ve agreed to sell.

And, of course, if you’re an advisor from one of the companies on this list, you might scoff at the suggestion that there is such a conflict of interest. After all, you and you alone decide what’s best for your clients, right? Oh, of course, all investment products and insurance products you recommend to your clients have to be approved by your parent firm, or you’re committing the regulatory violation of “selling away.” Hmm, maybe you don’t have as much say as you thought you did?

So there’s the worthy question to ask, whether of yourself or when chatting with a friend over brunch as they rave about their financial advisor: “Who’s paying your planner?” Here in Longmont, it’s only 549 other companies paying them first. No big deal, I’m sure.

Dr. Daniel M. Yerger is the President of MY Wealth Planners®, a fee-only financial planning firm serving Longmont, CO’s accomplished professionals.

Comments 1

Pingback: What is Your Why? Discussing meaning for financial planning