It’s no secret that I’m incredibly interested in the development of the financial planning profession. My area of research is compensation, with a focus on financial planners. I’ve presented on career tracks and hiring at multiple national conferences, and I’ve written an Amazon best-seller on financial planner careers. It is, with some Jane Goodall-observing-the-gorillas interest that I’ve started to peruse several forums and mediums where new planners, career changers, or newly minted CFP® Professionals regularly will ask, “How is this offer?” with regards to either job offers, their current compensation, or in looking for feedback on their current career path and whether they should be happy where they are or be looking for other opportunities. Regularly in these conversations, there will be a somewhat predictable crowd response: “F [your firm], get yours.” That’s not the universal feedback, but its certainly the sentiment expressed the majority of the time.

This concerns me. Not because I’m a firm owner concerned about my employees thinking that way (I encourage them always to be thoughtful about whether this firm is the right fit for them and their life goals), but because it exacerbates a deep sense of insecurity among firm owners, particularly small firm owners, about the risks of bringing on entry-level financial planners. I’ve discussed the pine-tree problem of the distribution of financial planning opportunities (there are less entry level jobs than jobs for those with experience) at length, but today I thought I’d share one firm’s example of how substantial the investment in a new financial planner is.

The Planner’s Career Track

Let me set the stage by explaining the career track and compensation philosophy for financial planners at MY Wealth Planners, including assumptions and baselines of compensation.

- All planners receive base salaries with requisite experience:

- Planning Analyst or Assistant – $49,559.52 minimum

- No Experience

- High School Diploma

- Associate Planner – $73,100.30 minimum

- 1 Year of Experience

- Associate’s Degree

- Planner – $99,119.04 minimum

- 2 Years of Experience

- Bachelor’s Degree

- CFP® Certification

- 40 Client Relationships

- Lead Planner – $170,542.96 minimum

- 6 Years of Experience

- Master’s Degree

- CFP® Certification

- 2 other professional designations

- 80 Client Relationships

- *Note: All salaries are indexed for inflation annually and all staff receive a 1% experience raise on their anniversary in addition to the inflation adjustment.

- Planning Analyst or Assistant – $49,559.52 minimum

- Bonus Compensation:

- All Staff: 30% Per-Capita share of profits above quarterly EBITDA Goals

- All Planners: 50% of any new client relationship’s fees for the first year

- Lead Planners: 0.5%-10% Revenue Retention Bonus Annually

- Multiple conference attendance at certain revenue growth goals

- Benefits

- 6% 401(k) matching immediately vested

- Health, Vision, Short Term Disability, Long Term Disability, & Life Insurance – all company-paid

- Dental insurance – 99% company paid (it’s a weird thing with the insurance carrier)

- 21-26 pre-determined holidays throughout the year

- Unlimited vacation

- Flexible work schedule and work location (Remote/In-Person Hybrid)

- 6 Months of paid Maternity/Paternity Leave

- 14 Weeks of paid Medical Leave (Personal or Family Member Caretaker)

- 2 Weeks of Bereavement Leave

- $5,250 Annual Educational Budget

None of that is to brag or boast about compensation or benefits; it is simply to set the stage for the discussion to come. So, for reference, a typical career path would be hiring someone as an analyst. That analyst learns about the firm’s processes and procedures and participates in client meetings and client service work for a year. They then promote to an associate planner, at which time they receive a bump in compensation and a business development and direct client service role. After one year, if they’ve completed their CFP® Certification and have 40 client relationships, they can be promoted to a planner and receive another compensation bump (admittedly, 40 relationships would be very aggressive in one year.) Then, after a total of six years of experience, assuming they have also completed their Master’s Degree, two more professional designations, and serve at least 80 client relationships, they’re eligible for a significant compensation increase. Hopefully that’s reasonably easy to follow. So now, let’s look at the economics of that career path.

Allocation of Revenue

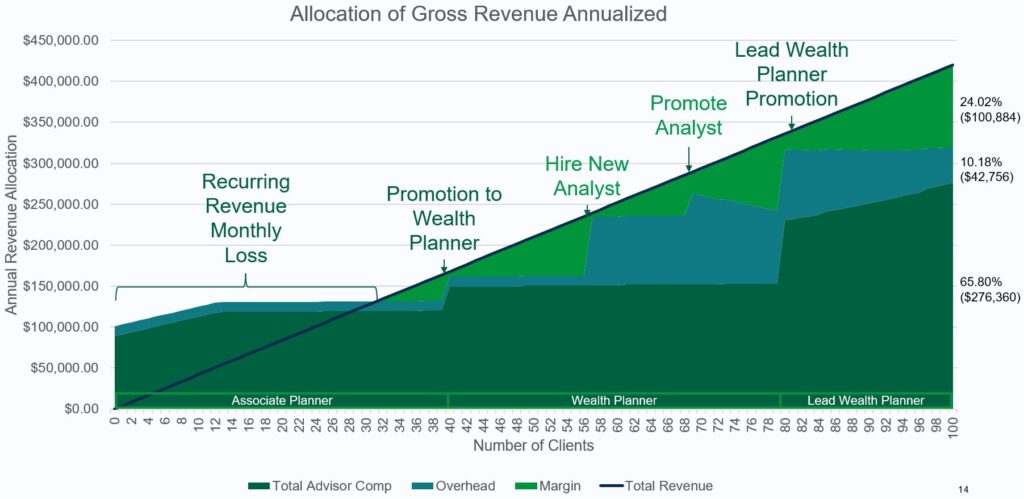

We’re about to examine one hypothetical version of a financial planner’s client growth and business development, and how the economics of that process play out. Remember, if they were an entry level hire, they’ve already been working at the firm for a year, helping the firm serve clients but not directly responsible for any growth in revenue. Let us assume in this model that they are onboarding one new client per month and receiving the full 50% bonus for onboarding new clients. We will also assume overhead costs of $1,000 per month, including software, technology, and fractional costs such as utilities and office space. We will assume all clients this planner brings on are just paying our firm’s minimum of $4,200 annually. With all these assumptions in mind, this is the revenue trajectory and ratio of revenue being paid out to various expenses at any given time.

As you can see, the associate planner does not reach breakeven with the cost of paying them and supporting them until they have onboarded 31 client relationships (43 months into their time with the firm, if the 1 client per month holds true). At that point, they’re only nine clients away from being promotion-eligible to the next position. Then, eighteen clients after that point, there is enough revenue to potentially hire a backfill new entry level analyst. Twelve months and twelve clients later, that analyst is promoted to associate planner, receiving a commensurate compensation bump, but also starting to generate their own revenue, as seen in the overhead decline starting after the original planner’s sixty-ninth client (or in this case, the new associate planner’s first client). Overhead on the new planner continues to improve over the remaining balance between the original planner reaching eighty clients and then potentially going up to a ceiling of one hundred clients. By the end of this one-client-per-month journey, after a nine year and four month career with the firm, assuming inflation adjustments to compensation the whole way but not necessarily raising the fee minimum at any point, the lead planner is receiving 65.8% of their revenue ($276,360), the backfilled associate planner is just short of covering their own cost, and the original planner’s overhead combined with the remaining cost of the backfilled associate equates to 10.18% of their revenue ($42,756), and there is finally a potential margin of 24.02% per year assuming 100% client retention ($100,884).

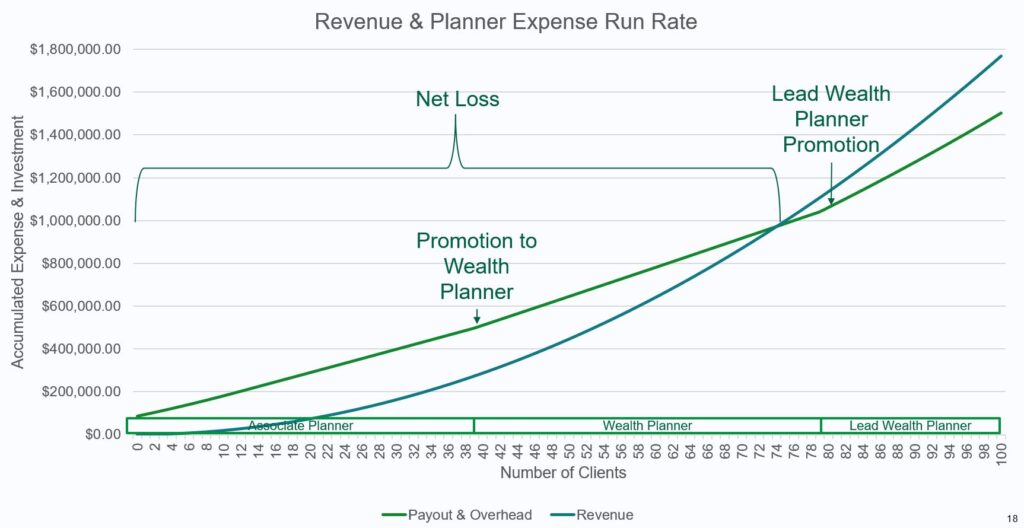

That was a lot of explanation, but it seems like over the course of a decade, developing a new entry level planner is a good deal, right? Well, that chart and explanation simply explain the annualized month over month economics. So, what are the cumulative figures?

While the monthly run rate reaches breakeven by 31 clients, assuming continued growth of one client per month and all the appropriate bonuses, it still takes 74 clients, or a cumulative 86 months since their original date of hire, for the firm to breakeven on hiring the entry-level planner to begin with, resulting in a total investment of $971,250 over the course of seven years and two months.

Let’s Address Fair Criticisms

Before we get to the conclusion of this explainer, let’s just address a couple of obvious criticisms that can be made, or rather, suggestions that could potentially improve this model:

- Pay the planners less. No.

- Charge more. We certainly can and very well might in the future, but this is a conservative model in terms of business development and revenue.

- Use a different business model. This is possibly the most fair critique. Models such as those with hourly fees or upfront project fees can certainly produce and grow revenue related to the new planner more quickly, particularly if compensation is scaled or tied to the hours or number of projects. That’s simply not the way we think our clients are best charged by the planning process we offer, but it’s a good model for other firms who provide a different type of planning service.

- The client average will be higher than the minimum. That is probably true. When we re-run the model with an average client revenue of $4,800, the margins are better and the breakeven happens earlier, but it still takes years to reach breakeven.

- Hire experienced people. Sure, but then we’re just perpetuating the pine-tree problem for entry level positions we’ve already discussed.

- Require less experience or start business development earlier. This is the solution of the insurance companies and wirehouses of the world. It certainly works well for them, but with a 13% survival rate for their employees/contractors, I’m not really a fan of this approach. I want to see the profession grow, not simply throw as many candidates at the wall and see who sticks (hint: those with affluent families or connections ready to invest significant capital or buy expensive financial products.)

Conclusions on the Issues of Developing a Financial Planner

This is not a comprehensive view of the problems described above. This is simply one business model, with one compensation model, articulating how significant of an investment it is to onboard new financial planners and develop them into productive professionals. The industry as a whole is extremely profitable and well-established firms typically have strong margins. Ultimately, a firm is served by new employees even if those employees do not drive revenue directly, but instead create indirect revenue through enhanced efficiency of more senior staff members or by expanding the bandwidth of the firm to serve more clients a whole. Still, I hope this helps articulate the issues on both sides of the table faced by those pursuing financial planning careers and those in a position to offer those opportunities.

Dr. Daniel M. Yerger is the President of MY Wealth Planners®, a fee-only financial planning firm serving Longmont, CO’s accomplished professionals.