No, it’s not “E-Oh-SS” as one word, but an acronym: Entrepreneurial Operating System; and yes, that means the title is just as redundant as saying “PIN Number.” EOS has been in the “management vogue” for the better part of the past decade, and represents a uniform system of business management, review, and role management. Generally targeted at firms with 10 or more employees, EOS provides a basic set of guide rails on everything from long-term planning to employee reviews. Previous “management vogues” have included things such as “EMyth” and “Good to Great,” but like all management systems and styles, there is always a better iteration on the horizon.

I read the original EOS book, “Traction” by Gino Wickman, back in 2016. At the time, I was a solo financial advisor, so while the material reminded me a lot of the reading in business school, it didn’t really stick as a meaningful set of insights because everything was about organizational planning and team leadership: nice ideas, but meaningless in the individual space. Yet today, as a four-person practice, I’ve kept the general EOS principles in mind over the years as we’ve grown, and being on the cusp of doubling the size of the firm over the next few years, it seems meaningful to engage in the EOS planning process sooner rather than later.

This week, I’m sharing what the EOS process will look like for MY Wealth Planners, what it looks like “without planning,” and what might come of the process.

Key Terminology

To spare you from having to Google what all the terms that we’re about to start using mean, here’s a link to the full EOS glossary, but also below are the key terms we’re discussing today taken from said glossary:

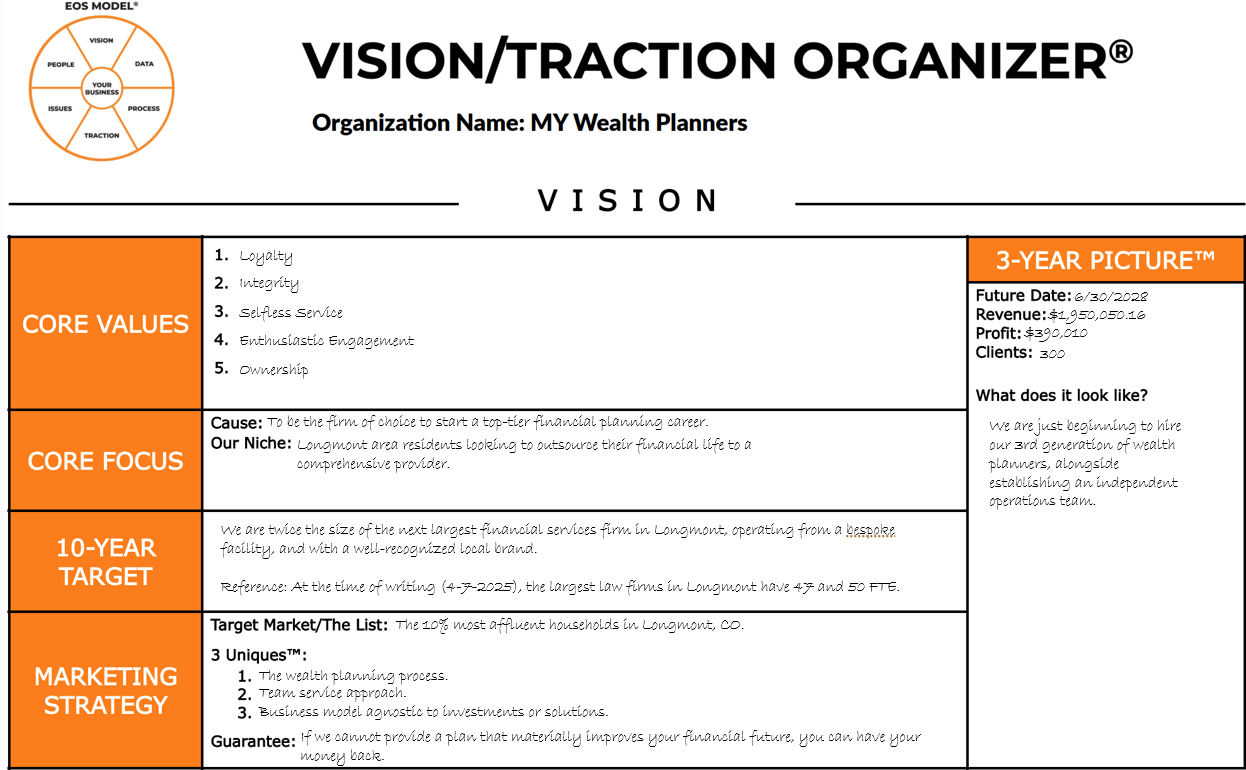

- Vision/Traction Organizer: A two-page strategic plan consisting of eight sections.

- Core Values: Three to seven essential, guiding characteristics that define your organization’s culture. Once defined, your Core Values are repeated often and used as real standards, rules everyone must play by.

- Core Focus: The organization’s “sweet spot.” Where your purpose, cause or passion meets the thing you’re driven to be best in the world at. Once defined, the Core Focus helps leadership teams make better decisions, investing time and energy within the Core Focus rather than being distracted by “shiny stuff.”

- 10-Year Target: A long-range, energizing goal for the organization. Goals range from five years to twenty years out.

- Marketing Strategy: Provides a clear definition of the firm’s target market and also includes three parts of a compelling marketing message to that target market, including three “uniques”, a proven process, and a guarantee.

- 3-Year Picture: A prediction made by leadership that clearly describes the organization you intend to build in three short years.

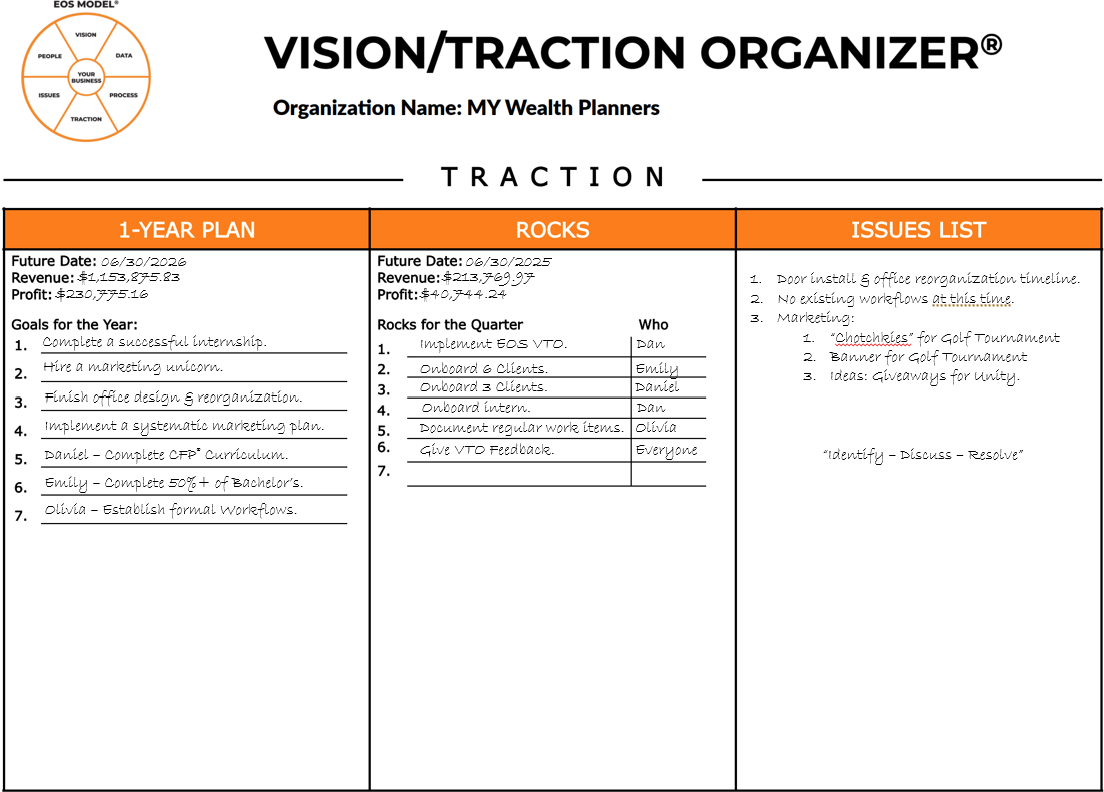

- 1-Year Plan: A prediction of what is going to happen during the year. It starts with financial predictions and includes three to seven goals, which are the most important things your company must accomplish in the coming year.

- Quarterly Rocks: Quarterly rocks, or “Rocks,” are 90-day priorities. They are each one of the three to seven most important things for the firm, department, team, or team member to accomplish in the quarter.

- Issues List: The issues list openly shows the real problems the organization is facing for all to see, helping all team members identify and understand what problems must be addressed for the organization to succeed.

An “Unplanned” Vision

As mentioned in the intro, I’ve been aware of the EOS system for almost my entire career as a financial planner. I’ve incorporated elements of EOS into how I’ve planned for the firm’s growth and development over time, but quite a bit of that vision and structure has lived in my head and been shared only piecemeal with the team at appropriate times and places. Were I to simply write up the Vision/Traction Organizer for the firm today using the EOS template, it would look something like this:

As you can see, some things are relatively enshrined. For example, the firm’s values have been publicly stated and on our website since the firm launched. These values do guide and dictate quite a bit of what we do, and have had a place in team member reviews since our first hire. Even back to my days in the army, where the values of the Army were LDRSHIP or “Loyalty, Duty, Respect, Selfless Service, Honor, Integrity, and Personal Courage,” organizational values represent more than nice things to put on a slide show or in a brochure. They are supposed to meaningfully drive the behavior and serve as guardrails for decisions made in the business and by every member of the team.

Next, you’ll see that the core focus of the firm has been “to be the firm of choice to start a top-tier financial planning career.” This has been a meaningful driver over the years because it encompasses two core constituencies: Both those who might come to work for the firm, but also those whom the firm serves. To be a place where any CFP® Candidate can grow and thrive as a professional not only requires that the firm provide quality compensation and culture for them to comfortably learn in, but also a variety of complex and interesting clients to work with. While the firm could easily serve several hundred more people on a going basis at its current size, to do so would require that it serve a relatively simple and homogenous client base. Yet, the most interesting financial planning work is done for the most interesting people. People with complex lives, stories, and careers, whose objectives in life extend beyond simple portfolio maximization or risk management. Therein, we’ve always focused on both providing that quality work environment with an incredibly robust benefits package, but also on ensuring that we enjoy working with every client we take on.

In that particular sense, we’ve also never “niched” in the sense that most financial planners think of it. In the industry, there’s a running joke that every financial planning firm specializes in “retirees, women, business owners, doctors, professionals, and families.” If you haven’t picked up on the joke, that’s “everyone.” Yet, in the niche context, many financial planners do actually specialize solely in doctors, small business owners, executives, or other select classes. Longmont and the surrounding community are home to many exceptional and diverse people and careers, but having been Longmont’s only fee-only financial planning firm up until last year, we’ve never made the decision to specialize in only serving one specific demographic; to do so would mean that any member of the public seeking quality financial planning services in Longmont would have to otherwise leave our community or otherwise be contented with one of the insurance or investment sales companies that dot our little town. Instead, we made our niche the Longmont community, and have happily been privileged to serve several hundred families therein.

The ten year target presents the most, call it, “optimistic” vision. Something that struck me a couple of years ago was the issue of hyperbolic discounting. For those who need a refresher on the term, hyperbolic discounting is the cognitive limitation that makes human beings bad at calculating compounding math. It’s the general idea that while we have little problem with calculating a ten percent return on one hundred dollars as being ten dollars, but that if we iterate that over and over again we are worse at estimating at what value the compounding will arrive at after more than a few iterations; at least without literally doing it one step at a time.

That hyperbolic discounting issue comes up in business planning quite a bit. When I first took the practice independent in 2019, I imagined we might have five total team members ten years in the future. Fast forward just over five years, and we’re already on the cusp of hiring our fifth team member. In that same sense, I might otherwise expect the firm to grow in a somewhat linear fashion for the next five years. But that’s the hyperbolic discounting talking, because with every new team member comes new effort, new bandwidth, and as such, the capacity of the firm and its ability to grow begin to compound and grow exponentially. As a result, while it will have taken just over five years to become a team of five, we will likely find ourselves more than double that in the next five years, and the next five beyond that. All of that to say, today we are neck and neck for being the largest financial services practice in Longmont (and we’re certainly the largest fee-only financial planning practice in Longmont), but with that expected growth comes several elements of the vision. We have to expect that if that growth continues to compound, we will be several times larger than our average peer firm in the community, and with that comes a desire to see the practice grow in a number of ways. That will include either buying or building a facility purpose-built for our practice and the needs of our client, but also I aim to keep an eye on our legal neighbours. While they’re a different profession entirely from financial planners, I find that the size of practices such as Lyons Gaddis and Brownell Peppin in Longmont serves as a healthy benchmark for what it would mean to be a recognizably major professional firm in the Longmont area.

It’s a bit easier to envision the three-year plan insofar as we’re actively working towards it. Today, we serve 193 households and have typically grown by about 20-30 households a year over the past few years. To imagine we might bring another one hundred or so households in to work with us, and keep our general ratios of direct and operating expenses in line, is much easier to envision in concrete and specific measurements such as revenue and profit. With those figures in mind, it seems likely that in three years, we’ll probably be onboarding our next generation of burgeoning financial planning talent.

We then circle along to Marketing Strategy (yes, we’re still in the vision category!), and here we find what might be an area that needs the most work. Being a financial planning practice, and well in line with the marketplace for competent financial planners, we find ourselves often serving the most affluent in our community by income or assets. This isn’t always the case, as we do have some pro bono clients that we enjoy working with. Still, the economic reality as I’ve discussed in previous blogs (1 2) is that financial planning is statistically a rarified profession compared to the general public at large’s need. It commands a relatively substantial investment in terms of revenue to be sustainable.

To meet the demand, we’ve offered a few points of differentiation from our peers in the community. First, we offer a comprehensive wealth planning process that distinctly addresses each element of a client’s financial planning needs throughout their life, careers, and family stages. While words like “comprehensive” and “holistic” are often bandied about in many industries (and financial planning is no different!) it’s easier to describe what we don’t do as financial planners than it is to describe what we do do, if that gives you some perception of the all-encompassing nature of what we offer our clients.

Second, we offer a team service approach. This isn’t necessarily distinct from every other financial planning firm out there, but it is distinct in Longmont. Because every fee-based firm in the Longmont community -distinctly different from our fee-only model (1 2)- is a franchise of some sort, they effectively operate in a manner in which there is either a singular financial advisor who is responsible for sales in their territory or otherwise as a single salesperson and administrative support staff member. Our firm takes a team approach with every client case, with each household’s plan developed and reviewed by the full team, as well as each household being supported by more than one planner to ensure they have quick responses to their needs and service redundancy in the event that one of their planners is unavailable.

Third, and perhaps already somewhat implied: Our business model doesn’t depend on how a client accomplishes their financial plan. We don’t make money based on whether clients do or do not follow our advice, nor do we care what they invest in, which insurance carriers they manage their risk through, or from which tax or legal professionals they seek additional professional support and advice. Our business model is built around alignment with the objective of growing and preserving a client’s wealth and means, and we see ourselves as permission givers for clients who struggle with using their wealth to live their best lives. With all of that said, our guarantee is and always has been straightforward: If we cannot provide a plan that materially improves a client’s financial future, then we won’t take them as a client in the first place.

Better Planned Traction

The traction element of EOS focuses on a “checklist approach” to moving in the direction of the three-year and ten-year plans. Given the example of the vision just discussed, the goals for the year are relatively direct:

- Complete a successful internship (Cecile Stone will join our team this summer), helping us execute on the vision of being the premier place to start a financial planning career.

- Hire a marketing unicorn: Succinctly, while we’re great financial planners, we’re mediocre marketers. While this blog has been running more or less weekly for the past five years, and we’ve successfully published around 65 podcasts between the defunct “Fleece Vests” and current “The Science of Wealth,” this has been marketing by habit or routine. Said differently, we’ve created content because we want to and because we generally know it’s good for the practice to do so, not because we’ve ever had a strong marketing strategy or client acquisition process. In fact, the majority of our clients come from current client referrals and search engine optimization! So, with an interest toward growing toward the three and ten-year goals, our next hire is a marketing “unicorn” who can take responsibility for the little bit of everything we really should be doing to grow the practice.

- As you saw in last week’s newsletter, we’ve already started the process of reorganizing the office. The reception has moved to the room that used to be my personal office, and we’ve almost finished building out a second meeting room so we can hold more concurrent meetings with clients. By extension, we’re also looking at doubling our square footage onto the second floor of our building to create more meeting spaces with the ten-year vision in mind.\

- Implement a systematic marketing plan. This is really just “2B”.

- We intend that Daniel Stefanski, EA, will complete his CFP® Curriculum within the next year and will sit for his CFP® Exam. Given that he already has almost ten thousand hours of financial planning experience, we have all the confidence that he’ll ace it.

- By extension, Emily Green has already gone back to school to finish her bachelor’s degree. While she previously completed undergrad with 138 credit hours, her earlier academic pursuits awarded her two associate’s degrees rather than a bachelor’s degree. The CFP® Certification requires a Bachelor’s degree, so this is a necessary step for her on the path, and we expect she’ll have finished at least half of her outstanding requirements to obtain a Bachelor’s of Science in Personal Financial Planning by then.

- Finally, having Olivia finish formal workflows for the firm. I’ll admit, as the commensurate know-it-all within our firm, I’ve never personally felt much need for formalized workflows and tracking systems. We have always had such a direct and individualized touch with our clients over the years that we’re typically able to know exactly what’s going on with their financial plan and the needs to implement or advise in certain areas. However, “Dan knows everything” isn’t really a scalable solution, so formalizing our processes and procedures for the team as it grows is a major objective.

The Rocks that follow the one-year plan are specific quarter-by-quarter tactical objectives. If you haven’t already gleaned it, the entire Vision/Traction Organizer is built around setting a long-term plan, a shorter-term plan, an even shorter-term plan, and the shortest-term plan (quarterly) to incrementally make progress toward the longer and longer-term plans. Consequently, the rocks are incredibly granular, and as you can see in the example above, focus on things like onboarding clients, completing projects, etc.

Finally, the Traction portion ends with an acknowledgment of challenges or issues the firm faces. These are floating priorities that are meant to be broken down into bite-sized increments and tackled efficiently over a quarter or more as needed. In the case of our organizer, the key issues we’ve identified at present include completing our office build-out project, getting workflows built and in place, and working on specific marketing activities for the year. The framework for all issues under EOS is: “Identify – Discuss – Resolve.” Most key in that framework is that while discussion is important, it’s not the process of creating solutions by consensus, but in a manner most directly aimed at solving the problems as understood.

A Planned V/TO

I’ve shared the “unplanned” version of our vision and traction organizer as a learning tool. You can read the many EOS books by Gino Wickman and assorted supporting authors to gain a much more in-depth understanding of the concepts, attend EOS conferences, and even hire an EOS implementer for your small business. The ideas of EOS are designed to give teams a consolidated understanding of what the business is doing and how it’s meant to accomplish it. With those aims in mind, while the “unplanned” version shared in this blog has been a meaningful generalization of how we’ve operated and what we aim to accomplish as a financial planning firm, we are undergoing one more quarterly rock: To rebuild our VTO. We’ll be happy to share it as another learning tool in July when it’s complete, and hope that by sharing our current “implementation” of the EO System, it sparks some ideas on your part about how you might better organize your own team or organization.