We all have money scripts. They’re immutable psychological principles that were founded in our early childhood and that have been informed by the terms and perspectives we’ve observed in others around money as we’ve grown up. Positive examples can be “a penny saved is a penny earned” or “pay yourself first”, while more destructive versions can be “there is never enough money” or “if I am good, the universe will take care of me”. Regardless of how you came by your money scripts, they influence and affect your behavior daily. Today I want to talk about one particular money script I often observe in business owners: “I view the expenses of my business as costs and not investments.”

How the Cost Mindset Manifests

Costs come with an inherently negative connotation. “I would do that, but it just costs so much!” Yet, money itself has no intrinsic value other than the value we give it. All too often we are unwilling to part with the tangible or intangible money we own in exchange for something that would bring us happiness, more free time, more productivity, or a greater sense of accomplishment in our work. This is no more apparent in the “expenses are costs” script. Let’s explain how this happens:

A business owner sells a professional service for $500. The service requires a license to perform and can’t be done by just anyone, but it is also time consuming so there is a finite amount of time to provide the service in the day (say 2 hours for the service in an 8 hour work day). Because of this, the business owner has expenses related to providing the service. The service involves a tangible deliverable (an end result made up of parts) and those parts cost $25. Furthermore, because of the amount of time the service takes, the business owner realizes that doing the more administrative parts of their business will rob them of valuable service-delivering time and therefore, revenue. The business owner hires a staff and must spend $75 on their wages and benefits every time they deliver the service for $500. The “expenses are costs” mentality then focuses on how to make things more profitable through the lens of reducing the expenses on the deliverable. “This only makes me $400 now, but if I could find cheaper parts or cut back on staff costs somehow, it could make me $425 each time or maybe even $450 each time. I’ve got to find a way to reduce costs.”

So What’s Wrong with the Cost Money Script?

It’s a fair question to ask. After all, many businesses are successfully operated and made profitable by keeping a very close eye on the costs of the business, eliminating waste or unneeded expenses, and focusing on keeping the business running lean. There are entire books written on how to do this, and the proof is in the pudding that avoiding unnecessary expenses is a valid way to help the survivability and growth of a business. Yet, eliminating costs does not create value, it simply extracts greater value from the finite value already in play. If the service can only be provided four times a day, then the cost mentality focuses solely on how to extract as much margin from the service as possible each time it is performed. This viewpoint is inherently limited because it never focuses on increasing the total revenue. Instead, with such a focus on cost, it simply seeks to improve the net income, and often at risk to the quality of service provided or the loyalty and retention of the team that supports the service.

So what’s the value of flipping the Money Script?

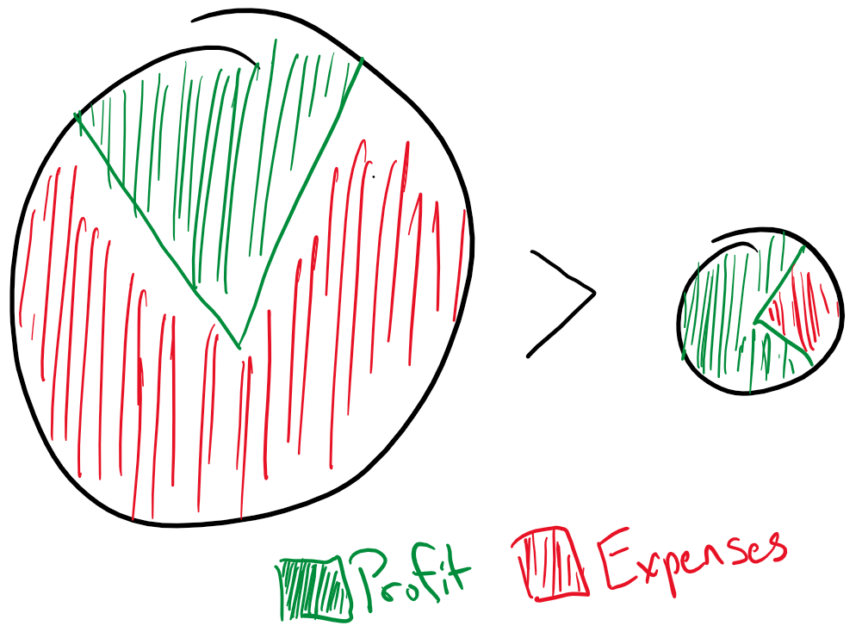

The inherent opposite viewpoint of viewing expenses not as costs but as investments, is that it is a limitless and abundant perspective on growth. When expenses are viewed as investments, the scenario above changes from “The revenue is $500 minus $25 in parts and $75 in staff costs” to “For the investment in $25 in parts and $75 in staff costs, we can generate $400 in profit.” That’s a simple mindset shift, but what follows is where the magic happens. The same mindset is willing to make additional investments (incur extra expenses) to enhance the possible outcomes. “We could invest $25 in parts and $150 in staff costs to take everything not including the service off my plate. By doing so, now I can perform the service two more times per day. Even though I’ve gone from a profit of $400 to a profit of $325, because I can perform the service six times instead of four times, my total profit has gone from $1,600 a day to $1,950 a day. In fact, if I was willing to give up another $100 per service to hire another professional like me to provide the service as many times as I do, I could increase my profit from $1,950 to $2,700!”

So I have to invest and ignore the Cost Money Script?

No, flipping the money script from focusing on costs to focusing on investments is not a diametrically opposed process. By focusing on investments you should not inherently ignore costs or assume that all investments will yield efficiencies that net out the added expenses. But you should fairly value the time commitment your work requires and identify opportunities to either make the delivery of the service more efficient (thereby either increasing your profits or reducing the time required to generate the same profits), and understand where your time is best used. A scalpel in my hands is worthless, but in the hands of a surgeon it’s a multi-million dollar revenue generating tool. Conversely that surgeon should spend no more time than is absolutely necessary managing their finances, because the return on every hour of financial work they spend is significantly lower than the return on surgeries they could perform. That same surgeon shouldn’t handle paperwork, administrative tasks, billing, or any other activity. But if they view all the expenses of outsourcing those tasks as taking money out of their pocket, they’ll never internalize the value of being able to help that many more people and therefore being more financially rewarded and fulfilled as a result.