Every two years, a research team from the University of Southern Maine and kitces.com (a popular research and thought leadership platform in financial planning) conduct and release a study on “How Real Financial Planners Actually Do Financial Planning”. The study, the only of its kind, surveys hundreds of financial planners from an array of business models on how they conduct financial planning, including their fee models, time spent on planning, parts of plans completed by the lead planners or their team members, profitability, software used, so on and so forth. Now I can already feel your question bubbling up, and yes, this is about to be another post about the state of financial planning and how it affects the public. “Dan, why can’t you just tell us what the next hot stock is?” I hear you asking, and I get it, but here’s the answer: “Because this is much more important.” Below, I’m going to share the three most important takeaways from the recent study, and I hope you’ll find them as interesting as I do.

The Cost of Financial Planning

A big area the study address was the pricing of financial planning. This is important, because the average age of a financial advisor in the industry is 58, meaning that there is already a large exodus of retiring financial advisors leaving the industry, causing supply to reduce faster than the opposite end of the bell curve, with hundreds of financial planning students graduating from the limited 216 programs around the country every year. As a result, financial planning costs across the board increased by 11.11% over the past two years, or a whopping 356% more than the national inflation of 3.56% over the same time period. The most common fee model for financial planning services, assets under management, didn’t change significantly in price, while the model growing in adoption the fastest grew over 25%. The average subscription fee model followed the formula below:

Annual Price of Financial Planning = $2,350 + (Assets * .1%) + (Income * .7%)

This means for the median US household earning $66,000 a year, with a net worth of $0, the average fee would be an unaffordable $2,812, or 4.26% of that household’s pre-tax income. As a result, the average client of a financial planner offering subscription fee services has a household income of $200,000 and $250,000 of assets, charging a net $4,000 a year. Conversely, the average financial planner offering services for a percentage of assets under management works with clients with a “mere” $170,000 of annual income, though the average asset minimum for a CERTIFIED FINANCIAL PLANNER™ only offering asset under management fees has a $1,000,000 investment minimum. All of this said to point out that financial planning, while an incredibly powerful wealth-building tool, is still largely used by people with significantly higher incomes and net worth than the average American.

Let me make a small admin note here if you feel uncomfortable reading this: It is MY Wealth Planners® policy that we will assist anyone who asks for our help, either as a service, pro bono or at the very least getting them in touch with services they can afford. If you need our help, don’t hesitate to ask.

Time for Financial Planning

The time to produce financial plans decreased over the past two. Two years ago, it took an average of 18.6 hours to complete the analysis and development of a financial plan, plus additional time for the onboarding meetings and implementation meetings for a total of 34.5 hours to get a financial plan built then implemented for use going forward. This year the study found that plan builds are slightly faster at 18 hours while total plan implementation is down to 31.6 hours in the first year. However, there were significant deviations between different business models in the time spent on financial planning. The study found that transaction-based firms (investment brokers and insurance agents) spent the most time on the sales side of the process (establishing a relationship and gathering information from clients) and on the delivery side of the process (implementing and monitoring); meanwhile, registered investment advisory firms (fee-only firms) spent significantly more time on the analysis and development of the financial plan. The conclusion? That transaction-based firms are interested largely in gathering information from clients to identify sales opportunities and rush the development of plans to then spend as much time as possible on the implementation of their sales recommendations, while fee-only firms focus largely on the development and delivery of financial planning itself. The question you should take away from this? “Am I paying for a financial plan so I can have products identified for me and then sold to me? Or am I paying for a financial plan so I can accomplish my life goals?”

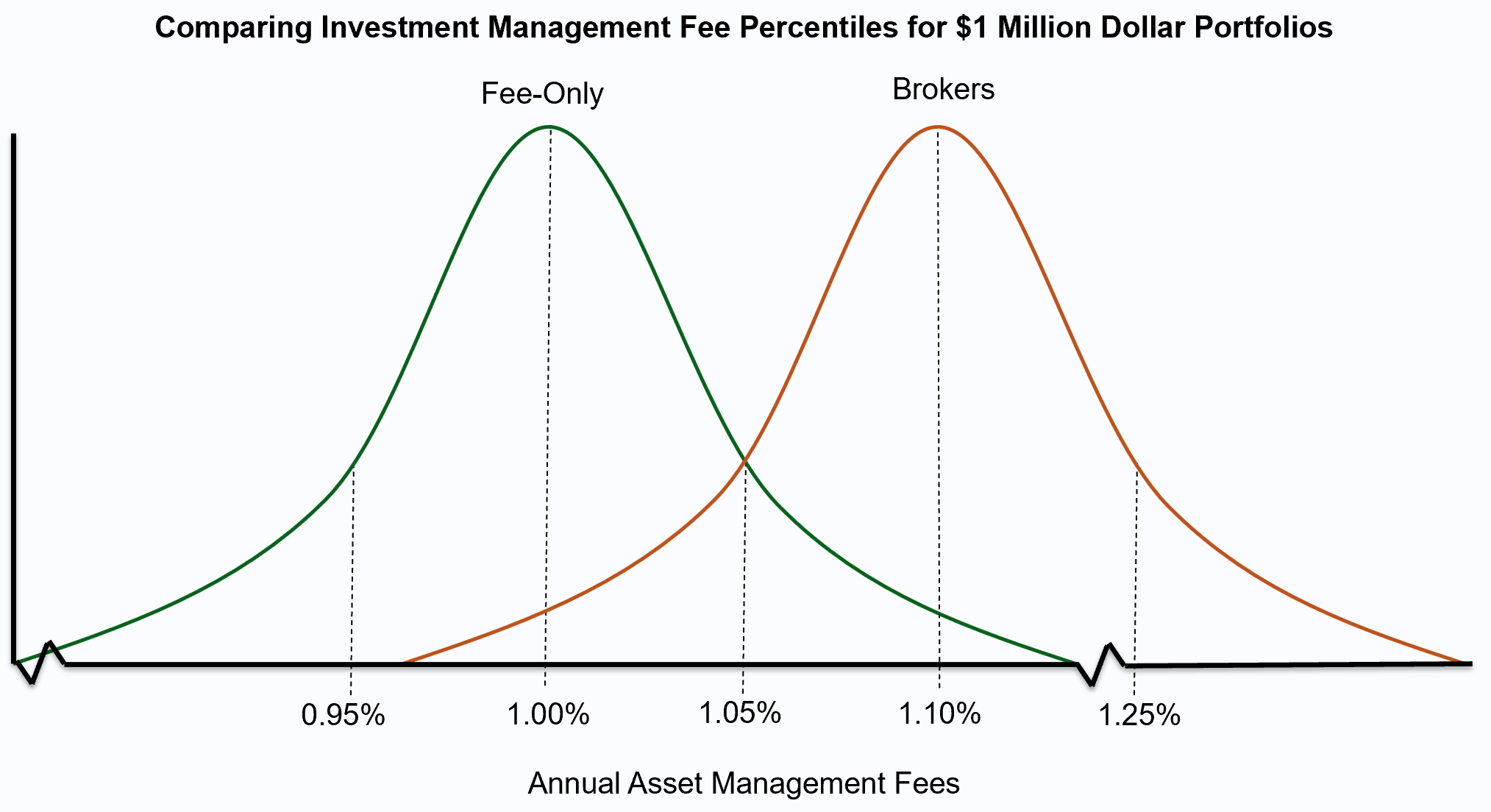

The Cost of Investing

Notably, the cost of investment management is often a bundled service for financial planners (particularly those serving the ultra-high net worth market). However, the cost investment management ranges widely between brokers/hybrid firms and fee-only registered investment advisers. While there was no evidence of fee compression (that financial planner fees could decline like the price of investment products have over the past ten years), the cost of low-balance accounts decreased while the cost of high balance accounts actually increased. Most notably, fee-only firms as the median charged less than the lowest 25th percentile of brokerage firms, while the highest 75th percentile fee-only firm charged less than the median of brokerage firms. In short, the bell curve of investment management costs between fee-only firms and brokerage firms barely overlap their range of standard deviations from the median cost of the service.

Not to mention research that has well established that brokerage firms actively choose to use higher-cost shares of institutional funds in order to provide revenue sharing at an extra added expense to the client of .26% per year more than they’d pay working with fee-only firms that don’t accept revenue sharing payments and therefore have no incentive or requirement to recommend higher cost shares. The researchers for this most recent study concluded that the increased cost to clients is likely to offset the compensation model used by brokerage firms, in which advisors are required to split off a percentage of their revenue, ranging from 5%-60% of the business they bring in. In other words, the fact that the firm’s brokerage advisors work to claim a larger share of the revenue, the advisors feel entitled to charge their clients more to offset the cost. All of this ironically then compounded by the higher fees the firms themselves force the advisors to charge via the more expensive share classes, which they “openly” disclose in their regulatory filings.

Summing It Up

Research and data are a tricky thing, but the findings of the most recent study are quite clear. Firms that open up additional lines of revenue spend less time on financial planning than their fee-only peers, focus more time on identifying sales opportunities and pursuing sales opportunities, and charge significantly more than their fiduciary peers. While the SEC has argued that “Regulation Best Interest” or Reg BI is here to protect the public and to disclose all possible issues that could lead to conflicts of interest or higher costs for consumers, independent journalists have already shown that a significant portion of firms are lying and omitting this information from their filings. All this to say, while there are still plenty of great fee-based and brokerage-based financial planners out there, the institutions they work for largely force additional costs into their business model and incentivize behavior that comes at the expense of their clients.

Dr. Daniel M. Yerger is the President of MY Wealth Planners®, a fee-only financial planning firm serving Longmont, CO’s accomplished professionals.