For those who wondered, “What happened to the blog last week? Heck, where was the blog yesterday?” The answer is as fun as it is mundane. Rather than writing a blog for July 30th, I was in Chicago attending the summer leadership meeting for the National Association of Personal Financial Advisors, or “NAPFA,” for which I sit on the west …

The Age of AI?

In 1961, during an Antarctic expedition, Leonid Rogozov came down with appendicitis. While this condition is typically solved with relatively minor surgery, there was just one problem: there was only one doctor on the expedition, Leonid Rogozov. Faced with a choice between certain death or an insane attempt at performing his own appendectomy, Dr. Rogozov chose to live. With a …

The Necessity of Fiduciary Financial Planning

Last week, WSJ reporter Jason Zweig broke the story of Powerball winners who were exploited for millions of dollars in commissions and fees. For those without the time to read the full article, succinctly, a couple won a $180.1 million dollar lottery in 2008 and walked away with $59.6 million after taxes. Shortly thereafter, they started a charitable foundation to …

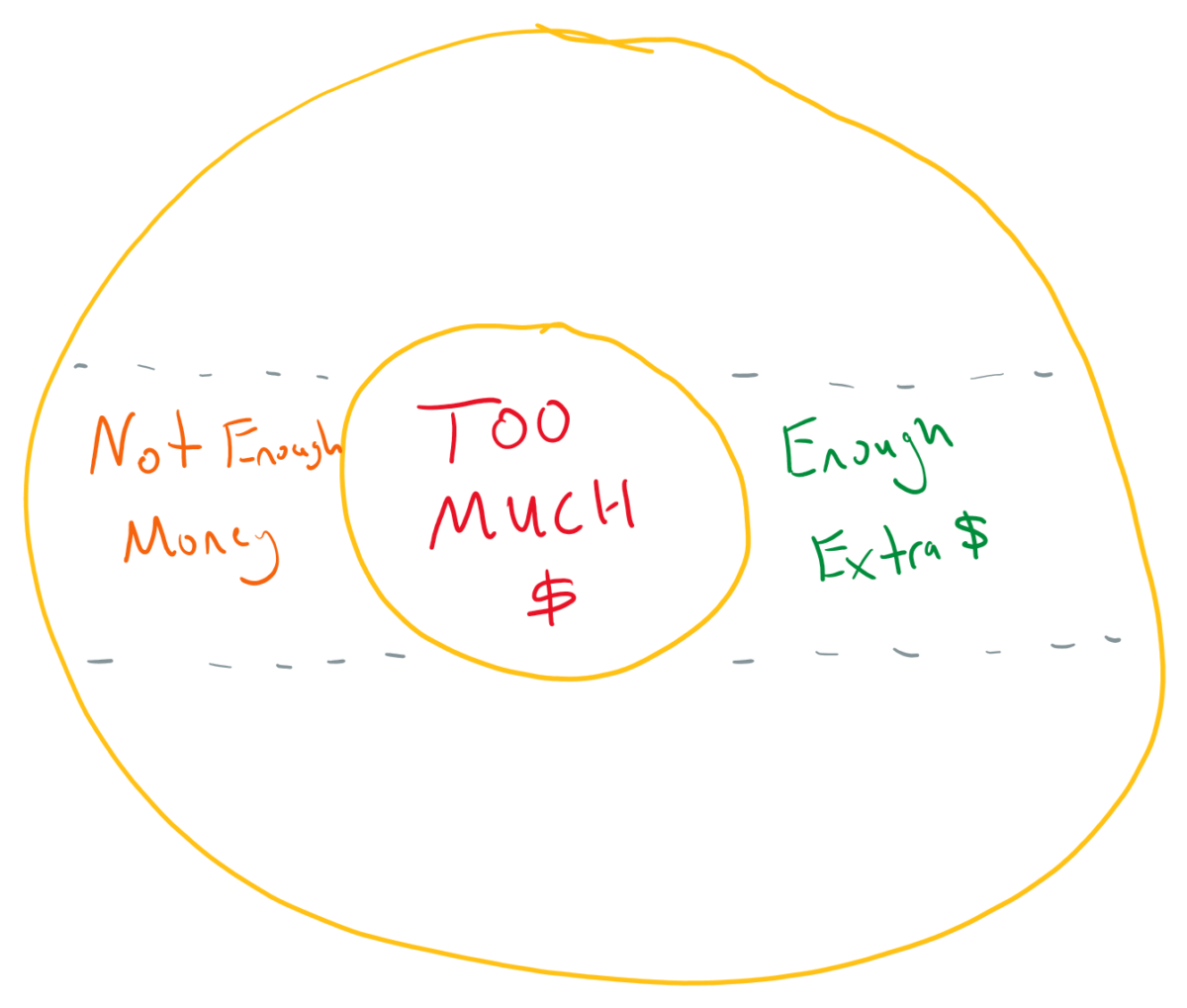

Donut Holes

A common misperception by many about taxes is that if they make too much money, they’ll end up having less money than if they hadn’t made the money. This often arises from a misunderstanding of the marginal tax system, in which incrementally, your taxes increase as your income rises. The misunderstanding then is that if you’re in the 22% bracket, …

The Business End of Fun

There’s a funny thing about entrepreneurship: many people who have successful businesses never thought of themselves as, and to this day may not think of themselves as, entrepreneurs. While this can apply to many common examples, such as those working in the trades as independent contractors, the same thing can often happen to those in more creative businesses. What might …

When the tide goes out

The Oracle of Omaha once said, “Only when the tide goes out do you discover who has been swimming naked.” While the meaning of this colloquialism varies based on who’s quoting it and the circumstances thereof, today we’re thinking about leveraged portfolios. Specifically, the risks of leveraged portfolios and where it’s often considered risky or safe, despite the risks being …

The Latest and Greatest in Planner Compensation

The latest study on compensation within registered investment advisers has been released, so today, we’re providing an overview of the compensation measurement changes for three entry-level and early career positions: non-licensed support (e.g., customer service, receptionist, office admin), entry-level financial planners (paraplanners, associate advisors, planning analysts), and experienced CFP® Professional Financial Planners. Non-Licensed Support Based on the data from 2022, …

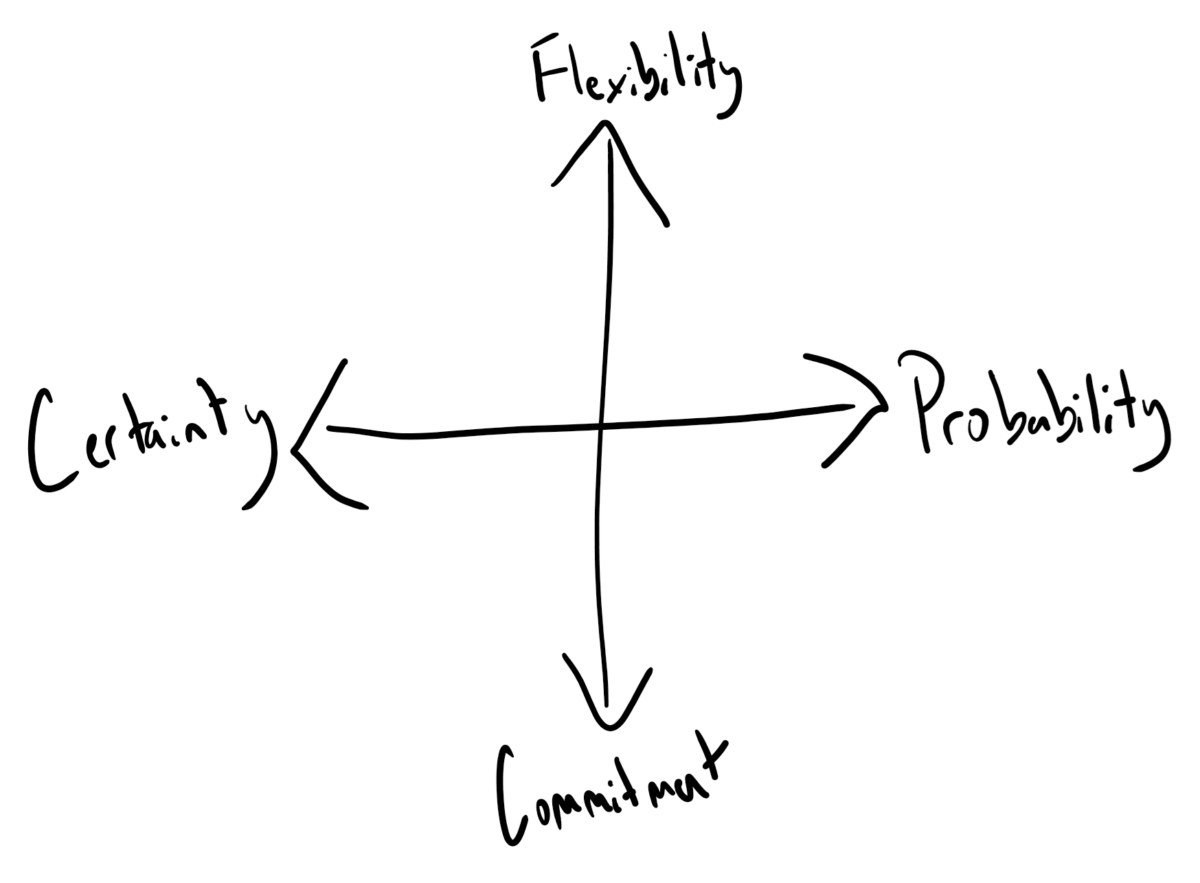

Establishing a Retirement Income Strategy

One of the things often missed by retirement savers is that they have a decision to make as they reach that point of financial independence: Where is my money going to come from? Despite potentially having saved an enormous amount of money during their lifetimes (or sometimes not enough!), many savers are ill-equipped to establish a strategy for sustainable retirement …

Becoming a B Corp

Back in March, we shared about our application to become a Certified B Corp. As of last week, we were excited to be confirmed as a Certified B Corporation, joining several thousand businesses around the world in placing the needs of our team, clients, and our community over pure profit as a legal foundation for MY Wealth Planners®. When we …

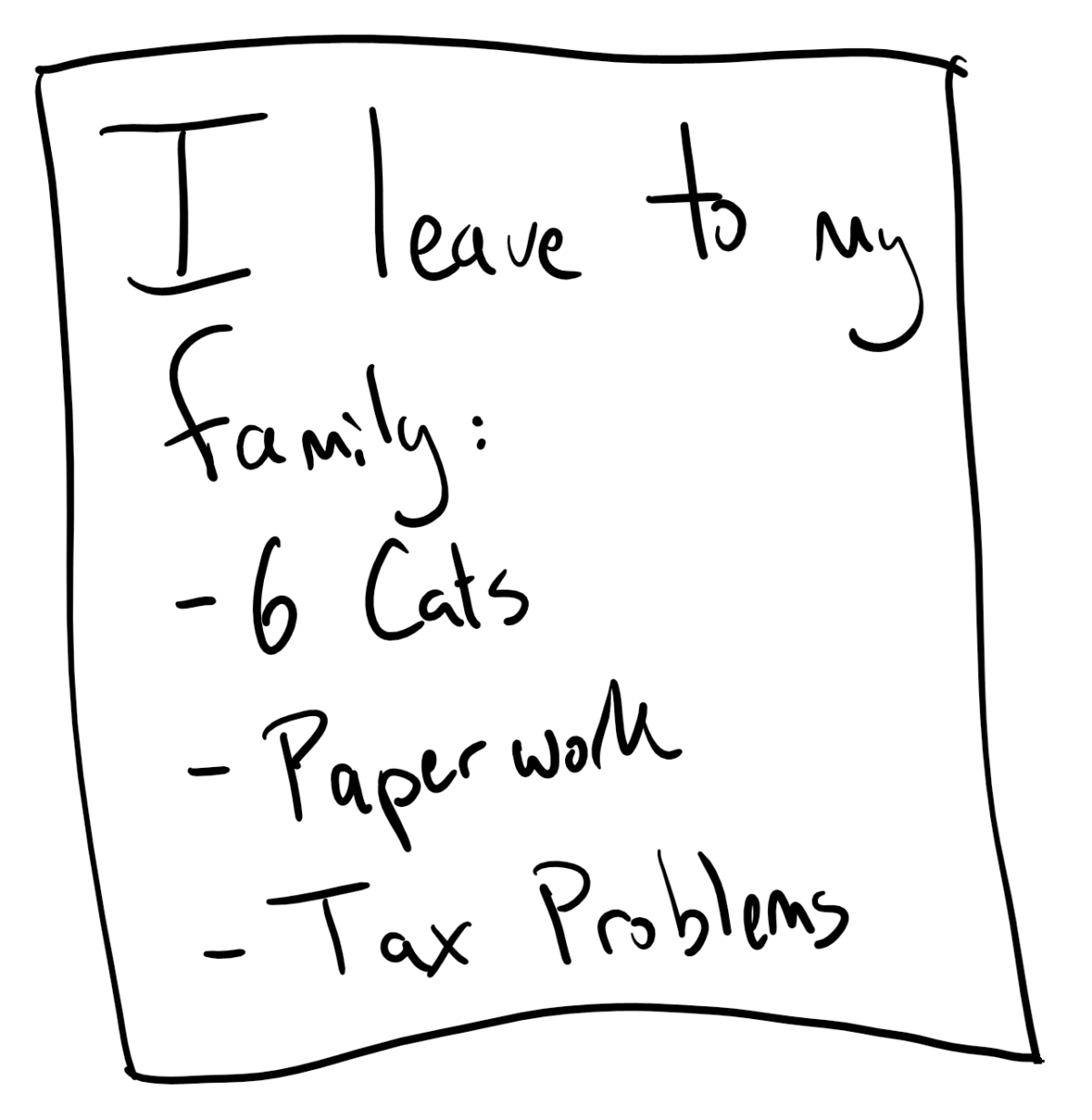

Inheriting a Gift of a Lifetime

As the old saying goes, the only two certain things in life are death and taxes. Today, we’re talking about both. Inevitably, through no fault of your own, you will pass away. Turns out there is a 100% chance that you will not live forever! Sadly, you and everyone else share this fate, and consequently, you also share the obligation …