There is a constant hem and haw to the discussion around financial planning, largely derived from the various interests of the firms that offer it and discontent about how “those other guys” do it wrong. You know the ones. Yet, against a backdrop in which being a CERTIFIED FINANCIAL PLANNER™ is compensation-neutral, a constant argument and debate is about how …

That Doesn’t Look Like Anything to Me

If you’ve ever watched the HBO show “Westworld”, the phrase “That doesn’t look like anything to me” has a special meaning. In the show, the ultra-wealthy vacation in what is ostensibly a live-action roleplay theme park, filled with “hosts”, synthetic androids that represent the townsfolk and bandits of an old western. The hosts do not know that they and the …

Theories of Financial Planning

Financial planning is a profession that has grown out of the traditions of several others: amalgamating segments of knowledge from attorneys, CPAs, stock brokers, insurance agents, economists, psychologists, and traditional institutional finance, financial planning draws from many fields and pulls in many resources and theories in its practice. In my own pursuit of a Ph.D. in Personal Financial Planning, I’ve …

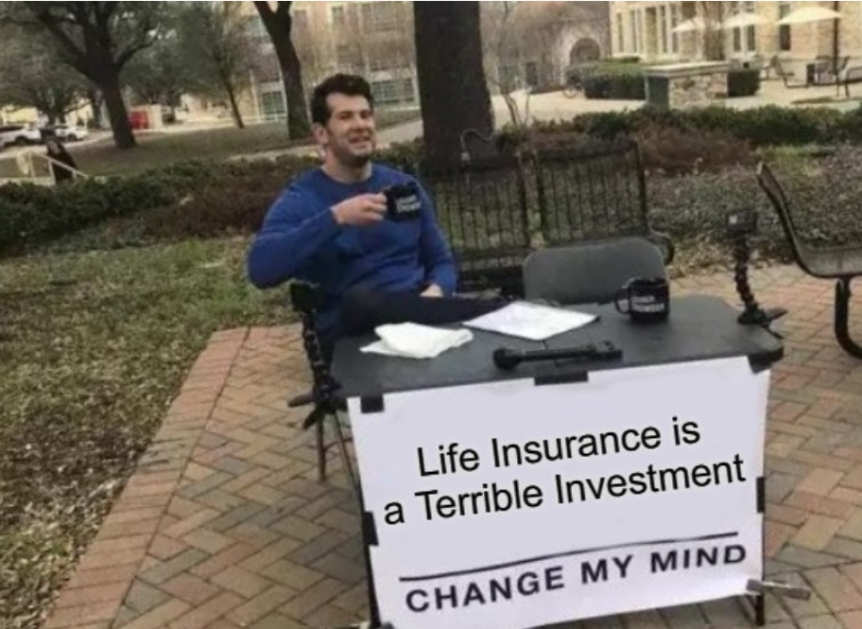

Universal Life – Game Changer or Game Complicator?

An Author’s Note at the Outset: About a dozen agents lacking in reading comprehension have rushed forward, shrieking their objections to this post without actually reading it carefully. So, I’ll put the warning up front: the purpose of this post is to highlight that a traditionally structured product is not a strong wealth accumulator. It is not to demonstrate a …

Retiring in Colorado

Colorado is a well-known destination for climbers, hikers, skiers, and all sorts of adventurers. It’s no surprise that not only is it a popular place to live, but a popular place to retire. Retiring in Colorado, whether you’re a local or a newcomer, comes with some particular planning elements that should be considered. So today, we’re talking about retiring in …

Secure Act 2.0

Welcome to 2023! The holiday omnibus bill brought out a significant number of changes to retirement accounts and other investment vehicles. Today we’re getting you caught up on just a handful of the many updates included in the “Secure Act 2.0.” We’ll start with the generics that apply to everyone, and some business-owner specifics are at the end. Required Minimum …

Planner Compensation 2023

As we strive to be radically transparent at MY Wealth Planners®, today I thought I’d publicly share our pay and benefits scales for 2023. Briefly, this is broken out into descriptions of job tiers, compensation based on Longmont, CO residency, and a summary of benefits as we offer them. Job Tiers Careers at MY Wealth Planners in the “financial planner” …

Benefits for All! Establishing a Business that Pays

Today marks the three-year anniversary of the launch of MY Wealth Planners®, Longmont’s first-and-only fee-only financial planning firm, a title that it maintains to this day. While the path to launching MY Wealth Planners started four and a half years prior as a “supported independence” practice under Waddell & Reed, the launch into full-blown entrepreneurship is both exciting and just …

Service Model Update

Hello everyone! This week is not our usual broad educational content but instead is to notify and educate you on changes we’re applying to our service models. If you’re an existing client, please read thoroughly. If you’re considering becoming a client, this should be a helpful tool for you to understand our service model. As always, a fair disclaimer to …

Play Stupid Games: Win Stupid Prizes – The FTX Story

In the early days, investing was largely the domain of “caveat emptor,” or “buyer beware.” Before the 1930s, there was essentially no regulation of investments and securities. At the time, one judge observed that people were “Selling things no more material than the blue sky.” This led to significant regulation in the 30s and 40s to create laws around the …