Recently, a well-known financial advisor took to Linkedin to share a bold opinion: “Advisors who make more money than you are some combination of smarter and/or harder working. End of story.” On its face, one can see the argument for it. Surely if you’re a financial professional whose job is to help their clients optimize their finances, surely you should …

Boulder County TABOR Notice

Along with the Colorado Statewide Ballots, we get localized ballots in Colorado for our county and municipality. We’ve written about the Colorado Statewide ballots already, and for those readers not living in the Boulder County area, you can probably just read the statewide ballot article or otherwise take a pass on this week’s blog. We’ve divided it into countywide and …

XYPN Live 2022 – The Good, The Bad, and the Dragon Slaying

For our regular readers, you’ll notice that this came out much later in the day than usual. To get you up to speed, I’ve been at XY Planning Network’s “XYPN Live” conference, where we spend time on continuing education, community building, and updating ourselves on technology and other solutions. The conference was let out this afternoon, and in a change …

Overemployed Risks and Rewards

It’s not uncommon for us to hear about being underemployed; the popular “college graduate working at Starbucks” sort of observation is often raised as a criticism of higher education and the low return on investment from many majors. Yet, there is an inverse term that we’re talking about today: overemployed. This term shares a resemblance to the expression “working two …

Activity Doesn’t Equal Results

We’re almost nine full months into what we could all easily describe as a disappointing investment year. While the fourth quarter could show signs of recovery and positive momentum, it seems fairly clear that this year the market’s esprit de corps lives and dies by the Federal Reserve’s perspective on interest rates and inflation. The Federal Reserve has been plain …

2022 Colorado Statewide Ballot

We received our 2022 Statewide ballot information packet in the mail yesterday. Not one to let an opportunity to read exciting political descriptions of things like mill levies and income taxes pass us by, we’ve decided to pass comments on the financial impact of each ballot measure. Whether you support the underlying issues and causes is a separate question, but …

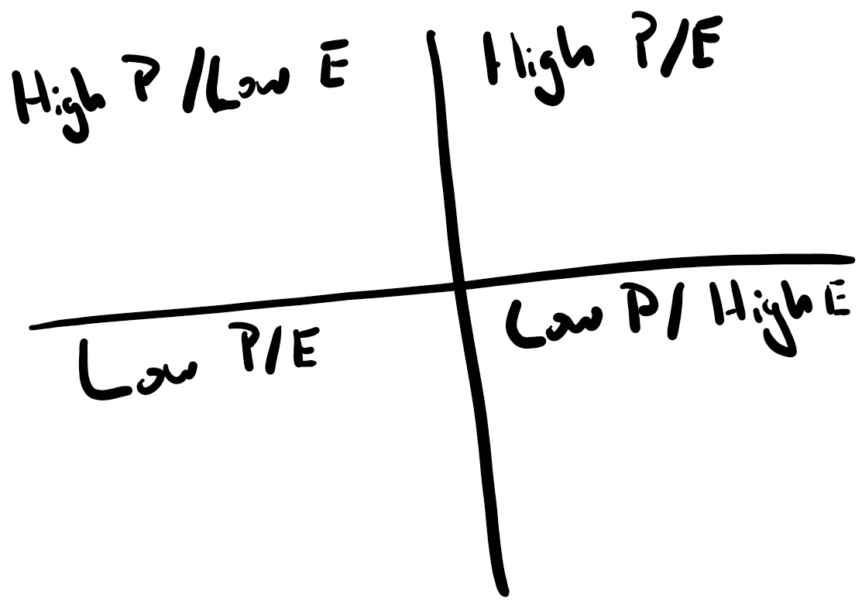

High Enjoyment and High Profit

Recently, at the suggestion of Arlene Moss, we conducted an exercise. The exercise is simple: Divide your clients into four quadrants, high-profit high-enjoyment, low-profit high-enjoyment, high-profit low-enjoyment, and low-profit low-enjoyment, as you can see above. The idea behind the exercise is multi-faceted. First, that the exercise should give you an idea of “what to do” with clients who fall into …

They Didn’t Teach Us That

It’s no surprise that we don’t know everything. Bring up a topic such as rocket science or neurosurgery and anyone will throw up their hands and say, “I don’t know anything about that,” except, of course, for the rocket scientists and the neurosurgeons. Yet, as we move down the spectrum of complexity, people become more confident, even bolder in their …

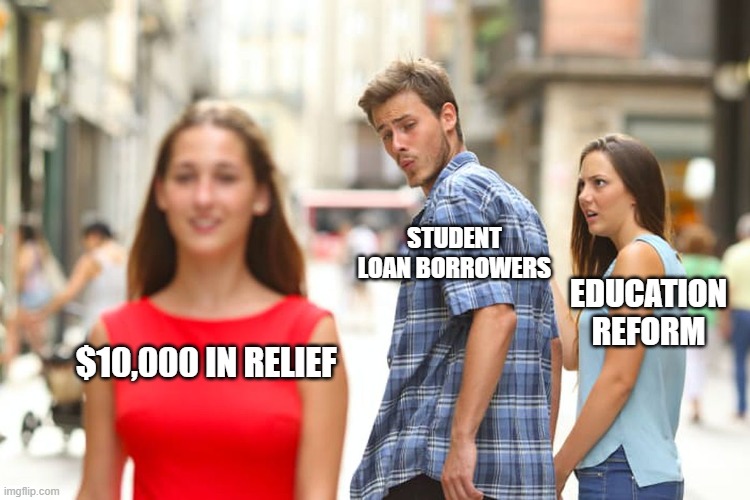

Student Loan Forgiveness

Well, it’s official. As of last Wednesday, the Biden administration has come out with an executive order to slash student loan debt. While it remains to be seen whether the order will make it through implementation or whether lawsuits threatened by the GOP and others will somehow stop this, at present, the proposal has some clear points to it and …

NexGen Gathering 2022

I’m writing this on a plane flight to the Financial Planning Association’s NexGen Gathering. There’s a bit of warm nostalgia in being on this flight; not because I have a deep fondness for packaged pretzels or half-cans of ginger ale, but because NexGen Gathering has been a significant touchstone in my professional career. The last time NexGen Gathering was held …