I’m writing this on a plane flight to the Financial Planning Association’s NexGen Gathering. There’s a bit of warm nostalgia in being on this flight; not because I have a deep fondness for packaged pretzels or half-cans of ginger ale, but because NexGen Gathering has been a significant touchstone in my professional career. The last time NexGen Gathering was held …

Knowing Your Budget – A Step By Step Guide

Hello there! This week we’re providing you with directions on how to perform your own step-by-step budget analysis! This is less of our usual general education and more of a recommended exercise to get your arms around where your money is really going. Without further ado, let’s jump into it! First, The Data This exercise is best completed through the …

Recession Impact 2022

Reading last Thursday’s WSJ headline: “U.S. GDP Fell at 0.9% Annual Rate in Second Quarter,” I had the brief flash to Fiddler on the Roof’s song “Tradition,” save that the titular chorus was replaced with “Recessioooooooon!” It’s official, the US Economy has entered the definition of a recession. Yet with a recession officially on the books, you might note that …

PTE 2020-02 Misses a Major Point

I’m consternated. For anyone who reads my normal weekly content, this may or may not be for you. This is more of a complaint or concern than an educational piece, but it’s one I feel a need to voice. This year, “Prohibited Transaction Exemption” or “PTE 2020-02” was released, giving guidance to financial planners and advisors about how they needed …

First Impressions

I’m an extremely passionate advocate for the value of financial planning. I’ve written a book on starting a career in financial planning, am halfway through a doctorate in financial planning, and serve on regional boards and national committees for multiple financial planning organizations. It might surprise you then to know that I had a terrible first interaction with a financial …

Reducing the Cost of YOUR Healthcare

Here’s a simple experiment: The next time you buy any good or service that isn’t clearly labeled with its price, ask what it costs. For example, if you go to a high-end restaurant and they list cocktails without prices, ask the server what it costs. They will likely know immediately or be able to check out the price quickly on …

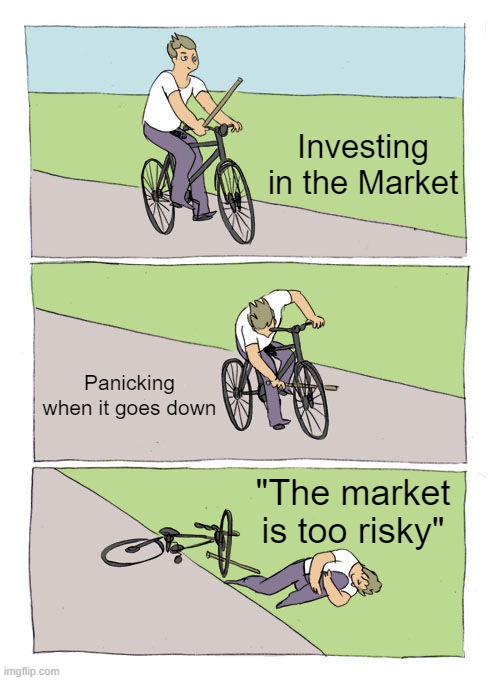

When Courage Fails

“A day may come when the courage of men fails, when we forsake our friends and break all bonds of fellowship, but it is not this day.” -Aragorn at the Battle of the Black Gate I have written a lot about volatile markets and market downturns, yet without fail, the lessons of dozens of market crashes before seem to fall …

Pension Maximization

If you have worked for the government in Colorado, or worked anywhere in the United States for more than ten years, then congratulations, you have a pension! Pensions have been a staple of retirement planning and income for centuries, with the first corporate pension being established in 1875 by the company we now know as American Express. Even before American …

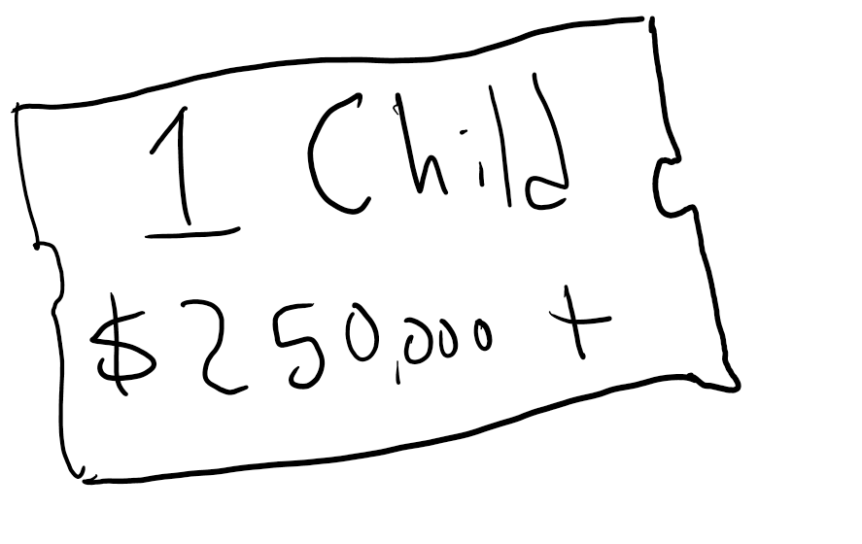

The Cost of Children

As I’m sure you’re aware, the Supreme Court overruled Roe v. Wade on Friday, overturning a 50-year precedent limiting the state’s ability to restrict access to abortion. Consequently, abortion has become outright illegal in 17 states, and is time-limited in 6 states, while a handful of others are undetermined. Regardless of the state you live in or your personal politics, …

Becoming A Millionaire in Seven Years

Well, this is an awkward brag of sorts, but as of May 31st this year, it appears I’ve become a millionaire. I’ll get it out of the way and say that I don’t feel like a millionaire. I certainly don’t live like one, or at least, I don’t live like what I’d think of a millionaire as living like. I’m …