Last week, investment giant Vanguard announced they would begin offering personal advisor services (“PAS”) clients their proprietary actively managed funds. This was a major shock across the financial industry where Vanguard is famous for their passive index investment options and a founding philosophy focused on the low-cost capture of the market’s movements. The stated rationale for this default selection is …

The Difficulty of an Investment Process

Speculation is in vogue right now and it’s the dearth of realistic thinking that drives it. Whether it be calls to invest in dog-based cryptocurrencies or special purpose acquisition companies (SPACs) being used to dodge SEC disclosure requirements for initial public stock offerings, you can’t take a single step in the financial world without bumping into someone who is excited …

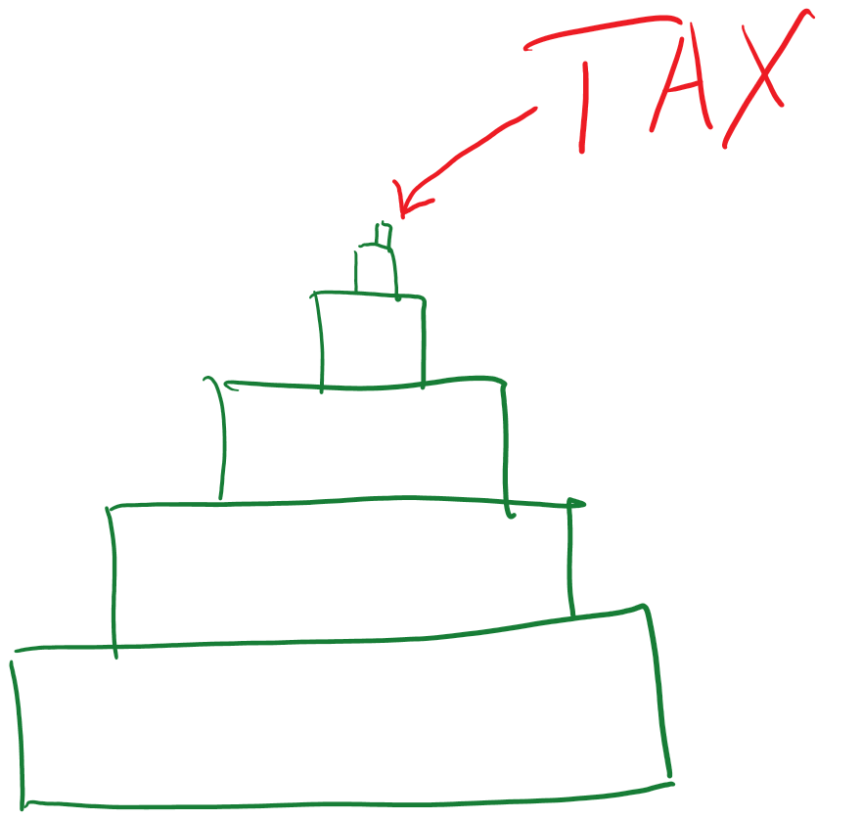

The Billionaire’s Tax and You

It’s not uncommon that we see a headline such as: “Elon Musk made $36 billion dollars in yesterday’s Tesla surge.” The grammar of such a statement leads us to believe that the profits of Tesla were so substantial that Elon Musk was given a check for $36 billion. However, that’s not really the case. While $36 billion is an incomprehensible …

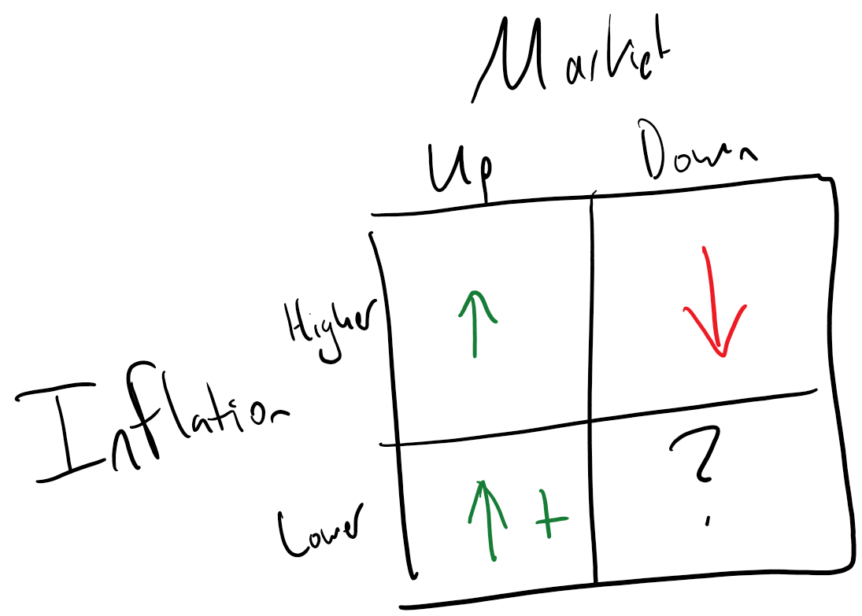

Rethinking Risk

Risk in the investment world doesn’t actually translate to the common meaning of the word “risk.” When I tell you that an investment is “high risk,” your first thought is probably that it means there’s a high chance of losing money or losing the entire investment. That could be the case, but in investment professional parlance, “risk” more typically refers …

You always pay for what you get

The old adage goes “you get what you pay for,” but I’m personally taken with a more realistic version from Hearn’s laws that goes: “You always pay for what you get. If you are lucky, you will get what you pay for.” Truly, this is the stuff of common sense, yet people often expect a French Bistro experience on a …

Lemon Avoidance

In the financial services industry, there are lemons. A lot of lemons. In fact, I’d go so far as to argue that the majority of financial products are lemons, and in turn, that most of the people producing and selling those lemons, know that they are lemons. In fact, the presence of lemons in a marketplace can be so significant …

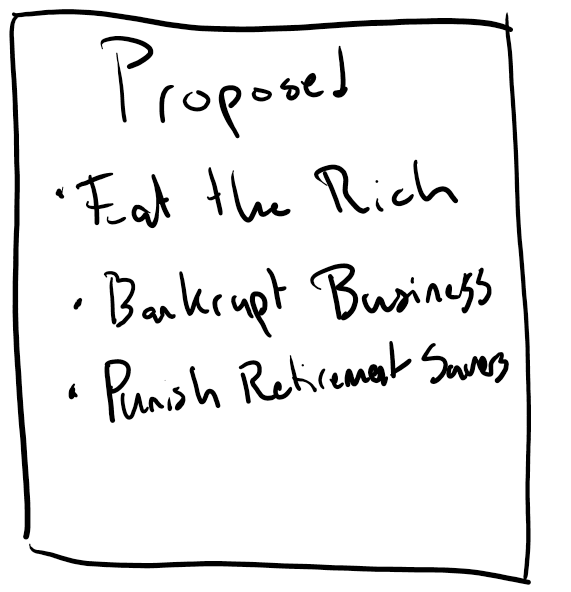

What’s Your Fair Share?

Over the weekend, the President of the United States made national news (as one often does) by stating that the $3.5 Trillion proposed spending bill in the house would cost “Zero” because it is “Paid For”. Much as I’d like to tell servers at restaurants that my bill is zero because I can pay for it, there aren’t any stores …

Tax Policy by Outrage

It’s no secret that laws are not written by perfect people, nor are they error free texts bestowed upon us by a higher power. In fact, it’s fairly well known that many laws are written in part or entirely by policy makers and lobbyists with an interest in the outcome of the laws. Yesterday, Congress released the text of the …

“Guaranteed” Passive Income

It’s not uncommon to see an advertisement for “guaranteed passive income”; whether it’s the harmonica playing insurance agent, a real estate mogul, an accredited investor Regulation D offering on Facebook, or just your bank touting some FDIC secured CDs, there is no end to the promises of others to give you guaranteed passive income. Yet, as the old adage goes, …

Tax Traps and How to Avoid Them

The old adage goes that there’s “no free lunch” when it comes to life. Put more clearly in context, only two things are sure in life: “Death and Taxes.” One of the key roles a financial planner plays in their client’s lives is that of “tax eliminator.” This differs from tax evaders (criminally not paying taxes that are due), but …