The Oracle of Omaha once said, “Only when the tide goes out do you discover who has been swimming naked.” While the meaning of this colloquialism varies based on who’s quoting it and the circumstances thereof, today we’re thinking about leveraged portfolios. Specifically, the risks of leveraged portfolios and where it’s often considered risky or safe, despite the risks being …

The Latest and Greatest in Planner Compensation

The latest study on compensation within registered investment advisers has been released, so today, we’re providing an overview of the compensation measurement changes for three entry-level and early career positions: non-licensed support (e.g., customer service, receptionist, office admin), entry-level financial planners (paraplanners, associate advisors, planning analysts), and experienced CFP® Professional Financial Planners. Non-Licensed Support Based on the data from 2022, …

Establishing a Retirement Income Strategy

One of the things often missed by retirement savers is that they have a decision to make as they reach that point of financial independence: Where is my money going to come from? Despite potentially having saved an enormous amount of money during their lifetimes (or sometimes not enough!), many savers are ill-equipped to establish a strategy for sustainable retirement …

Becoming a B Corp

Back in March, we shared about our application to become a Certified B Corp. As of last week, we were excited to be confirmed as a Certified B Corporation, joining several thousand businesses around the world in placing the needs of our team, clients, and our community over pure profit as a legal foundation for MY Wealth Planners®. When we …

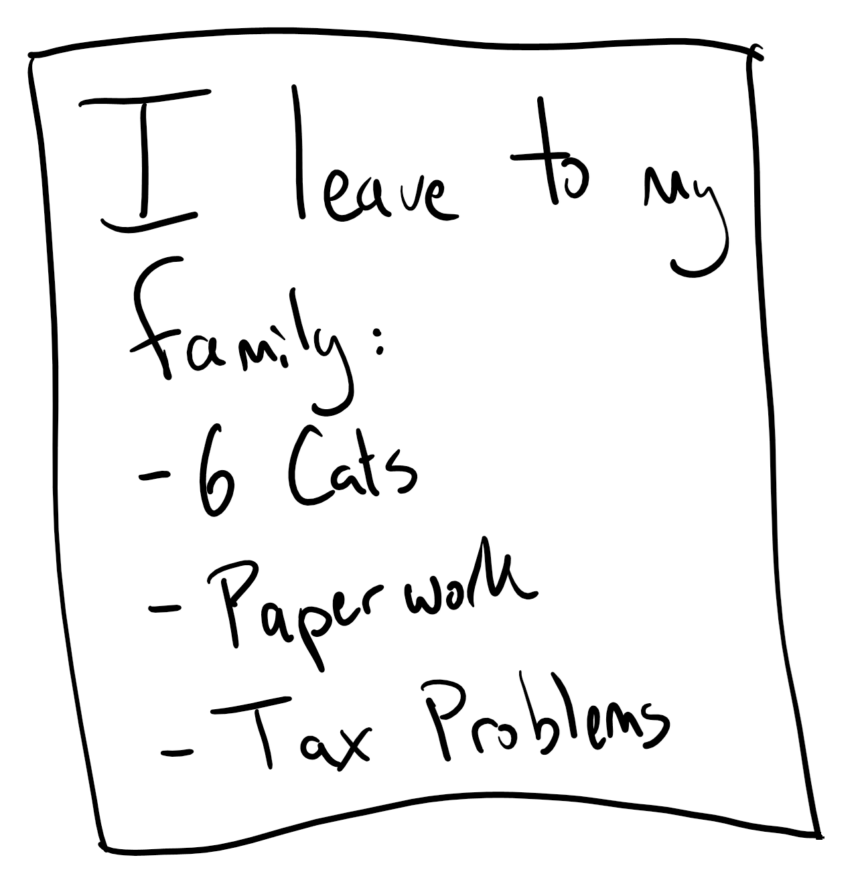

Inheriting a Gift of a Lifetime

As the old saying goes, the only two certain things in life are death and taxes. Today, we’re talking about both. Inevitably, through no fault of your own, you will pass away. Turns out there is a 100% chance that you will not live forever! Sadly, you and everyone else share this fate, and consequently, you also share the obligation …

Doing the Work – Thoughts on the Path of the Profession

This post is written by a professional with a professional audience in mind. While you might be a client or general member of the public reading this, I regret to say that this piece is not about financial education or striking a thought-provoking idea into your mind for the week. This is an article about a professional’s concerns with their …

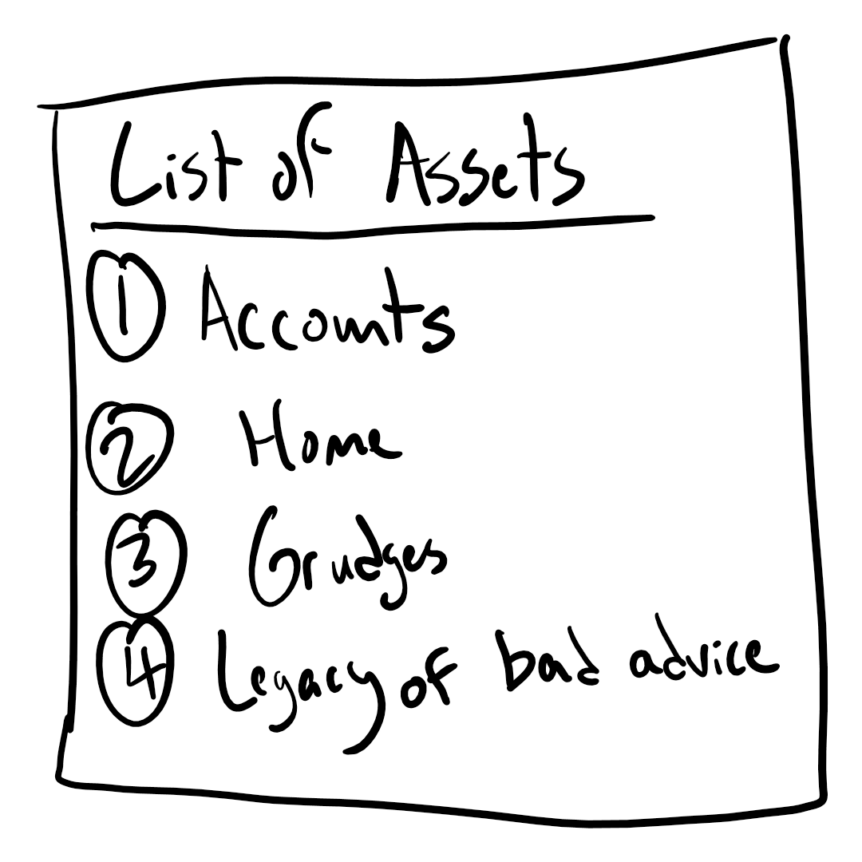

The Five Most Common Issues of “The Last Guy”

It might surprise you to learn that most of our clients worked with a financial advisor before they came to MY Wealth Planners. In fact, the vast majority of clients come to us with a grab-bag of ex-advisor’s insurance or investment recommendations. While early on, a financial planner might be surprised to see the goofs and bad choices recommended by …

There Are No Free Lunches

It’s commonly held that there are no free lunches. Expressions such as “if you’re not paying, you’re the product” come to mind when people talk about social media, for example. In the case of the investment world, we talk regularly about all the hidden tricks, fees, and gotchas that are designed to “move the customer’s money from their pocket to …

Book Review: Infinite Number Going Up

I’ve found the time recently to read two books on the subject of the FTX crypto scandal in the past few months and wanted to take some time to shed some light on the story. I wrote at the time about the preliminary examination of what caused FTX to implode, but the two books on the subject lay out the …

Shelf Space

Have you ever had this embarrassing moment happen to you? You’re in a grocery store in the chips and soda aisle, and some fellow is up on a ladder organizing a bag of Pringles on the top shelf. You’re looking for something that isn’t Pringles, and frankly isn’t even chips or soda, and you walk up to the fellow and …