During my time in the Army Reserve, I had a job at IBM working in various roles in assisting projects relating to training and transferring services for various client companies to IBM. At one point, I went through the training for the service desk for a Department of Defense contract. The trainer, a woman named Cady, explained “the magic black …

Sex Sells

Yesterday, as often happens, a tweet went viral. Now, notably, I’m not here to talk about vesting schedules. Vesting schedules would be contrary to the title, and might be the “least sexy” thing we could possibly discuss. Suffice it to say, vesting schedules exist because employers want to incentivize employees to stay longer than minimum terms with the company. Other …

State of the Union

Every year, we as a country trot out an elderly statesman to give a grandiose State of the Union address at the pace of a DMV queue about the state of the country. The speech runs a sentence at a time, punctuated by intermittent cheering or boos by the respective political parties. The news covers the speech in detail, the …

Never Work for Free

A gathering of powerful men sits, cantankerously debating the solution to a mutual problem. Among their shouting, a stranger enters their company and offers a solution to their problem. “It’s simple.” He says, which of course, raises a question from the group: “If it’s so simple, why haven’t you done it already?” To which he replies, “If you’re good at …

My Thoughts on Retreat

I made my first impression on the FPA community in the spring of 2019 when I posted on the FPA Activate page, complaining about what I perceived as a lackluster keynote lineup for FPA Retreat. That complaint haunts me to this day in, what I think might be the FPA Staff’s favorite karmic justice, as my testimonial about the quality …

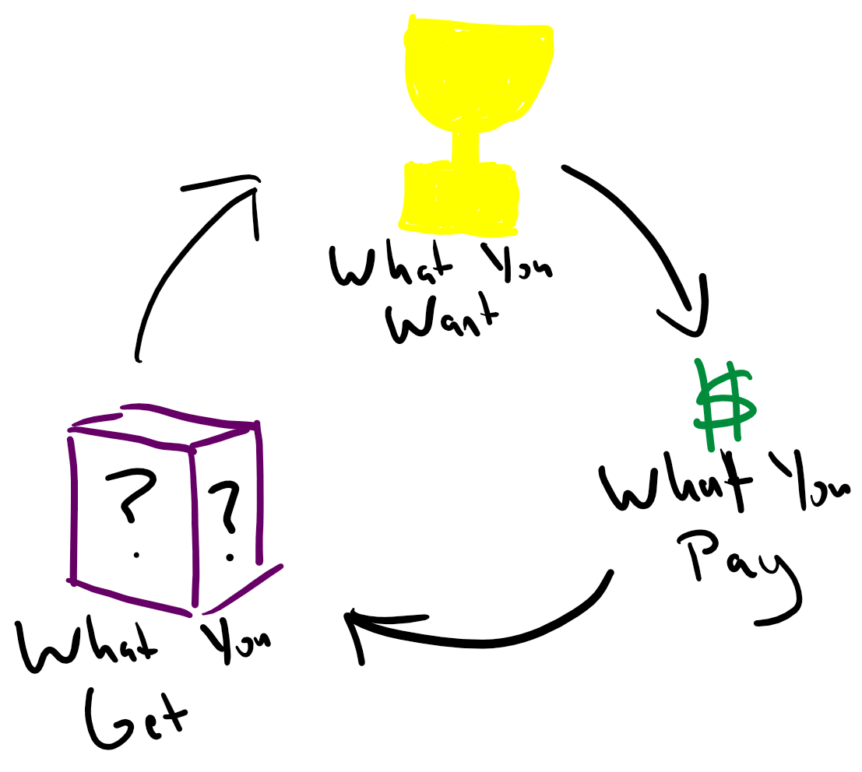

Shopping Your Insurance

There’s a question I ask every financial planning client when they start a financial planning relationship with us. “Would you like us to shop insurance for you to see if we can get better coverage for the same price or the same coverage for a better price?” It’s not a promise of results or a pitch for a sale, given …

Lethal Interactions

It is well known that many innocuous substances when combined, can produce unintended outcomes. For example, someone taking opiate painkillers who then drinks alcohol can end up with symptoms as mild as nausea and extreme as stopping breathing and going into a coma (assuming the former doesn’t simply result in death!) These issues are a large part of the specialized …

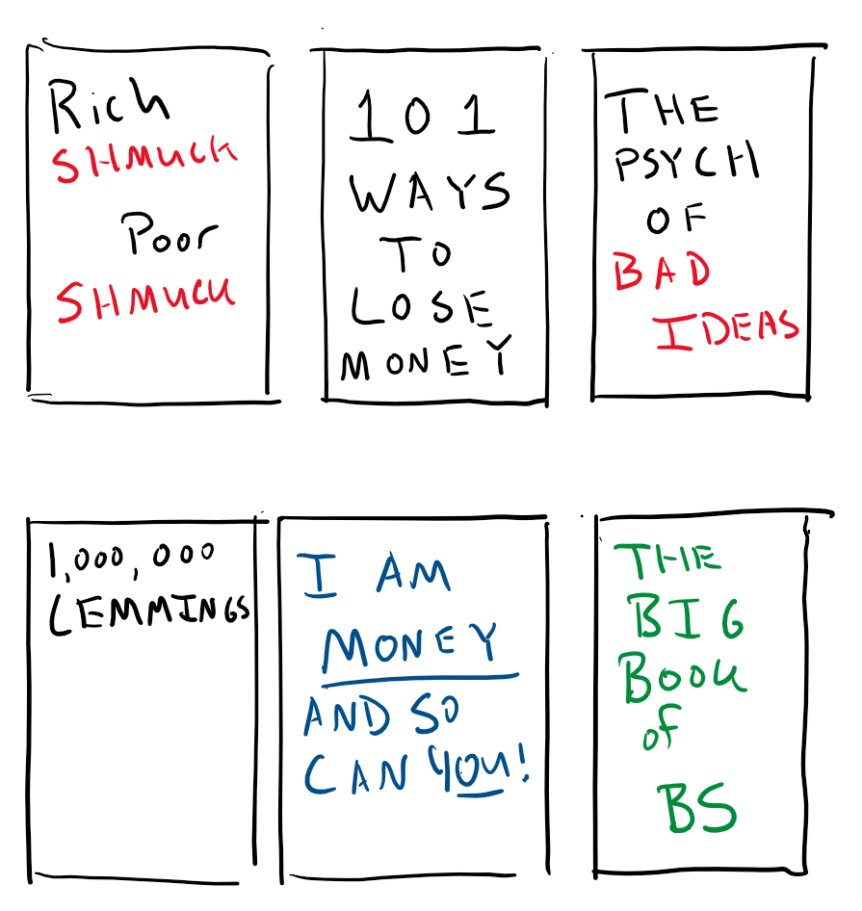

Pop Science in Finance

Over the weekend I spent a great deal of entertainment time listening to a new podcast called “If Books Could Kill.” The basic premise of the podcast is that bloggers and podcasters Michael Hobbes and Peter Shamshiri read books sold at the airport, often made up of “pop science” topics such as behavioral psychology, self-help, political topics, and personal finance, …

Reverse Mortgage – Villain or Vindicated?

You see a verdant green forest and a well-groomed dirt path. A moment later, the Magnum PI, Tom Selleck, appears and begins to tell you about how this isn’t his first rodeo and he wouldn’t be talking to you about reverse mortgages if he thought they were a scheme to rip you off or take your home away from you. …

Hearn’s Law

A colleague of mine, a CPA by the name of Michael Pharris, has a framed piece of paper in his office. The header reads, “Hearn’s Laws”, written by Professor Hearn, an instructor when Michael was in undergrad studying accounting. While there are many good tidbits on the paper (“he who signs the other man’s form, takes care of the other …