I’m writing this on a plane flight to the Financial Planning Association’s NexGen Gathering. There’s a bit of warm nostalgia in being on this flight; not because I have a deep fondness for packaged pretzels or half-cans of ginger ale, but because NexGen Gathering has been a significant touchstone in my professional career. The last time NexGen Gathering was held …

PTE 2020-02 Misses a Major Point

I’m consternated. For anyone who reads my normal weekly content, this may or may not be for you. This is more of a complaint or concern than an educational piece, but it’s one I feel a need to voice. This year, “Prohibited Transaction Exemption” or “PTE 2020-02” was released, giving guidance to financial planners and advisors about how they needed …

Becoming A Millionaire in Seven Years

Well, this is an awkward brag of sorts, but as of May 31st this year, it appears I’ve become a millionaire. I’ll get it out of the way and say that I don’t feel like a millionaire. I certainly don’t live like one, or at least, I don’t live like what I’d think of a millionaire as living like. I’m …

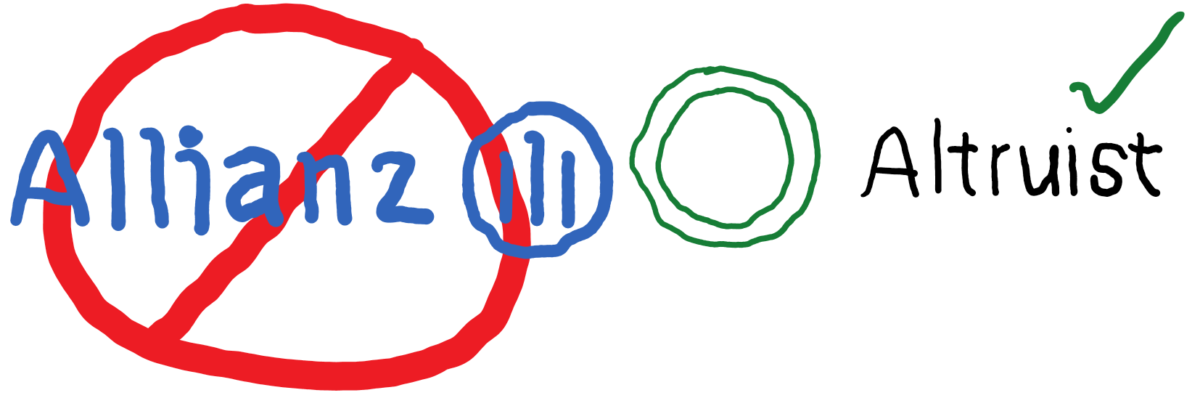

Allianz Scandal and Altruist Announcement

The Allianz Scandal Today the SEC announced that it had reached a settlement with Allianz to the tune of a billion-dollar fine and five billion dollars in restitution to victims of a fraudulent portfolio management scheme. In short, three of its senior portfolio managers had glossed over the potential risks of an options trading strategy that was sold to 114 …

Why I Wrote the Book

If you read our email over the weekend, you know that I published a book, that was ranked as the #1 New Release in Wealth Management on Amazon! That said, the book is not targeted at our clients, nor is it an investing or personal finance book. So why did I write the book? First and foremost, the reason is …

2021 Wrap-Up & 2022 Vision

Hello everyone, thank you for coming to our Ted Talk this week! Today we’re going to cover the state of the firm, the mission of the firm, and the 2022 vision going forward. A Bit of History The firm started as Daniel’s personal financial planning practice in 2015, originally affiliated with Waddell & Reed Financial Advisors as an independent practice. …

What We’ve Been Up To

Well, the cat’s out of the bag. Yesterday, Investopedia announced its Top 100 Financial Advisors of 2021, and we were ecstatic to learn that Daniel Yerger was one of the award recipients and the only one representing Colorado. Notably, the Top 100 from Investopedia is different from many awards in the financial industry. It’s not uncommon to see lists of …

Firms Charging over 2% in the State of Colorado and who have offices within 10 miles of MY Wealth Planners LLC

Primerica Fee Type Annual Fee Program Fee 2.24% Up Front Revenue Sharing 0.25% Quarterly Revenue Sharing 0.0175% Annual Cost to Clients in the First Year 2.56% Disclosure of Revenue Sharing Regulatory Filings for Advisory Services Merrill Fee Type Annual Fee Merrill Lynch Fee Rate 2.00% Style Manager Rate 0.65% Revenue Sharing ? Annual Cost to Clients in the First …

A Career in Financial Planning

This week I’m taking a step back from the usual general education content to write specifically on the topic of careers in financial planning. This piece is specifically for financial planners (either aspiring or firm owning), so if you are part of the general public and have no interest in financial planning careers and business models, this is a good …

Three Invisible Costs of Fee-Based Advisors

At MY Wealth Planners®, we are a Fee-Only Financial Planning firm. This means we are paid directly by our clients and no one else. This is an advantage to our clients for an obvious set of reasons: fee transparency, reduced conflicts of interest, and in many cases, lower costs to clients. However, when the public is asked to compare financial …