Nothing quite captures the attention of the American public like being wealthy. Whether it’s celebrating or decrying billionaires for traveling to space, observing major gaps in wealth between various members of the population, and otherwise simply hanging on every word (or tweet) of the ultra-successful, nothing seems to capture our attention like people with money. Yet, research over the decades …

Bootstrapping a Business

Surprisingly, starting up a business is a common occurrence during economic recessions. As many people are laid off or their companies fail during an economic downturn, it’s not uncommon that some people say “now is the time to start a business.” This is a phenomenon that was somewhat absent during the recession in the late 2000s, largely driven by the …

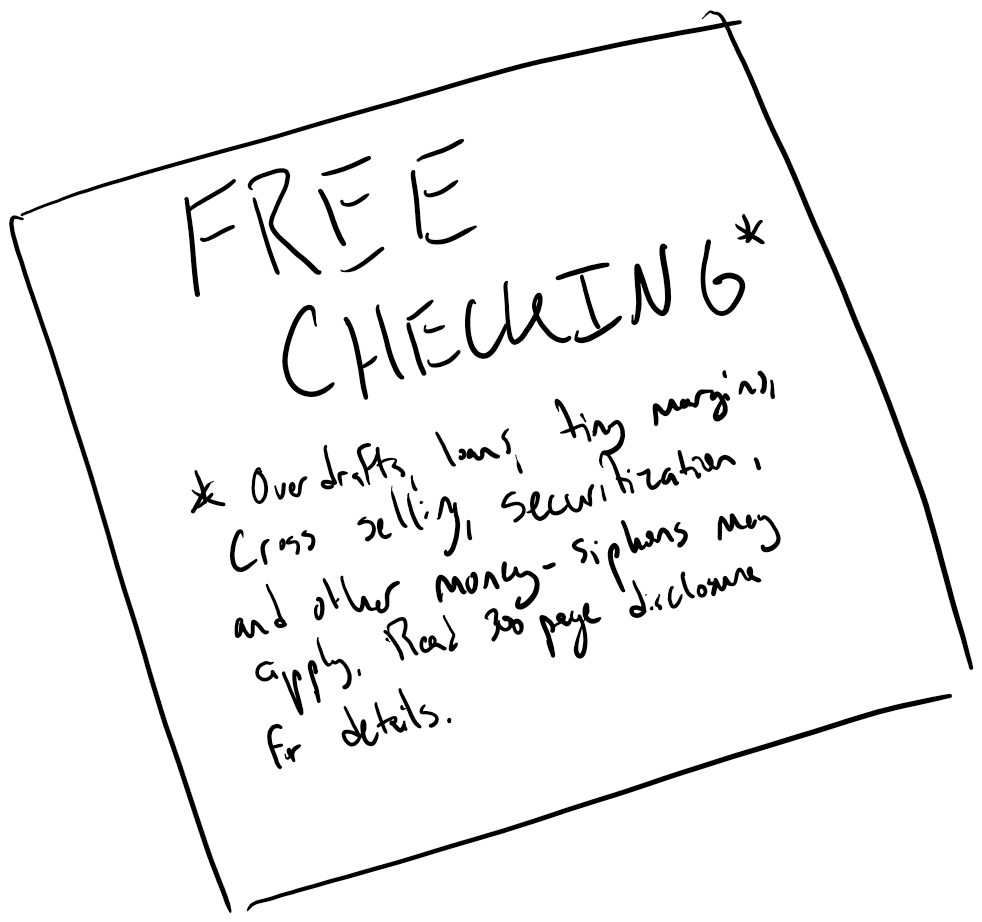

Banks are not your Friend

I have a love-hate relationship with banks in general. While Banks have a long and questionable history, it is unquestionable that they’re a cornerstone institution in our society. That role isn’t only held by “bank banks”, but also by credit unions and assorted depositories of various types. Ultimately when I say bank going forward, you can assume we’re talking about …

The Home Equity Credit Desert

Inflation and home prices have made the news in spades this year. In Longmont, CO, over a dozen homes have sold for well over $100,000 in asking price, and that was after the list price for properties had increased by double-digit percentages since January. In other news, inflation continues to rear its head, with the CPI this month reflecting a …

Preserving Wealth for the Benefit of Others

In the United States, we have a number of financial safety nets. Social Security, originally known as “old age, survivors, and disability income”, assorted forms of unemployment insurance, and various programs such as SNAP and WIC for supplemental nutritional support. While these can be hotly debated and contested, today we’re going to set aside the politics and talk about the …

Beats Me – In Defense of Humility

“The more I learn, the more I realize how much I don’t know.” -Albert Einstein As most of you would probably agree, being an expert in what you do is an odd experience. Whether you’re a teacher being told by random people on the internet about how and what to teach, or a doctor being shouted at by multi-level marketing …

Firms Charging over 2% in the State of Colorado and who have offices within 10 miles of MY Wealth Planners LLC

Primerica Fee Type Annual Fee Program Fee 2.24% Up Front Revenue Sharing 0.25% Quarterly Revenue Sharing 0.0175% Annual Cost to Clients in the First Year 2.56% Disclosure of Revenue Sharing Regulatory Filings for Advisory Services Merrill Fee Type Annual Fee Merrill Lynch Fee Rate 2.00% Style Manager Rate 0.65% Revenue Sharing ? Annual Cost to Clients in the First …

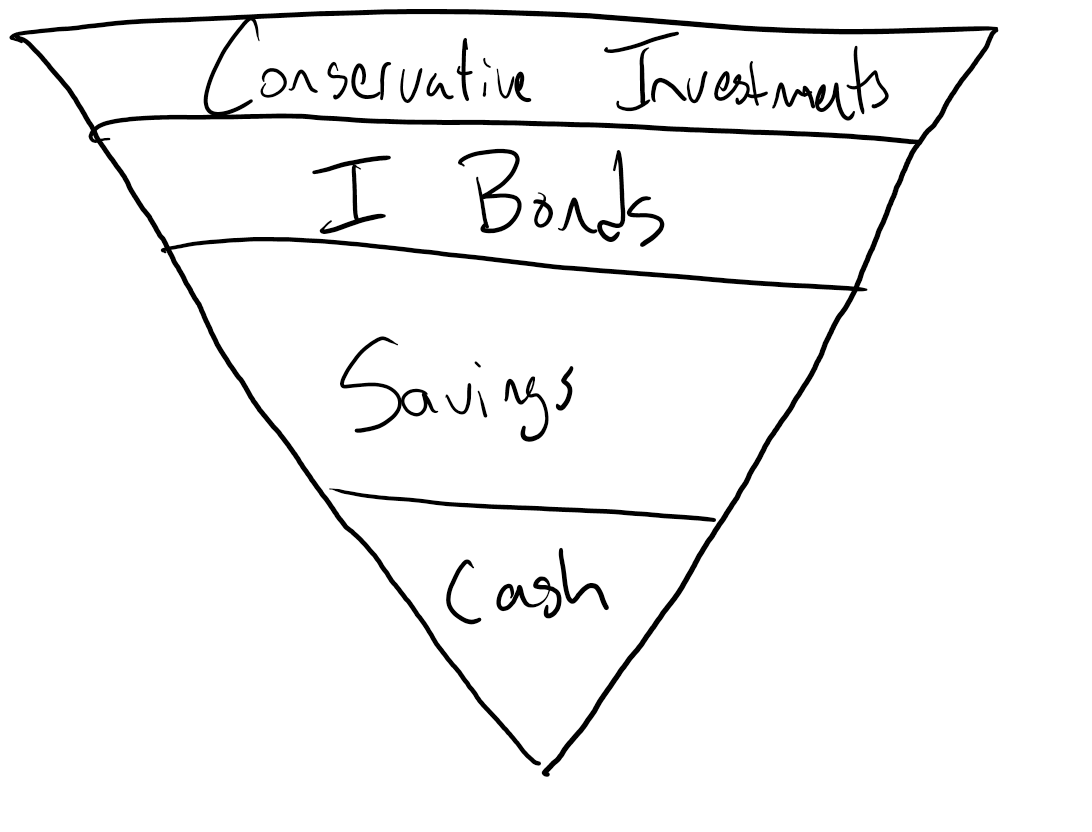

The Safe Harbors of Capital

If you hadn’t noticed over the past decade, interest rates have been low. Really low. Historically low, in fact. This has been an enormous economic boon for small businesses, home buyers, and other borrowers of just about any sort. While the Federal Reserve’s monetary policy is to keep the reserve rate low, competition for low rates on every form of …

The Value Proposition of Financial Planning

In business school, you’re taught a lot of things: business plans, marketing, managerial accounting, and so on. One of the most important things that does not get enough attention is the “value proposition” of a business. Simply put, the value proposition is the core reason someone would do business with you rather than doing business with someone else. Sometimes that …

Inflation and You

In case you’ve forgotten, inflation is the simple principle that over time, the value of existing currency declines as the perception of the public is generally that things get more expensive with time, and that as the population grows, there is a natural growing demand-side pressure on the supply-side of the economy. Inflation has been all but absent for the …