Last year, the SEC released marketing rules that came into effect today. Now I know what you’re thinking: Dan, rules, from the SEC, about marketing, sounds like the most boring thing ever, of all time. Oh contraire! You see my friend, these rules are about to have a major effect on how you are targeted and marketed to by a …

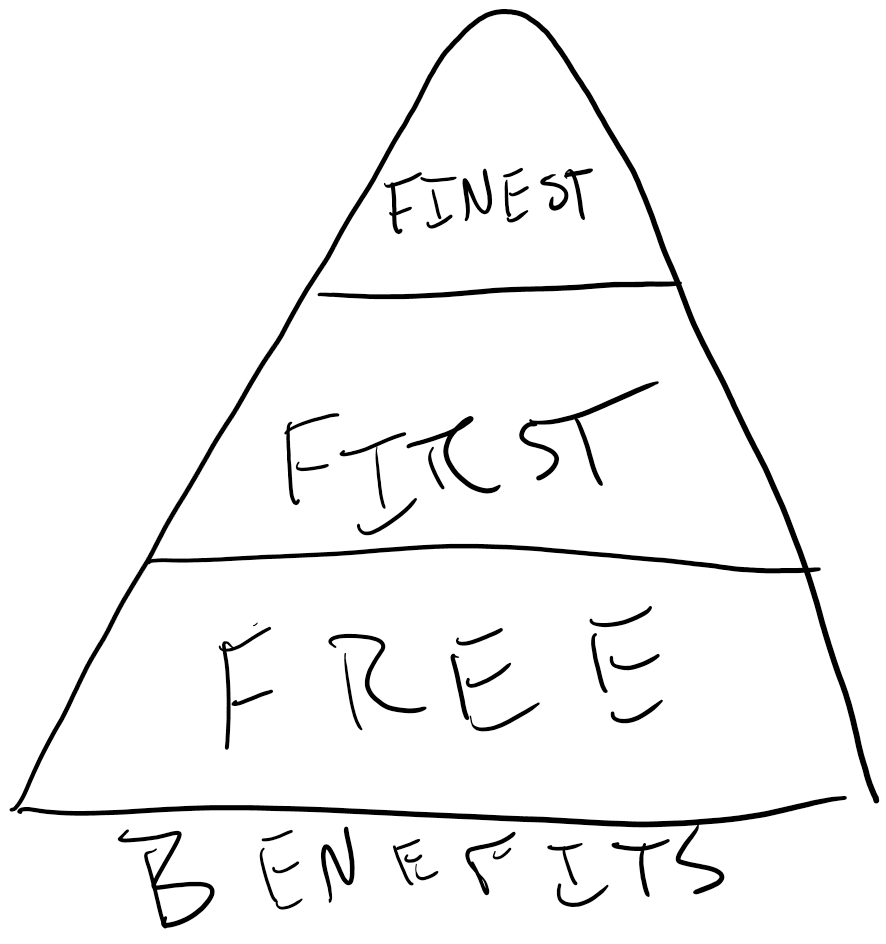

The Free, The First, and the Finest

Whether you’re a startup founder, accidental entrepreneur, or simply looking for help in deciding what job offers to accept, the benefits package is a big deal. People work within organizations (public, private, or non-profit) for a handful of reasons: They believe in the mission, they love the work, or the compensation is right. In a perfect world, it’s all three. …

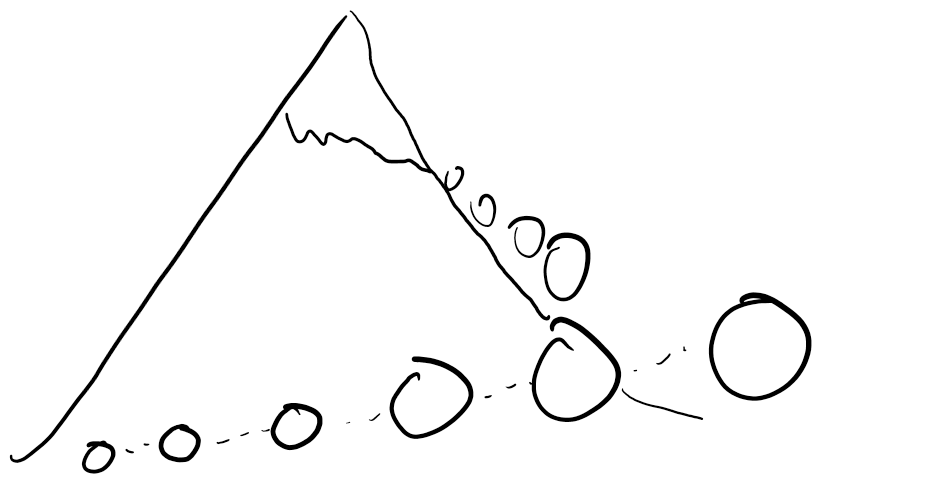

Snowballs and Avalanches

With a national debt of $23.3 trillion dollars, you could say that debt is American as “baseball, mom, and apple pie.” Yet debt is a major source of existential and cultural angst, with multiple studies linking stress and both physical and mental health issues to the levels of debt carried by Americans. In 2015, the Federal Reserve even found that …

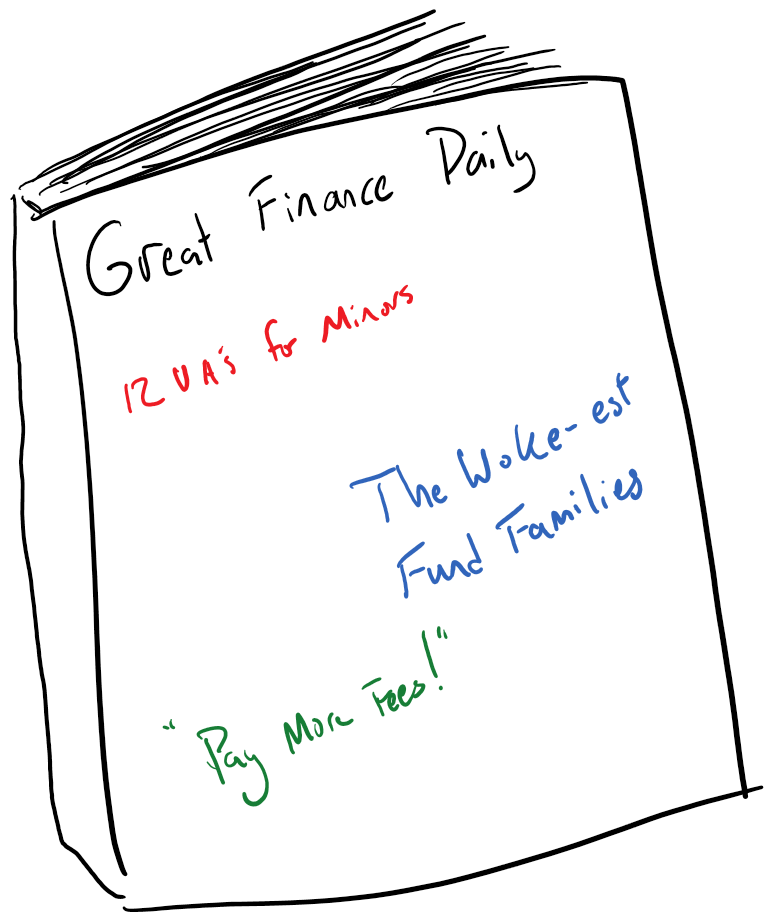

Don’t Judge a Book by its Cover

The admonishment to not “judge a book by its cover” is usually one encouraging us to be better people. “Look past a person on their worst day or who presents poorly to see that they’re a human being just having a hard day. See the merit in every individual and get to know them better than they appear;” or some …

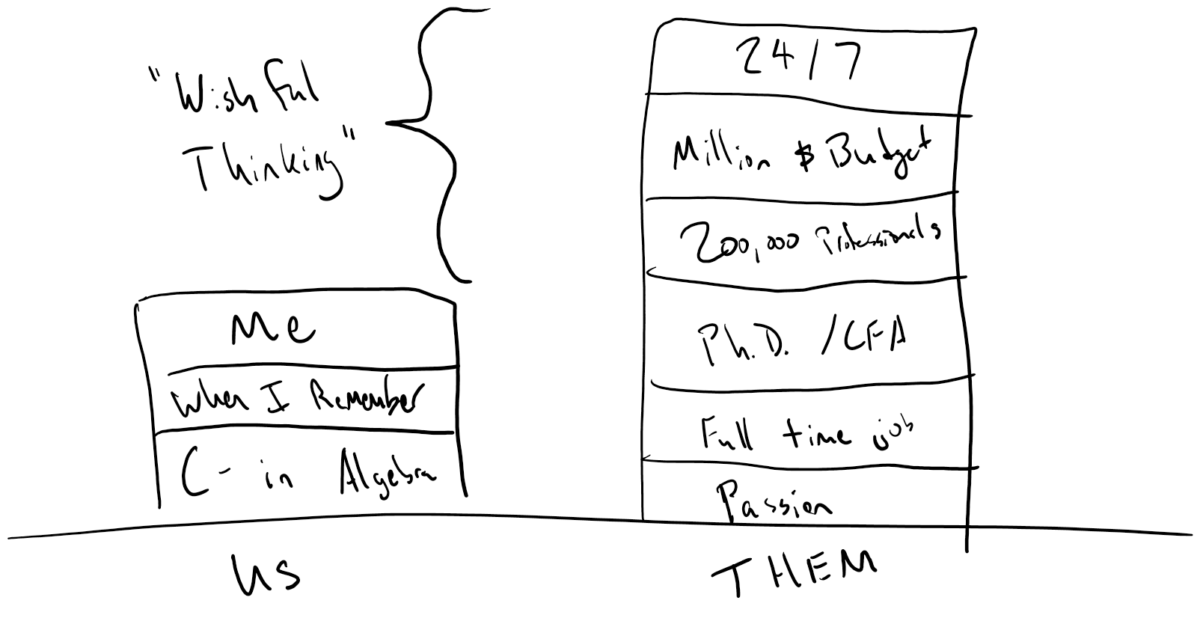

This Time I’m Different

“The four most dangerous words in investing are ‘this time it’s different.’” Said Sir John Templeton, indicating the historical trend that investors often identify “unprecedented opportunities” to invest in, only to find that history repeats itself often when said opportunities crash or end up mediocre. After all, since the most valuable company on earth, Apple, had an initial public offering …

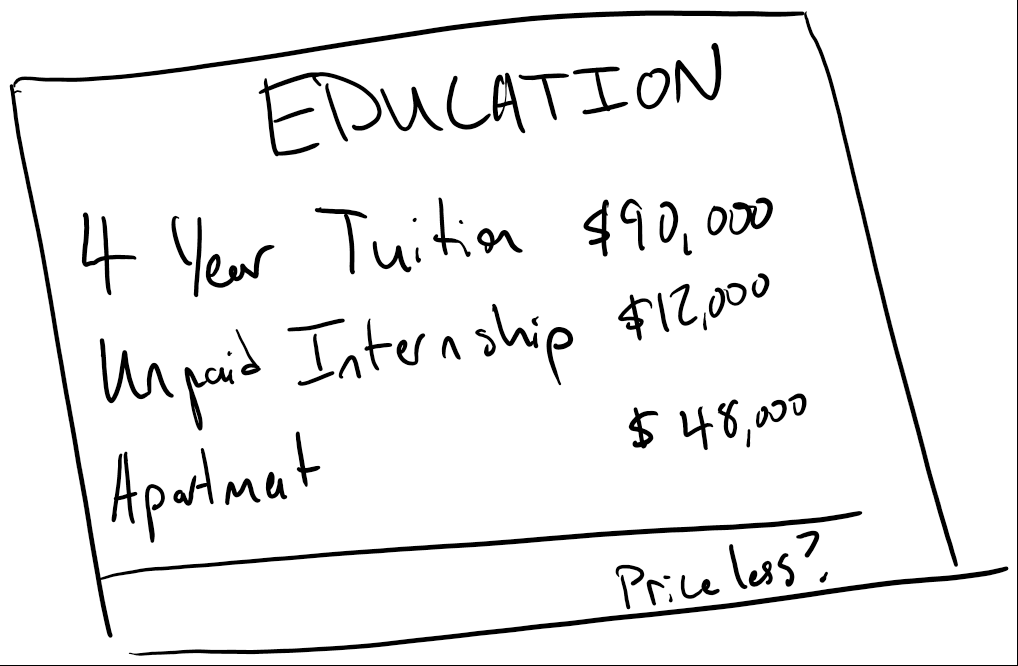

The Cost of Education

If there’s one thing Americans can bemoan, it’s the cost of higher education. Whether it’s lower tuition at a community college or tuition in excess of hundreds of thousands of dollars, Americans largely can agree that a good education is too expensive. Yet, a common financial planning challenge that comes up for families is not only how to pay for …

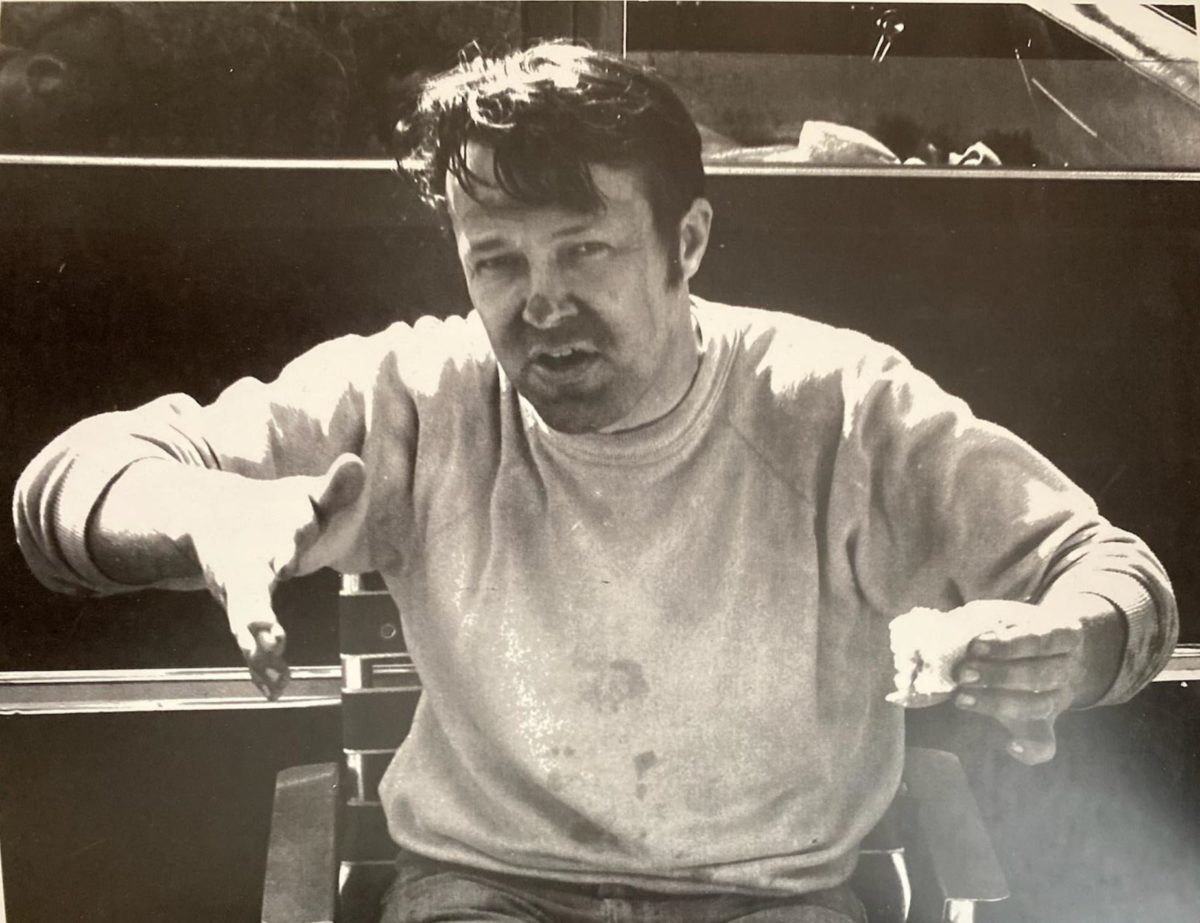

Plan Ahead – Financial Lessons from the Life of a Good Man

Financial Lessons from the Life of a Good Man My grandfather, Chester Persons, passed away on March 5th. While his passing is sad, he has left behind an incredible legacy, one part of which I want to share with you: financial lessons. While Chet didn’t die a rich man, he overcame enormous uphill battles to support his family and create …

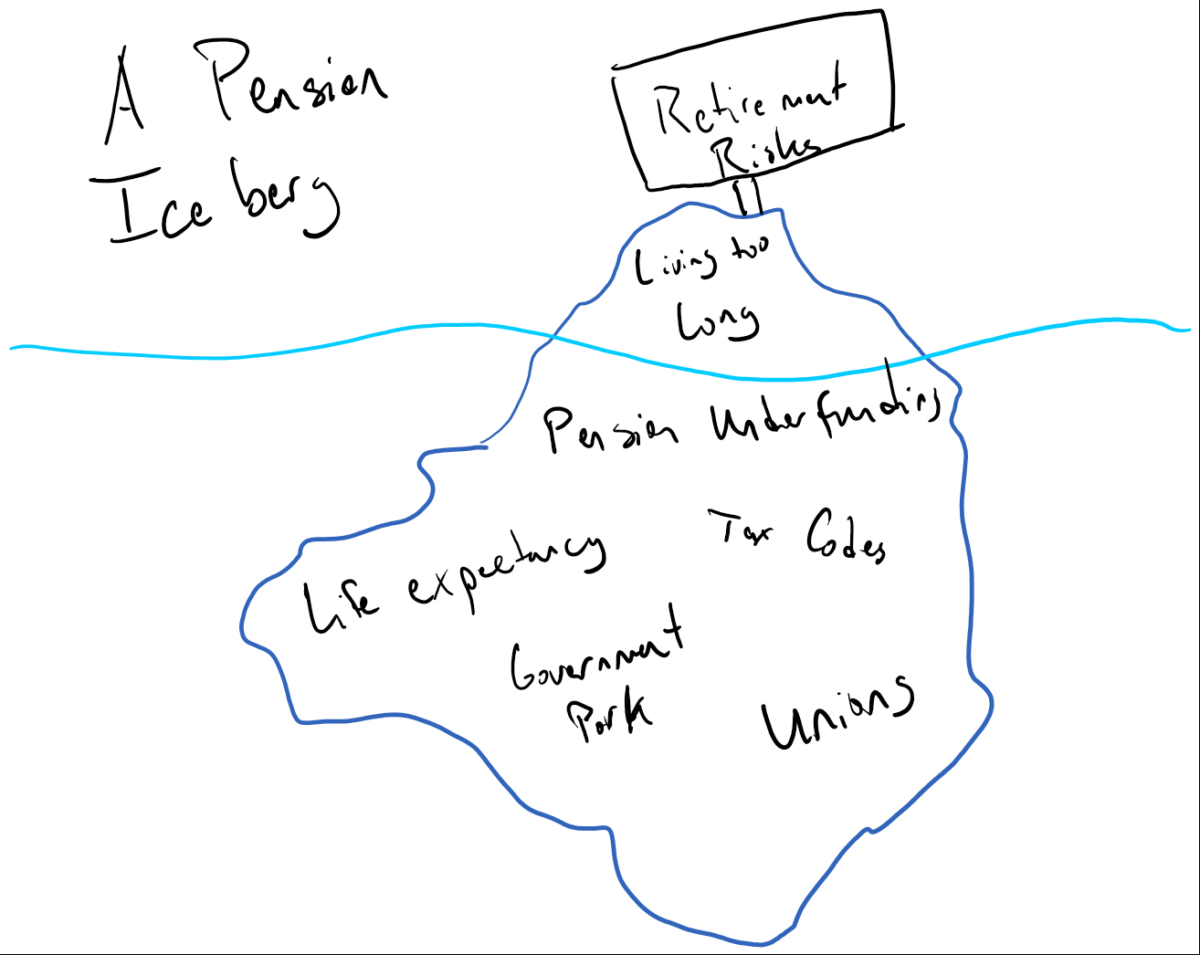

Some Retirement Plans are More Equal Than Others

In the United States, we have a national pension and disability insurance system called Social Security; you may have heard of it. Originally established in 1935, social security started as a safety net to provide the elderly, widows, and orphans with some form of supplemental income. At the time and since that time as the program has developed, the concern …

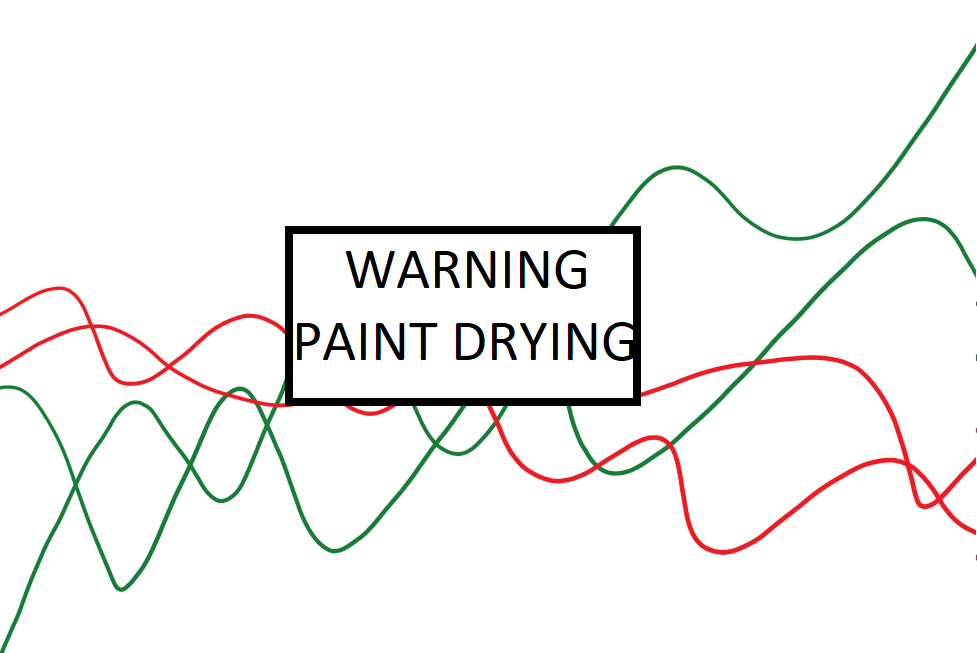

This Time It’s Different – Why I’m a Boring Investor

It was exactly one year ago when my phone rang. It was a client out in California, and the S&P 500 index had just shown a slide of over 11% in the proceeding five days. “Dan, don’t you think we should get out now? It’s getting kinda scary.” He said. “No; this is what asset allocation is for. We have …

Death and Taxes

There’s an old saying from Benjamin Franklin: “…nothing is certain but death and taxes.” Charmingly dour as the sentiment is, he’s not wrong about that when it comes to your financial affairs and the handling of your assets when it comes to moving on from this life. As a nation, we’ve experienced a disproportionate amount of loss in the past …