At MY Wealth Planners, we advise business owners and managers at all stages of a business, from startup to the sale of the enterprise. Understandably, then, we’ve also seen mistakes. A lot of common mistakes. We’ve even made some ourselves! This week, we’re talking about the three most common stages we see by business owners in the startup phase, the …

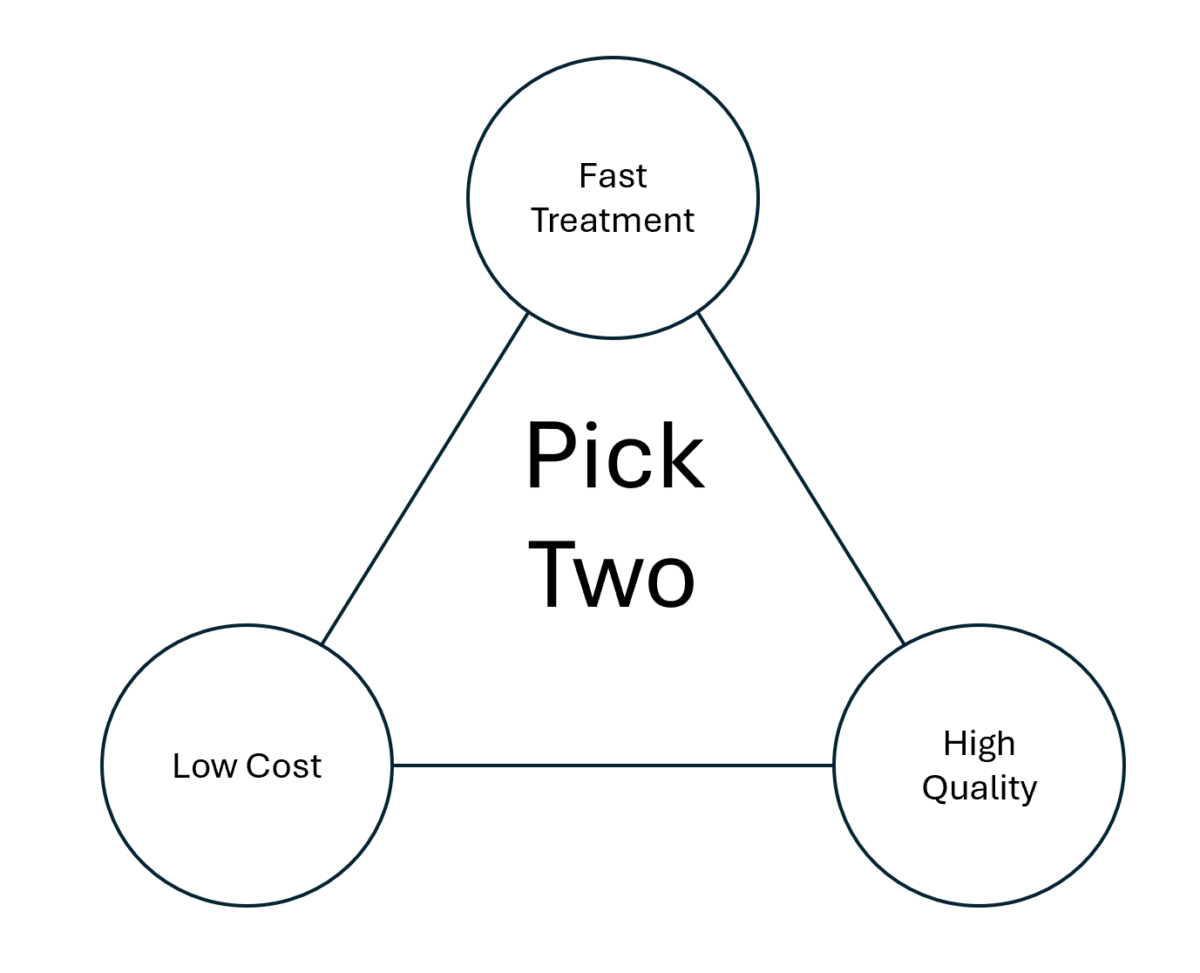

Colorado Legislative Session 2024

Last week marked the beginning of the Colorado legislative session, and over 160 bills are already being proposed to amend everything from tax treatment to studying healthcare. This week we’re taking a few minutes to highlight some more salient and relevant bills in the legislative session that may come to impact you at a personal or work level. None of …

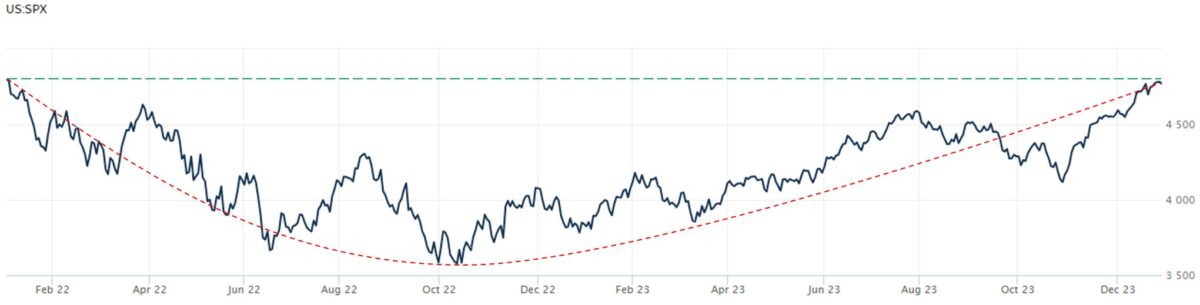

There is Always a Reason to Panic

There is an amusing chart from Avantis Investors floating around the financial planner ecosystem at the moment that sums up the trendlines of 2023 by pointing out the various bits of news throughout the year that might send any given investor into a tizzy of delight or give them a reason to panic. All the while, the chart highlights new …

A Special Notice on the Bitcoin News

Effective today, the SEC has approved the first “spot Bitcoin products,” known as “ETPs” or “Exchange Traded Products.” These differ from the only historically existing Bitcoin securities product, a Bitcoin futures product that used conventional futures contracts in an attempt to mirror the Bitcoin market, albeit with mixed results. These spot products represent the first “legitimacy” of Bitcoin in the …

Important Security Updates for 2024

Before you read on, give this recording a listen. Did you give it a listen? Good, it was an important demonstration. For the skim readers, what I said was: Hey, it’s Dan. Here’s the good news: we’re living in the future, and it’s a place full of exciting possibilities. The bad news? This isn’t Dan. This is an AI duplicating …

Annual Tax Filing Season & BOI Reporting

Annual Tax Filing Season This week, we’re in for a two-fer! First and foremost: ‘tis the time of the season where we set New Year’s resolutions and get out into the world, fully renewed with the zest of life and the excitement of the many adventures to come! Yet, this is also the time of the season where Dan must …

Talk Less and Show Up

As we approach New Year’s Eve and the season for New Year’s resolutions kicks off, allow me to proffer a New Year’s resolution for the financial planning community: talk less and show up. This might be a challenge, even an affront to some, when read plainly. That’s alright, you’re an adult, and I believe you can stomach it. So let …

Negotiating a Pay Raise

This past weekend, my wife and I played “Diplomacy” with a group of friends. Diplomacy is an older game from the 50s that looks a lot like Risk, except that it’s set in Europe at the start of 1901, and there are no dice. Instead, every move every player can make is completely within their control, save that other player’s …

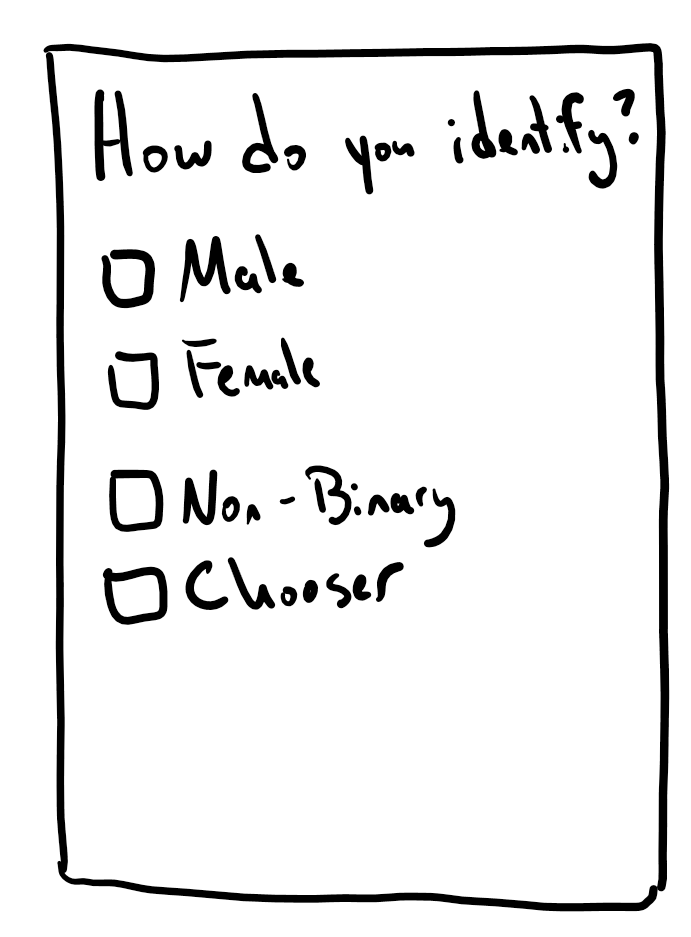

Choosers and Beggars

I recently had the experience of turning down an $8,000 per year client. They were nice enough people, planning to retire soon, who had saved up a sizeable nest egg and were looking for someone to manage their investments in retirement. We had an initial consultation, discussed their objectives and financial interests, worries and concerns, and explained our financial planning …

Giving Tuesday

Hello everyone! It’s time for your annual reminder that today is Giving Tuesday, the biggest non-profit fundraising day of the year. Thousands of companies donate to provide matching dollars for donations to any number of 501(c)3 non-profits, raising billions annually over the past several years that the event has occurred. I, for one, elected to donate to the Longmont Community …