A common issue encountered by business owners and entrepreneurs of every stripe is the value of their business. While it’s common in the land of startups and venture capital to create valuations of an idea, followed by funding rounds over the years that progressively measure and estimate the value of a business enterprise for future funding rounds until the business …

Get Disability Insurance

That’s the tweet, as they say. Now, the reason for the terse and titular advice is that I’m currently bedridden with back pain (causes unknown) and have been for the past two days. Regardless of the why, the experience is, like many, illuminating. What would you do if you were suddenly unable to work? We often think of disability as …

Should and Is

If you’ve read my blogs at length, you’ll know I’m fond of a particular story about United States Marine Colonel “Chesty” Puller. The story goes that he was in command of a unit at the Chosin Reservoir during the Korean War, and upon receiving news that his unit was completely surrounded by the Communists, he declared: “Good, they can’t possibly …

There and Back Again – First Class

Well folks, I’m back from my wedding and honeymoon, and of course, as anyone who has spent any time traveling overseas does, I must now inform you of my impending transition from financial planner to travel blogger. I’m kidding, of course, but I did think it would be helpful for folks to know a few financial tips and tricks related …

An Open Letter to Mr. Field

Dear Mr. Field, Today, I write this open letter to you because I had the mixed fortune of watching you speak before 200 or so NexGen financial planners. I call it mixed fortune because I thought you spoke well for the most part. Your story of the pizza parlor and its pay-it-forward policy was heartwarming. Your personal journey of having …

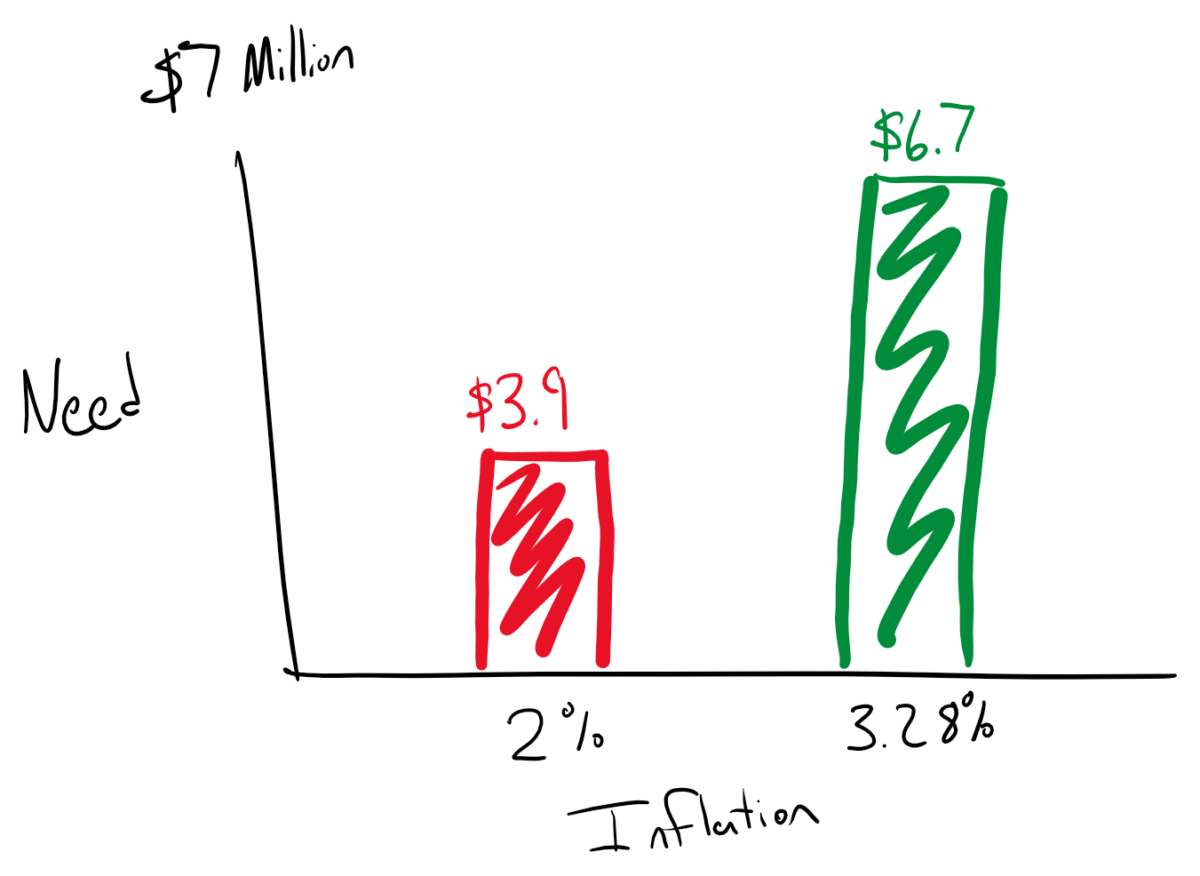

Small Errors, Big Problems – An Inflation-Adjusted DIY Case Study

Recently, a financial planning colleague asked on his Twitter page: DIYers – What average investment return (profit) do you assign to your retirement plan? What’s your reasoning? — Tyler Olson (@olsonplanner) August 20, 2023 One of the first replies was from an Anesthesiologist: “5%. Expect 7% and account for 2% inflation with projection for “today’s dollars.” While that seems like …

Paying and Getting Paid What You’re Worth

About a year or so into being a financial planner, I was given an opportunity to speak to the Women’s Community within the Boulder Chamber of Commerce. I had a fifteen-minute block, alongside an investment adviser from Boulder and a disability insurance saleswoman, who had their own fifteen-minute blocks. The investment adviser gave some good, if perhaps a bit off-base …

Uncle Sam Wants His Share

One of the most common frustrations of a financial planner, really, of any financial professional, is when the client does things backwards. They make a big financial decision and take a big financial action, then afterward, come to the professional seeking advice on how to mitigate the consequences of their decision. “How was I to know that selling that condo …

Guest Post: What I’ve Learned as a Financial Planner

A farewell guest post by our Associate Planner, Samantha Rauch. Over the past couple of years while working at MY Wealth Planners I have had the pleasure of experiencing what it means to be a financial planner. This is a role that goes beyond numbers and spreadsheets. It is a role that allows you to make a meaningful impact on …

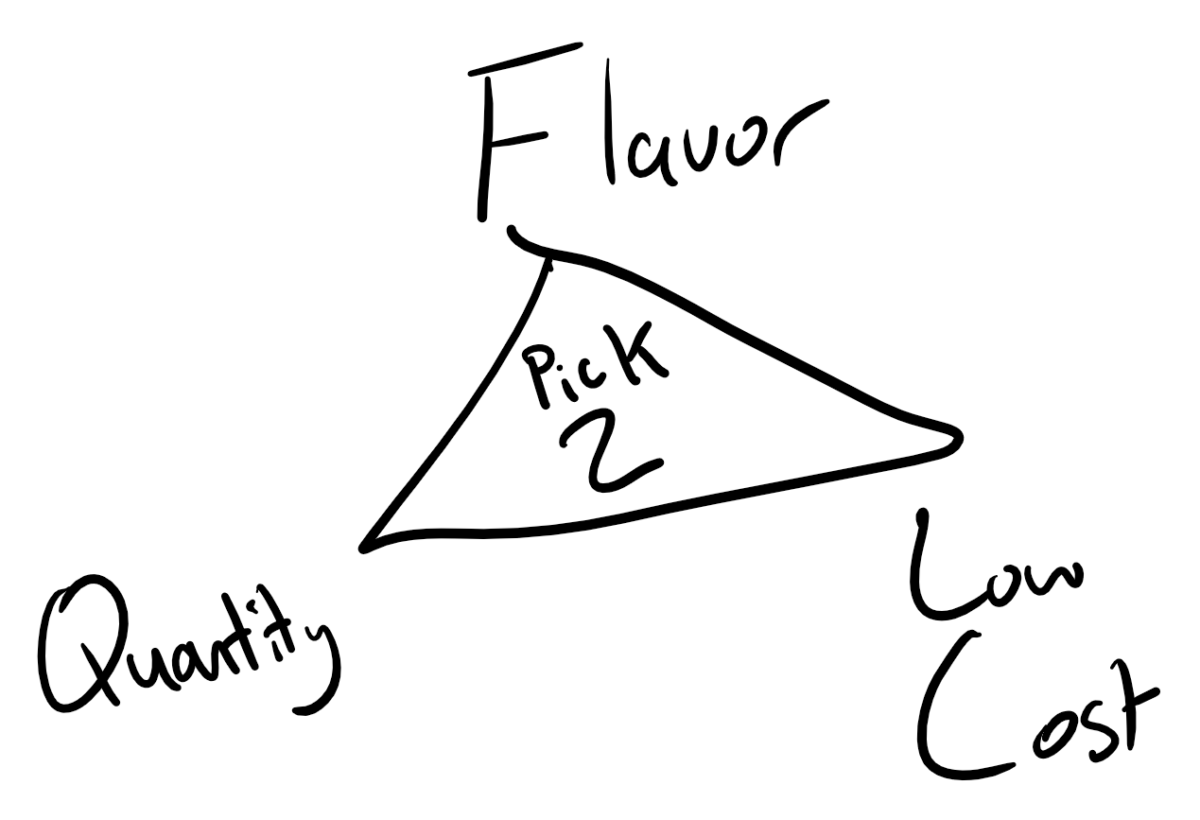

Pick Two

As the old expression goes: “You can’t have your cake and eat it too.” Yet it seems there are cultures both among aspiring financial planners and financial planning firm owners that attempt just that. Students and career changers have casually shared with me time and time again that they’re looking for a position for two or three years that will …