The Wealth Planning Process

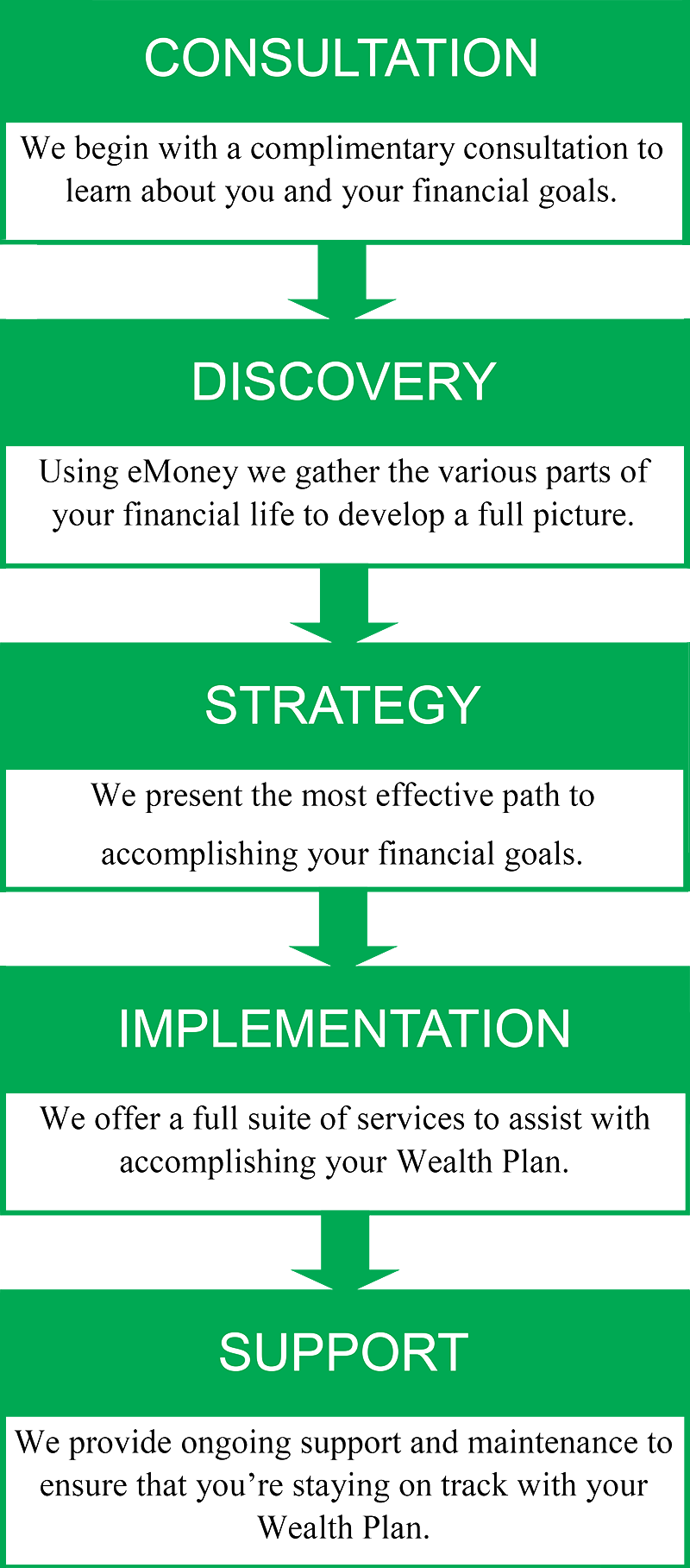

Developing a Wealth Plan involves taking a comprehensive look at your financial picture and developing a set of goals to achieve your best financial life. The process of Wealth Planning will involve gathering information on your insurance, taxes, investments, estate plan documents, business documents, and other assets. Once this information has been gathered, a CERTIFIED FINANCIAL PLANNER™ Professional will craft a draft Wealth Plan reflecting your current circumstances and where, all things being equal, your current plan will take you. We then blend in your financial goals, questions, and concerns to show different scenarios in which different circumstances could have positive or negative effects on your financial plan, and let you decide on the course of action you think is best.

Once your Wealth Plan has been finalized, we are able and willing to assist you in implementing your plan. Some people will find that their wealth plan does not require any changes to their current financial position. Others will need to make adjustments to their investments, consolidate assets, reinvest funds, acquire insurance, and make changes to their personal business and estate plans. We are able to provide direct assistance with implementing many of these solutions and have strong relationships with other professionals such as CPAs and Attorneys who can assist you in areas we cannot.

Once your plan has been developed, we can work on an ongoing basis to ensure you’re being kept on track. We make it our personal responsibility to ensure that your Wealth Plan is implemented and in force for the long haul.